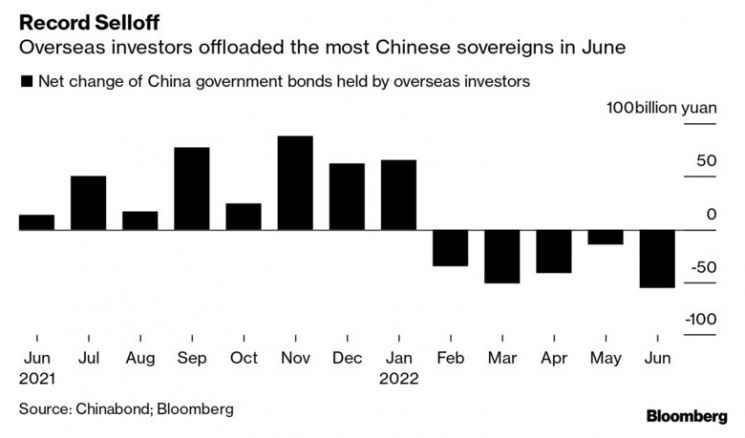

[Asia Economy Reporter Park Byung-hee] Last month, foreign investors recorded the largest-ever net sales of Chinese government bonds, Bloomberg News reported on the 22nd, citing statistics from the China Central Depository & Clearing Co., Ltd. (CCDC, ChinaBond).

Bloomberg explained that the net sales of onshore Chinese government bonds by foreign investors last month amounted to 55.9 billion yuan (approximately 10.84 trillion KRW), the highest since Bloomberg began compiling CCDC statistics in 2014. It added that this is an example showing a large-scale outflow of foreign funds from the Chinese market.

The amount of government bonds held by foreigners was recorded at 2.32 trillion yuan as of the end of June. This is 200 billion yuan less than the record high of 2.52 trillion yuan in January.

Foreign investors have been net sellers of Chinese government bonds for five consecutive months since February, when the Ukraine war broke out. Bloomberg noted that this is the longest net selling period on record.

It is interpreted that foreign investors are temporarily withdrawing from the Chinese market due to overlapping negative factors that increase economic uncertainty, such as the ongoing slump in the Chinese real estate market since last year, the Ukraine war, and the zero-COVID policy.

In fact, China's second-quarter economic growth rate, announced by the National Bureau of Statistics of China on the 15th, was only 0.4%, the second-lowest since China began releasing quarterly economic growth rates in 1992. The only time China’s growth rate was lower than the second quarter of this year was in the first quarter of 2020 (-6.8%), when the COVID-19 pandemic began.

The sharp rise in U.S. Treasury yields has also reduced the expected returns on Chinese government bond investments, which is cited as another reason foreign investors are avoiding Chinese government bonds. While the U.S. Federal Reserve (Fed) raised its benchmark interest rate by 1.5 percentage points this year to curb inflation, the People's Bank of China has maintained a monetary easing policy to stimulate the economy. As a result, the interest rate gap between U.S. and Chinese government bonds has significantly narrowed.

In June, foreign investors also net sold 90 million yuan of Chinese local government bonds and 35.47 billion yuan of government-related bank bonds, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.