[Asia Economy Reporter Kim Hyemin] Within a day of the announcement of the tax law amendment bill, which centers on the abolition of the comprehensive real estate holding tax (종부세) surcharge rate for multi-homeowners, over 6,000 apartment listings nationwide disappeared. This is interpreted as the result of multi-homeowners, who will bear less tax burden, simultaneously withdrawing their listings.

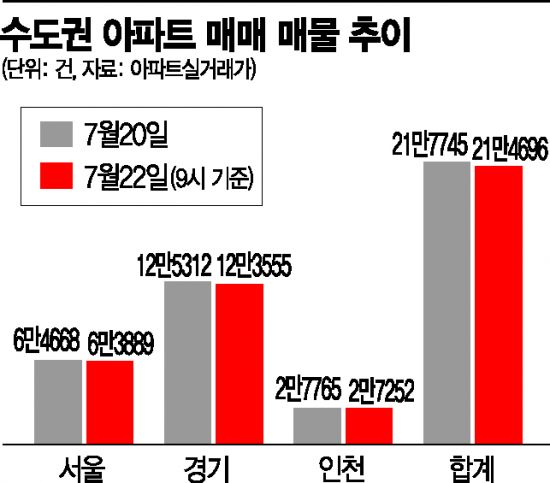

According to Apartment Actual Transaction Price (Asil), a real estate big data company, from the previous day until 9 a.m. on the 22nd, apartment sale listings in 17 metropolitan local governments decreased by 6,039 units. The listings dropped sharply from 434,335 units two days ago to 428,296 units as of 9 a.m. on the day of the announcement. Notably, the decrease in listings in the 수도권 (Capital Region), which accounts for half of the total listings, stands out. The 수도권 apartment listings fell from 217,745 units on the 20th to nearly 3,000 fewer units in one day, and decreased by another 200 units on the day, totaling 214,696 units.

In Seoul, listings evaporated by 779 units, from 64,668 to 63,889. Seoul’s apartment listings had fluctuated between 63,000 and 65,000 units but had recently been on a three-day increasing trend. The district with the largest decrease in listings in Seoul was Seongdong-gu. Listings in Seongdong-gu dropped by 120 units (2.4%), from 2,532 to 2,412. This is the first time since early June that apartment listings in Seongdong-gu have fallen to the 2,400 range. Other districts with notable decreases include Gangseo-gu (83 units), Seocho-gu (71 units), and Nowon-gu (61 units).

The government announced the tax law amendment bill the previous day, making comprehensive revisions to the real estate tax system. Notably, the surcharge system for multi-homeowners was abolished, significantly reducing their tax burden. The 종부세 rate for multi-homeowners will drop from the current maximum of 6% to 2.7% next year. The tax burden cap, which varies depending on the number of houses owned, has been unified to 150%, effectively halving the cap for multi-homeowners from 300%. The existing deduction amount has been raised from 600 million KRW to 900 million KRW based on the official property price. In other words, if the combined market value of the houses is about 1.3 billion KRW or less, no 종부세 will be paid.

Ham Young-jin, head of the Zigbang Big Data Lab, said, "Among those who own multiple houses and had to urgently decide on gifting or selling due to the 종부세 burden, the government’s announcement has given them more time." He added, "Houses near expanded transportation networks in the 수도권, areas lacking new housing, and residential areas adjacent to self-sufficient business districts are more likely to be retained rather than sold." Yoon Ji-hae, senior researcher at Real Estate R114, also said, "A significant portion of the listings currently on the market are from multi-homeowners," and "There may be an increase in multi-homeowners who decide to hold on due to this tax reduction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)