[Asia Economy Reporter Lee Seon-ae] The syndrome of the cable channel ENA's drama "Extraordinary Attorney Woo" is creating a whirlwind in the stock market. Related beneficiary stocks, including the production company, are soaring day after day. The stock price increase rate exceeds 100%. It is as if they have ridden on the "whale" that the drama's protagonist Woo Young-woo likes. However, since the stock prices have surged rapidly due to the drama's success, there are repeated warnings to be cautious of stock price volatility.

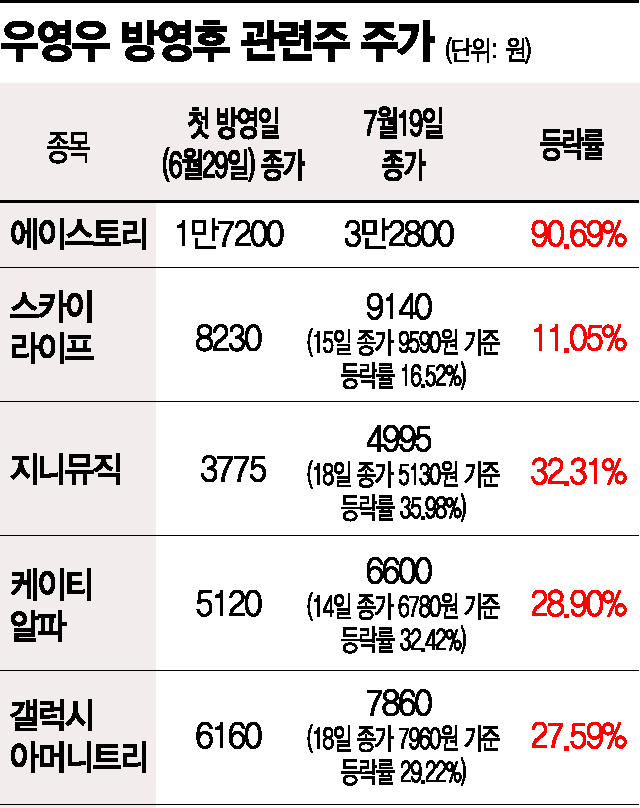

According to the Korea Exchange on the 20th, the stock price of the drama's production company Ace Story surged by a whopping 90.69% from the drama's airing start on the 29th of last month until the day before. During this period, individual investors scooped up Ace Story stocks worth 12.3 billion KRW. The stock price, which was trading in the 17,000 KRW range until the end of last month, surpassed 33,000 KRW during the trading session on this day. Considering that it hit a 52-week low of 16,050 KRW during the session on June 24, it has surged more than 100% in just half a month. The market capitalization also increased. The market capitalization, which was 162.9 billion KRW on June 24, grew to 312.6 billion KRW the day before. This is purely thanks to the drama.

Securities firms expect the drama to be a catalyst for Ace Story's profit growth. The success of Woo Young-woo is expected to diversify revenue by utilizing IP (intellectual property). As of the first quarter of this year, 75.8% of Ace Story's sales composition comes from copyrights, and 25.8% from drama copyrights. Woo Young-woo ranked first in the non-English TV program category in Netflix's "Global Top 10" rankings from July 4 to 10, receiving evaluations of success both domestically and internationally.

The securities industry forecasts Ace Story's expected sales this year to be 113.5 billion KRW and operating profit to be 18.8 billion KRW. This represents increases of 92.7% and 172.5%, respectively, compared to the same period last year. Lee Sang-heon, a researcher at Hi Investment & Securities, said, "Ace Story plans to launch a webtoon based on 'Extraordinary Attorney Woo' in the global market in the second half of the year," adding, "With the power of its own IP and the full-scale lineup, content expansion will continue, leading to performance improvement."

Genie Music, a subsidiary holding a 35.97% stake in KT Studio Genie, which co-produced the drama with Ace Story, also joined the theme's upward march. The rise rate from the closing price on the airing day to the day before reached 32.31%. Thanks to this, it is evaluated that KT's CEO Koo Hyun-mo's strategy to transform KT beyond telecommunications has also gained momentum.

Skylife, which operates channel ENA, is also a partner riding the whale's back. As of the day before, Skylife's rise rate compared to the airing day was 11.05%. KT Alpha, a KT affiliate and the parent company of the ENA channel, also saw its stock price rise by 28.9% compared to the airing day as of the day before. Galaxia Moneytree, which holds a 13.14% stake in the agency Namu Actors representing actress Park Eun-bin, who is playing the lead role Woo Young-woo, is also considered a theme stock, with a rise rate of 27.59% compared to the airing day until the day before.

However, since the related stocks' prices have surged rapidly, there is advice to keep in mind that volatility may be high. In fact, last year, when the Netflix series "Squid Game" became a global hit, related stocks (Bucket Studio, Showbox, etc.) saw their prices rise sharply and then plummet vertically. Already, Skylife, Genie Music, KT Alpha, and Galaxia Moneytree showed signs of a slowdown as their stock prices closed lower the day before. In fact, the rise rates compared to the 15th or 14th are higher than the day before.

Meanwhile, the "Woo Young-woo effect" has also strengthened "K-content stocks," which is expected to revive investment sentiment. From the airing day to the 14th, when the Woo Young-woo syndrome was at its peak in the stock market, Studio Dragon (9.09%), Contentsree Central (4.16%), and Wysiwyg Studios (1.63%) each closed higher. Recently, volatility has caused a downward trend. However, securities firms evaluate that there is competitiveness such as performance improvement. Lee Hwa-jung, a researcher at NH Investment & Securities, explained, "Although Netflix's subscriber numbers have recently declined, K-content has a high market share in Asia and content efficiency (cost-effectiveness), so it is a time when performance can improve." Jang Ji-hye, a researcher at DS Investment & Securities, said, "Domestic content producers can expect an increase in production volume due to the growing Asian market and the global popularity of K-content," adding, "Attention should be paid to undervalued domestic content producers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.