"Officetel urgent sale. I will also pay the acquisition tax." Recently, a post appeared on a real estate community offering a residential officetel (apateul) in Suwon-si, Gyeonggi Province, at about 300 million KRW, which is 30 million KRW below the market price. The seller promised to provide free options worth about 15 million KRW, including a refrigerator, washing machine, and air conditioner, and also to pay the acquisition tax themselves.

Also, a seller of an apartment in Hongje-dong, Seodaemun-gu, Seoul, posted that it was an urgent sale and offered to cover the acquisition tax and brokerage fees worth about 3 million KRW. They added that if the buyer’s financial capacity is insufficient, a ‘joojeon transaction’ is also possible. This refers to a transaction where the seller lives in the sold house under a jeonse lease.

As the real estate transaction freeze continues and the big step (a 0.5 percentage point increase in the base interest rate) has frozen buyer sentiment, sellers have become very active. They play classical music so buyers can hear it as soon as they open the door, hang nice diffusers on the front door, and use music and scent as ‘tips for quickly vacating the room.’ This is because it has become much harder to find buyers in the sales market.

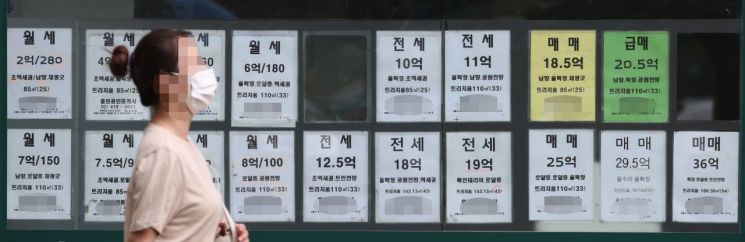

While the decline in Seoul apartment prices is widening, the apartment sales supply-demand index has fallen for 10 consecutive weeks. Concerns that house prices will fall further due to the economic downturn and interest rate hikes are increasing, causing buyer sentiment to freeze more and more.

According to the Korea Real Estate Board, this week’s Seoul apartment sales supply-demand index was 86.4, down 0.4 points from last week’s 86.8. It has been declining for 10 weeks since the temporary exclusion of multi-homeowners from capital gains tax surcharges was implemented in May. The sales supply-demand index is calculated by analyzing surveys of member real estate agencies and the number of online listings, quantifying the ratio of demand (buyers) to supply (sellers). The lower this index is below the baseline (100), the more sellers there are compared to buyers in the market.

Seoul apartment prices have been falling for seven consecutive weeks. This week, according to the Korea Real Estate Board, Seoul apartment prices fell by 0.04%, with the decline widening compared to last week’s -0.03%. Yongsan-gu saw apartment prices drop by 0.01% this week, ending a four-month period of price increases or stability and turning to a decline. Since the temporary exclusion of multi-homeowners from capital gains tax surcharges was implemented in May, prices have been falling for 10 weeks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)