High-Cost Drug 'Soliris'

Competition Heats Up for Biosimilar Development Ahead of Patent Expiry

Samsung Bioepis Leads

Applications for Approval in Europe and Korea

Amgen Completes Phase 3 Dosing

Patent Agreement for 2025 US Launch

Isu Abxis Succeeds in Phase 1

Technology Exported to Russia and CIS

Original Developer Alexion

Defends Market Share with New Drug

Annual Treatment Cost Reduced by 30%

[Asia Economy Reporter Lee Chun-hee] As the patent for the high-priced drug Soliris (generic name eculizumab), which costs 400 to 500 million KRW annually for treatment, is about to expire, competition to develop biosimilars (biopharmaceutical generics) is accelerating. Samsung Bioepis is leading the way, while the original developer has also launched a new drug with reduced price burden to defend its market share.

Samsung Bioepis Challenges Soliris

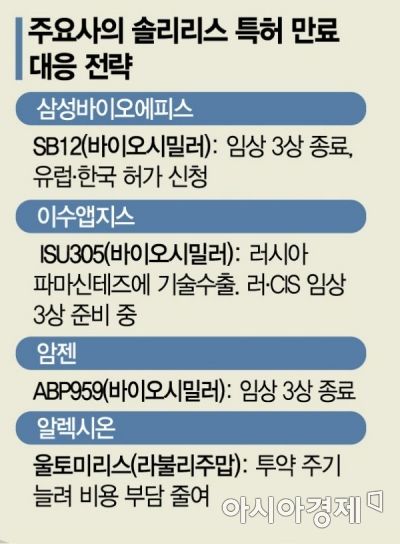

According to industry sources on the 22nd, Samsung Bioepis recently applied for marketing authorization for the Soliris biosimilar ‘SB12’ to the European Medicines Agency (EMA) and the Korean Ministry of Food and Drug Safety. Since no biosimilar has yet been internationally approved, they are aiming to be the first biosimilar on the market.

At the European Hematology Association (EHA) conference held in Austria last month, Samsung Bioepis announced results from a multinational Phase 3 clinical trial involving 50 patients with paroxysmal nocturnal hemoglobinuria (PNH) from eight countries including Korea, Taiwan, and India, demonstrating clinical equivalence of SB12 to the original drug. Given Soliris is a high-cost treatment, Samsung Bioepis is also offering to provide SB12 free of charge for up to two years to clinical trial participants.

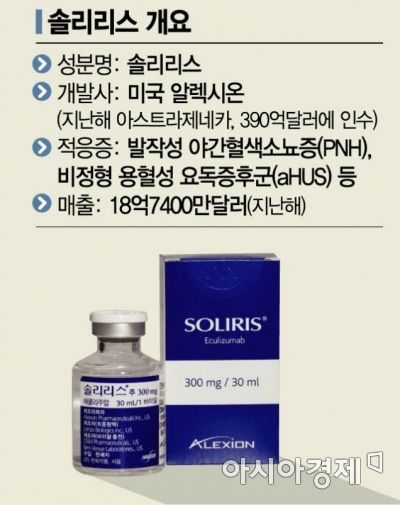

Soliris is a treatment for rare and difficult-to-treat blood disorders developed by the US company Alexion. Its main indication is PNH, a condition caused by destruction of red blood cells in the blood, and it is also used for atypical hemolytic uremic syndrome (aHUS) and generalized myasthenia gravis (gMG). However, the only current cure for PNH is bone marrow transplantation. Soliris is a drug that prevents disease progression, so continuous administration is required.

As of last year, Soliris had grown into a blockbuster drug with global sales of $1.874 billion (approximately 2.4643 trillion KRW). This success was a driving force behind AstraZeneca’s acquisition of Alexion in 2020 for $39 billion (approximately 51 trillion KRW), the largest pharmaceutical M&A deal in history. This is also why Samsung Bioepis, Isu Abxis, Amgen, and others have entered the race to develop biosimilars for Soliris, whose patent is nearing expiration.

Amgen and Isu Abxis Enter Market... Alexion Responds by Extending Dosing Interval

Amgen is also accelerating development and closely pursuing SB12. Their biosimilar candidate ‘ABP959’ recently completed multinational Phase 3 dosing involving 42 patients across 14 countries including the US, UK, and Italy. Unlike Samsung Bioepis, which filed a patent invalidation trial against Soliris’ use patent in Korea, Amgen has reached a patent agreement with Alexion for US launch in 2025.

Isu Abxis is developing ‘ISU305’. After successfully completing Phase 1 trials, they licensed the technology for the Russian and Commonwealth of Independent States (CIS) regions to Russia’s Pharmasyntez in 2020. An Isu Abxis official explained, "Pharmasyntez is currently preparing for Phase 3 trials, but there has been a slight delay due to regulatory issues in Russia. We are also seeking local partners in other advanced regions."

Alexion has launched ‘Ultomiris’ (generic name ravulizumab), a shield that improves convenience and reduces cost burden to defend its market share against biosimilars. Based on patient co-payments in Korea, Soliris costs 5.13 million KRW per vial, while Ultomiris costs 5.6 million KRW per vial. However, the dosing interval differs significantly: Soliris is administered every 2 weeks, whereas Ultomiris is every 8 weeks, resulting in approximately a 30% reduction in annual treatment costs with Ultomiris.

Since its reimbursement in Korea in June last year, Ultomiris has rapidly replaced Soliris. Both Soliris and Ultomiris require prior authorization before treatment to receive health insurance coverage due to their high cost. However, from June last year to April this year, no prior authorization requests were made for Soliris, while Ultomiris received over 100 approvals. In terms of sales, Soliris’ domestic quarterly sales, which were around 11 billion KRW, sharply dropped to 2.8 billion KRW in the first quarter, whereas Ultomiris’ sales increased to 8.9 billion KRW in the third quarter and 10.7 billion KRW in the fourth quarter following reimbursement.

An industry insider analyzed, "Although Soliris was once known as the world’s most expensive drug like Zolgensma, a significant price reduction effect is expected once biosimilars are launched. However, Ultomiris offers much greater dosing convenience, so intense competition between Ultomiris and Soliris biosimilars is anticipated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.