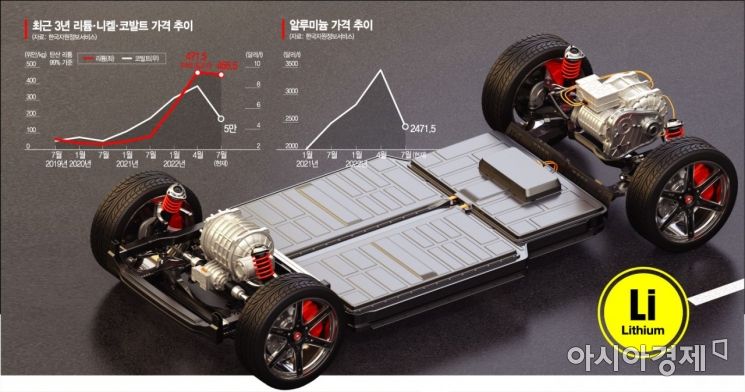

Up a staggering 468% from a year ago... 3% drop from the peak

Rising demand for LFP batteries complicates processing and mining permits

[Asia Economy Reporter Donghoon Jeong] While raw material prices, which had soared due to inflation concerns and supply shortages, are showing a downward trend, the price of lithium, an essential raw material for electric vehicle batteries, is alone experiencing a 'high-altitude march.' Recently, while prices of other raw materials have fallen by nearly 30-40%, lithium has only seen a slight decline. The soaring price of lithium, considered a key battery material, symbolizes the still unresolved 'supply chain crisis' despite global recession concerns.

Battery Symbol ‘Lithium’ Still Holds High Ground

According to the Korea Resource Information Service and the industry on the 10th, the price of lithium (lithium carbonate 99% standard), which was 80 yuan (about 15,500 KRW) per kilogram in July last year, has surged 468% to 455 yuan (about 88,200 KRW) currently. This is only a 3% drop compared to the all-time high of 471 yuan (about 91,300 KRW) recorded last April.

In contrast, other battery materials such as nickel and cobalt, which surged after the Russia-Ukraine war, are sharply declining. For the most expensive cobalt, the price dropped about 38% from $81,600 per ton (about 107.3 million KRW) until April to $50,000 (about 64.8 million KRW) currently. Nickel also fell 32% during the same period, from $32,800 (about 42.5 million KRW) to $22,000 (about 28.5 million KRW).

The reason lithium prices are rising is interpreted as due to its extensive industrial use in the battery sector. Lithium is a core material that generates and stores electricity in batteries. When charging begins, lithium ions and electrons in the cathode move to the anode. After charging (cathode→anode) is complete, the discharge process (anode→cathode) proceeds, providing electrical output to devices equipped with batteries.

Lithium is used in both NCM (nickel-cobalt-manganese) batteries, referred to as ternary batteries, and LFP (lithium iron phosphate) batteries. The domestic industry mainly produces ternary batteries, while China leads in LFP. Recently, demand for the relatively cheaper LFP batteries has spread across the industry, driving the high price trend of lithium. In fact, sales of electric vehicles using LFP in China are surging, and global automakers like Tesla are eagerly adopting LFP batteries. Goldman Sachs estimates that LFP batteries will increase their market share from the current 30% to nearly 40% by 2030.

Although lithium reserves are abundant, processing lithium for battery use requires considerable time and cost. Due to growing environmental concerns, obtaining mining permits involves complex procedures, making short-term production expansion difficult. Therefore, the prevailing view is that lithium prices are unlikely to fall anytime soon.

Raw Material Prices Plunge While Oil Stays Above $100

Meanwhile, international raw material prices, which had been breaking ceilings daily, are rapidly declining. Particularly, prices of iron ore, copper, aluminum, and other raw materials foundational to industrial production in steel and non-ferrous metals have dropped more than 30% over the past three months. This is the first time in over two years since the COVID-19 pandemic that the upward trend in major raw material prices has been broken.

Copper, a representative industrial basic material and a barometer of the international economy, barely exceeded $7,500 per ton (about 9.71 million KRW). This is more than a 20% drop compared to early this year. Compared to the all-time high of over $10,600 per ton (about 13.73 million KRW) recorded in April, the decline rate reaches 30%. According to the Korea Resource Information Service, aluminum prices fell more than 30% in the past three months to $2,417 as of the 7th. The spot price of iron ore, which surpassed $200 for the first time in mid-last year, has also dropped to the $110 range.

The Standard & Poor's (S&P) GSCI grain price index, which hit an all-time high in mid-May, has also fallen 28% currently. The metal price index tracking six industrial metals traded on the London Metal Exchange (LME) has dropped more than 30% since peaking in March.

On the other hand, international oil prices remain high. On the 8th (local time), West Texas Intermediate (WTI) crude oil for August delivery on the New York Mercantile Exchange (NYMEX) closed at $104.79 per barrel, up 2.0% ($2.06) from the previous day. This is two days after it plunged 8.2% below $100 amid recession fears on the 5th, regaining the $100 mark. Concerns that global oil supply might decrease lifted international oil prices, which had been falling sharply for two days due to recession fears.

The Russian Novorossiysk court ordered the Caspian Pipeline Consortium (CPC) to suspend operation of the pipeline connecting western Kazakhstan and the Black Sea for a month, and the U.S. strengthened sanctions on Iran, fueling these concerns. Jeffrey Halley, senior analyst at OANDA, forecasted, "With Russia's oil supply expected to decrease and OPEC countries not investing in maintaining oil production capacity, oil prices will continue to exceed $100 for the foreseeable future."

Possibility of U.S. Economic Recession...Concerns Over Export Slowdown↑

According to the Atlanta Federal Reserve Bank's 'GDPNow' on the 10th, the U.S. real GDP growth rate for the second quarter is expected to be -1.2% annualized. GDPNow estimates the U.S. real GDP in real-time based on data and mathematical models. If the forecast holds, the U.S. will have recorded two consecutive quarters of negative growth, technically entering a recession.

Since the Federal Reserve (Fed) implemented a 'giant step' (a 0.75 percentage point hike in the benchmark interest rate at once) for the first time in 28 years in mid-last month to curb high inflation, concerns about a recession have been spreading. Recently, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), warned that a global recession could occur next year and announced plans to lower this year's global economic growth forecast soon.

The IMF lowered its global economic growth forecast for this year from 4.4% to 3.6% in April, a 0.8 percentage point cut.

If the world, including the U.S., experiences a recession, concerns about our economy will inevitably grow because it negatively affects exports, the backbone of our economy. Signs of export slowdown are already appearing. June exports increased by only 5.4% compared to a year earlier, dropping to single-digit growth for the first time in 16 months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)