[Asia Economy Reporter Ji Yeon-jin] Among 10 university students who have started stock investing, 7 are investing in overseas stocks. Additionally, 26.3% have invested in virtual assets.

Korea Investment & Securities, a subsidiary of Korea Financial Group (CEO Jeong Il-moon), announced on the 6th that these results were revealed through a survey conducted on 430 university and graduate students participating in the '5th Bankis University Student Mock Investment Competition.'

According to the survey, most university student stock investors have a short investment period of less than three years. Among all respondents, 65.1% answered that their stock investment period is between 1 and 3 years. Including those under one year, the total is 81.4%. Considering the average respondent age is 24.6 years, most started investing in stocks after becoming adults, specifically after the Donghak Ant Movement period.

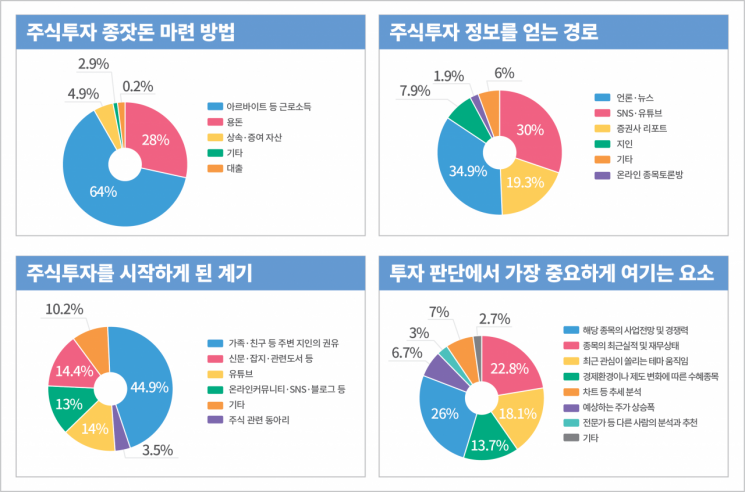

Investment funds were mostly sourced from 'part-time jobs or earned income' at 64%, which is higher than allowances (28.1%) or inherited/gifted assets (4.9%). However, the scale of their investments is not large. 47% invest less than 5 million KRW in stocks. Among investors who use credit transactions or loans for stock investments, known as 'debt investing,' 18.2% were identified, with most loan amounts being under 5 million KRW (53.5%).

The most common way students were introduced to stock investing was through 'recommendations from acquaintances' at 44.9%, followed by newspapers, magazines, and books at 14.4%. Reflecting their familiarity with online activities, a significant portion of university student investors also cited YouTube (14%) and online communities, SNS, and blogs (13%) as sources. Channels for obtaining investment information were also dominated by media/news (34.9%) and SNS/YouTube (30%).

However, when it came to selecting and deciding on investment stocks, many respondents said they relied more on their own judgment rather than others' opinions. When asked about factors influencing investment decisions, 26% chose 'business prospects and competitiveness of the stock,' 22.8% selected 'recent performance and financial status of the stock,' followed by 'theme movements' (18.1%) and 'economic environment or institutional benefits' (13.7%).

In contrast, only 3% of respondents answered 'analysis and recommendations from experts or others.' The number of stocks invested in was mostly between 2 and 5 (56%), and in terms of investment strategy, growth stocks (48.1%) were preferred over value stocks (45.3%).

Students were active in investing in overseas stocks. 68.5% of university student stock investors were found to be investing in overseas stocks. Regionally, there was a strong concentration in U.S. stocks. Among respondents investing in overseas stocks, 88.4% invested in U.S. stocks. Despite multiple responses allowed, those investing in other regions such as China, Europe, and Japan each accounted for less than 5%.

Additionally, 26.3% invested in virtual assets besides stocks. The biggest reason for investing in virtual assets was 'high expected returns' (49.1%). 17% of respondents said they invested because they saw future value in virtual assets. Those who did not invest in virtual assets cited 'excessive volatility' (41.8%) and 'uncertain intrinsic value' (37.1%) as reasons, reflecting opposite views on the same factors.

Other factors influencing the choice of brokerage firms included 'event benefits' at 32.1%, followed by 'brand awareness' (22.8%) and 'fees' (20%). Regarding stock market-related systems, university student investors viewed 'reforming the short-selling system' (38.1%) as the most urgent. Tax systems such as securities transaction tax (25.3%) and market safety measures for investment stability (12.6%) were also seen as needing improvement.

Meanwhile, Korea Investment & Securities holds mock investment competitions for university and graduate students to foster a sound investment culture. Participants invest virtual initial operating funds over a set period, competing based on cumulative returns at the end. Scholarships are awarded to top students in domestic and overseas leagues, and students in their 3rd and 4th years receive benefits such as passing document screening when applying for jobs at Korea Investment & Securities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)