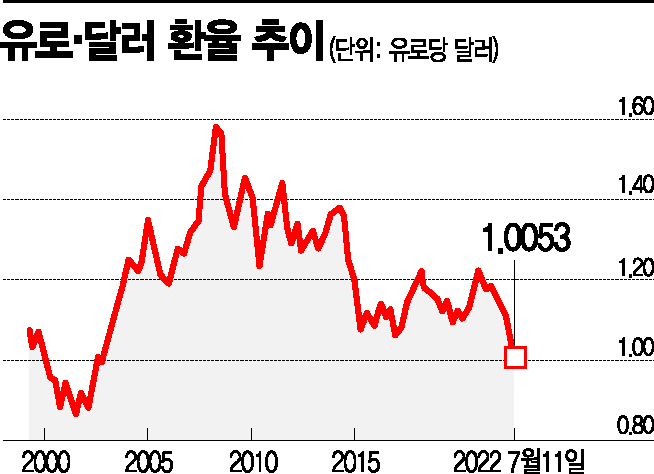

Concerns Over Complete Cutoff of Russian Gas Supply... Countdown to Unprecedented Parity in 20 Years

[Asia Economy Reporter Park Byung-hee] As the parity between the euro and the dollar (1 euro = 1 dollar) approaches, the dominance of the dollar is expected to strengthen further. Following the yen, the euro's value as a safe-haven asset is also declining, causing capital flows to shift toward dollar assets. There are growing concerns that the sharp drop in the euro's value could further drag down the already struggling European economy.

According to Bloomberg News, on the 1st (local time), the euro's value against the dollar fell by up to 1.3%, with the euro-dollar exchange rate reaching $1.0053 per euro. This broke the euro's 20-year low recorded last week.

ING predicted that euro-dollar parity could occur this week due to Russia's gas supply cut. Jordan Rochester, a foreign exchange strategist at Nomura Securities, forecasted that if Russia completely shuts off the Nord Stream 1 gas pipeline, the euro's value could fall to $0.95 per euro.

◆ Fear of Russian Gas Supply Cut = Russia announced that it would shut down the Nord Stream 1 gas pipeline, which supplies the most gas to Europe, from today until the 21st for regular maintenance. However, amid the worst relations between Russia and Europe due to the Russia-Ukraine war, there are cautious forecasts that Russia may not resume gas supply even after completing the maintenance.

Valdis Dombrovskis, European Union (EU) Executive Vice President, said at a press conference ahead of the Eurozone finance ministers' meeting that "a complete cut-off of Russian gas supply is a risk that cannot be ruled out." He added, "On the 14th, the EU Commission will release new economic indicators and revise upward the inflation forecast," reflecting the risk of reduced Russian gas supply.

The EU Commission, in its economic outlook released in May, predicted that Eurozone inflation would reach 6.1% this year and fall to 2.7% next year. At that time, the Commission forecasted EU and Eurozone economic growth rates of 2.7% this year and 2.3% next year.

However, if inflation intensifies, the European Central Bank (ECB) will likely implement high-intensity tightening, increasing the risk of an economic recession. In May, the EU Commission warned of recession risks, stating that due to Russia's overt gas supply cuts, the Eurozone GDP might maintain growth compared to the previous year but could decline quarter-on-quarter.

Paolo Gentiloni, EU Commissioner for Economy, pointed out, "Unfortunately, the situation has not improved," and noted that "(Russian gas) supply reductions and actual shortages could make our economic situation more difficult."

Vice President Dombrovskis also said, "Although the economy is proving resilient this year, due to high uncertainty and risk factors, economic slowdown is still expected," adding, "The slowdown may continue into next year." He mentioned that measures are being prepared in anticipation of a permanent cut-off of Russian gas supply, with the measures to be announced next week.

A decline in the euro's value could raise import prices, further fueling inflation and creating a vicious cycle.

◆ Growing Investor Anxiety = The last time the euro and dollar were at parity was in 2002. The euro was introduced on January 1, 1999, and officially circulated from January 1, 2002. Before 2002, the currencies of existing Eurozone member countries, such as the German mark and French franc, were used together.

Therefore, 2002 was effectively the first year the euro was officially circulated, and the parity at that time can be attributed to technical factors related to the introduction of the new currency. This is the first time the euro's value is being assessed lower than the dollar for economic reasons.

The decline in the euro's value is also expected to increase investor anxiety about the Eurozone. In fact, the yield spread between German and Italian 10-year government bonds has gradually widened since the Russia-Ukraine war. The spread was 1.72 percentage points on February 23, just before the war broke out, but has since widened to 1.96 percentage points. The ECB plans to announce measures this month to prevent fragmentation caused by widening interest rate spreads among Eurozone member countries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)