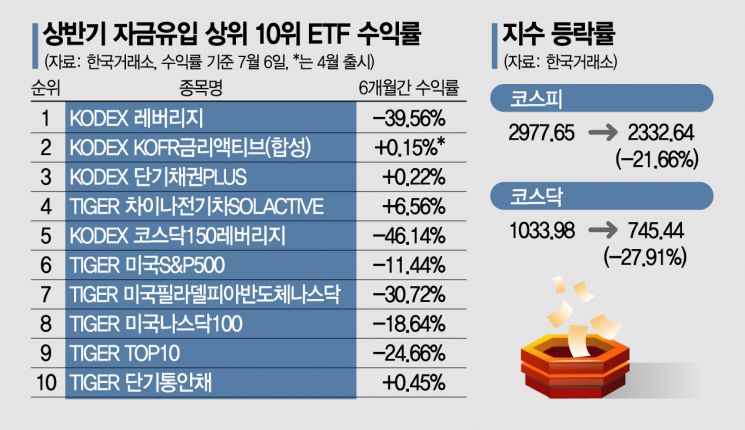

Top 10 ETFs by Inflow in H1 Average Return -16.3%

Largest Loss -47.65%... 'KODEX Kosdaq150 Leverage'

Top Gain +6.56%... 'TIGER China Electric Vehicle SOLACTIVE'

[Asia Economy Reporter Hwang Yoon-joo] Exchange-traded funds (ETFs) that attracted significant capital inflows in the first half of this year recorded average double-digit losses. The ETFs that drew the most money were bonds, semiconductors, Chinese electric vehicles, and leveraged products, with semiconductors and leveraged products suffering the largest losses. Chinese electric vehicles and bonds generated profits even in a bear market.

According to the Korea Exchange on the 7th, the average return of the top 10 ETFs by capital inflow in the first half of this year was -16.3%.

The ETF that attracted the most money in the first half of this year was ‘KODEX Leverage’ (KRW 1.5085 trillion), which tracks the KOSPI 200 index at more than twice the rate. While it can generate significant profits in a rising market, it was a high-risk product in the first half of this year. Its return was -39.56%, ranking second in losses among the top 10 ETFs by capital inflow.

The second (KRW 1.0213 trillion) and third (KRW 752.2 billion) ETFs by capital inflow were ‘KODEX KOFR Interest Rate Reactive’ (+0.15%) and ‘KODEX Short-term Bond PLUX’ (+0.23%), respectively. Both are short-term bond products classified as safe assets.

After the U.S. Federal Reserve (Fed) began raising the benchmark interest rate in earnest in March, followed by high-intensity tightening of 50 basis points in May and 75 basis points in June, money flowed into ETFs investing in short-term bonds. Although investment returns were modest, losses were effectively prevented.

Among the top 10 ETFs by capital inflow, three were short-term bonds, and two of the top three were short-term bonds. Considering that these ETFs mainly attract institutional investors' funds, this indicates that capital flows quickly shifted to bonds during the interest rate hike period.

An asset management company official explained, "It appears that institutional investors concentrated funds in ultra-short-term products to manage investments amid the volatile market during the interest rate hike period."

The ETF with the largest loss was ‘KODEX KOSDAQ150 Leverage’ (KRW 655 billion), which recorded -47.65%. This decline exceeded the KOSDAQ index's first-half drop of -27.91%. Leveraged products track indices at more than twice the rate, thus carrying proportionally higher risk.

It is notable that both KOSPI 200 and KOSDAQ 150 saw money flow into leveraged ETFs. This is interpreted as individual investors pouring funds into leveraged products to maximize returns. However, in the volatile first half of this year, these products became the biggest losers.

The second-largest loss was the most heavily funded ‘KODEX Leverage,’ and the third-largest loss was ‘TIGER U.S. Philadelphia Semiconductor Nasdaq’ (KRW 626.8 billion) at -30.72%.

This was due to growing concerns over deteriorating earnings of semiconductor companies amid declining semiconductor demand. The overall weakness in tech stocks, influenced by the U.S.'s high-intensity tightening stance, also played a role.

The fortunes of U.S. semiconductors and Chinese electric vehicles diverged. The highest-performing ETF was ‘TIGER China Electric Vehicle SOLACTIVE’ (KRW 696.7 billion), which posted +6.56%. This product includes companies such as BYD, the No. 1 Chinese and No. 2 global electric vehicle manufacturer, and CATL, the No. 1 Chinese and No. 3 global electric vehicle battery producer.

This is interpreted as a result of increased electric vehicle sales following China's easing of COVID-19 lockdowns and economic stimulus measures. China is strengthening eco-friendly policies and providing full support to the electric vehicle and solar power industries.

Not only individual investors but also overseas investors' buying momentum pushed the net assets of overseas stock ETFs listed domestically to surpass KRW 4 trillion for the first time.

Samsung Securities researcher Jung Ha-neul said, "With the end of Shanghai's lockdown, companies that had experienced production disruptions have not fully recovered to previous levels but production is normalizing. Especially for BYD, due to the electric vehicle subsidy policy that lasts only until 2022, sales are expected to accelerate toward the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.