Government Expresses Intention to Revise Inheritance and Gift Tax

Top Obstacle in Business Succession: 'Enormous Tax Burden'

Inheritance Tax Reclaimed Due to Failure to Meet Post-Conditions

"Communication with the Field... 'Thankful' for System Realization"

[Asia Economy Reporters Kim Bo-kyung, Kim Jong-hwa] The small and medium-sized enterprise (SME) sector welcomed the government's tax reform plan announced on the 21st to support smooth business succession.

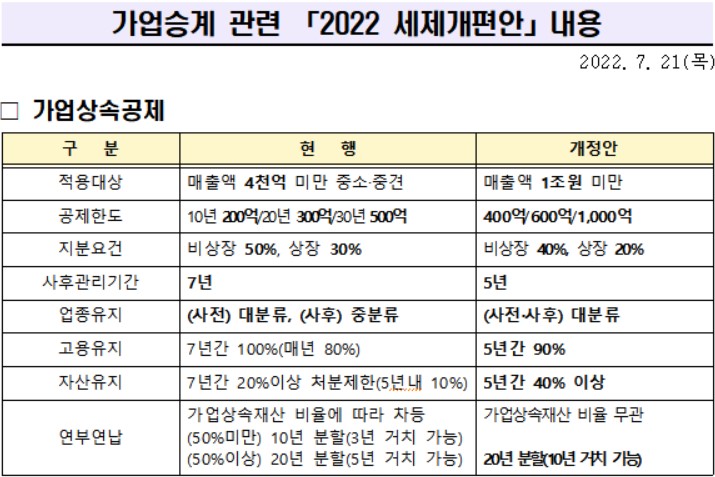

The tax support measures related to business succession announced by the government on this day include ▲enhancing the effectiveness of the business succession deduction through amendments to the Inheritance and Gift Tax Act ▲expanding special tax treatment for gift tax on business succession ▲deferral of inheritance and gift tax payments.

◆Strict Requirements...Low Utilization of Business Succession Deduction= The government operates the business succession deduction system as part of tax support for SME succession, but the post-management period, which requires compliance with various conditions such as industry, employment, and assets, is set at 7 years, resulting in low utilization of the system.

There have also been cases where companies that received the business succession deduction failed to fulfill post-management obligations and were subject to inheritance tax reassessments. According to the National Assembly Legislative Research Office, 14.5% of companies benefiting from the business succession deduction between 2015 and 2017 were reassessed for inheritance tax.

So far, the industry has demanded easing the requirements of the business succession deduction system to enhance its effectiveness and expanding the special tax treatment limit for gift tax on business succession.

According to a survey conducted by the Korea Federation of SMEs targeting 500 SMEs with over 10 years of operation, 98% of respondents cited "concerns over enormous tax burdens" as a difficulty in the business succession process.

◆Industry 'Welcomes'... "Breathing Room for Companies"= The SME sector is welcoming the recent tax reform bill.

According to the government's announced tax reform bill, the post-management period for companies utilizing the business succession deduction is shortened from 7 years to 5 years. The employment retention requirement is relaxed from 100% for 7 years to 90% for 5 years, and the asset disposal restriction rate is eased from 20% over 7 years to 40% over 5 years. The industry retention requirement has been restructured to allow changes within major categories such as manufacturing and construction both before and after succession.

An industry official stated, "In the case of the business succession deduction, the pre- and post-requirements were so strict that many companies could not utilize the system," adding, "This time, some of the industry and employment retention requirements have been eased, reflecting the industry's demands."

The Korea Federation of SMEs issued a statement saying, "We thank the government for actively communicating with the field during the tax reform process and striving to make the system more realistic," and added, "This will provide breathing room for companies struggling with enormous tax burdens during succession and serve as institutional support for them to grow into competitive long-standing companies."

However, they argued that it would be desirable to completely abolish the industry change restriction and relax the employment retention requirement to 80% cumulatively over 5 years.

Yang Chan-hoe, Head of the Innovation Growth Division at the Korea Federation of SMEs, said, "It is positive that the industry restriction has been eased to 'major categories,' but it is regrettable that it has not been abolished," and added, "The Federation will continuously request the abolition of industry restrictions during the legislative process."

Kim Hee-seon, a research fellow at the Korea Institute of Startup & Entrepreneurship Development, also said, "The recent tax reform bill reflects the position of SMEs in many aspects," and added, "The industry retention requirement is a system unique to Korea, so it is appropriate to ease it gradually."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.