As news spreads that the Polish government has decided to massively import South Korea's weapon systems, interest in defense industry-related companies is rising. With an unprecedented large-scale supply contract for representative K-defense products, competitiveness in the global defense market has been proven, and positive signals have been raised for additional large contracts. Asia Economy analyzed Hyundai Rotem and Korea Aerospace Industries, which are gaining attention for exporting the K2 tank and the domestically produced light combat aircraft FA-50. Hyundai Rotem is shedding financial burdens and re-emerging as a key affiliate of Hyundai Motor Group, while Korea Aerospace Industries is finding growth opportunities not only in the defense industry but also in the expansion of the space industry.

[Asia Economy Reporter Park So-yeon] Hyundai Rotem recently attracted attention by signing a supply contract for K2 tanks with the Polish Military Procurement Office. As Germany, a global tank powerhouse, prioritizes modernization of its own military, it is unable to fully meet the tank demand of surrounding European countries, which is expected to bring a ripple effect benefit to Hyundai Rotem. The increase in large-scale orders is anticipated to drive Hyundai Rotem’s top-line growth and profitability improvement.

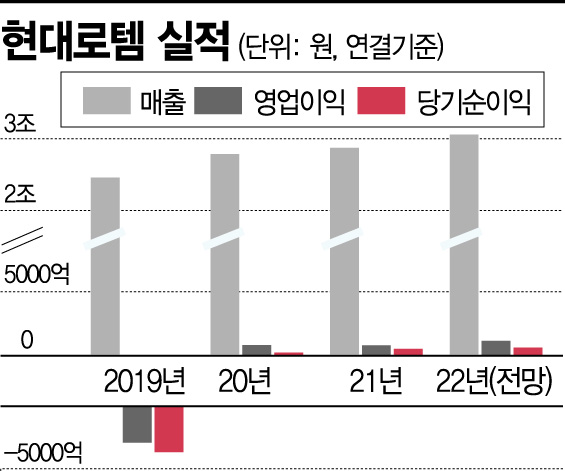

Hyundai Rotem’s business is broadly divided into Rail Solution, Defense Solution, and Eco Plant sectors. Based on last year’s data, the sales revenue proportions were approximately 58.3% for Rail Solution, 31.2% for Defense Solution, and 10.5% for Eco Plant. Annual sales over the past five years have been maintained between 2.4 trillion and 2.8 trillion KRW.

Hyundai Rotem was incorporated into Hyundai Motor Group in 2001. At that time, it posted solid results based on its market dominance in train manufacturing, but from 2010, performance slowed due to overseas order slumps, including being outpaced by Chinese companies. In 2016, it implemented voluntary retirement for the first time in 11 years, and from 2015 to 2019, its cumulative pre-tax losses reached 1 trillion KRW. However, through emergency management, portfolio restructuring, and strengthening business competitiveness, it has established itself as a core affiliate 20 years after joining the group.

Recently, Hyundai Rotem’s financial structure has greatly improved as it expanded high-quality orders. In May, Korea’s three major credit rating agencies?Korea Credit Rating, Korea Investors Service, and NICE Investors Service?upgraded Hyundai Rotem’s credit rating from ‘BBB+’ to ‘A-’. This was the first upgrade in two years since 2020. The agencies positively evaluated Hyundai Rotem’s financial structure improvement, noting that it expanded high-quality orders by making order review transparent and that its order backlog increased. A Hyundai Rotem official explained, “We established a transparent order committee to preemptively block risks and standardized the management system throughout the bidding process. These efforts led to financial stability.”

Poland K2 Tank Supply Contract

Minimum 17 Trillion KRW Overseas Sales Maximum

Increasing High Value-Added Business

Reducing Risk with 'Transparent Order Committee'

Hyundai Rotem is streamlining low-profit businesses and increasing the proportion of high value-added businesses such as railway signaling, operations, and maintenance. Hyundai Rotem’s order backlog increased from an average of 6.9 trillion KRW annually between 2015 and 2019 to 8.1 trillion KRW in 2020 and 9.2 trillion KRW last year. As of the first quarter of this year, the order backlog reached 10 trillion KRW. The large-scale order backlog is expected to increase further with the K2 tank supply contract with the Polish Military Procurement Office. Hyundai Rotem is scheduled to sign a memorandum of understanding (MOU) soon in Poland for export-related cooperation, and the export amount is known to be at least 17 trillion KRW, making it the largest single-weapon overseas sale in history.

Hyundai Rotem’s financial situation deteriorated as it recorded operating losses of around 200 billion KRW consecutively in 2018 and 2019. However, in 2020 and 2021, it returned to normal by posting operating profits of about 80 billion KRW annually. The operating profit margin improved significantly from -11.38% in 2019 to 2.79% in 2021. The debt ratio, which reached 362% in 2019, decreased to 236% in the second quarter of this year. As of the end of Q2 this year, Hyundai Rotem holds borrowings of 1.3551 trillion KRW. Interest-bearing debt amounts to 1.24 trillion KRW. Cash and cash equivalents stand at 596.9 billion KRW, reducing net borrowings to 758.2 billion KRW.

The market expects Hyundai Rotem to sustain its growth momentum based on its abundant order backlog. Besides the Polish K2 tank order, there is strong anticipation for additional orders from countries such as Norway. The proportion of defense business in Hyundai Rotem’s performance is also expected to increase further. Hyundai Rotem’s strategy is to secure future growth by aligning with Hyundai Motor Group’s hydrogen mobility ecosystem construction strategy, not limiting itself to train and tank orders. Hyundai Rotem has been recognized for its business capabilities by consecutively winning orders related to hydrogen, including hydrogen extractors, hydrogen shipping centers, and liquefied hydrogen charging stations. It plans to achieve sales of 350 billion KRW in hydrogen new businesses such as hydrogen charging facilities and hydrogen reformers by 2025. The financial investment industry expects Hyundai Rotem to maintain profitability for the third consecutive year this year, showing a clear recovery trend. In particular, operating profit in the first half of this year is expected to increase significantly compared to the previous year, achieving the best performance in six years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.