Interest Rates Vary by Deposit Period... No Limit on Amount

[Asia Economy Reporter Minwoo Lee] SC First Bank is launching a demand deposit product that offers up to 2.5% annual interest (before tax) depending on the deposit period of each deposit transaction.

SC First Bank announced on the 4th that it will sell this 'My Run Account No. 5' for a limited period.

This product is a demand deposit that provides interest rates ranging from a minimum of 0.1% to a maximum of 2.5% depending on the deposit period of each deposit transaction, up to 6 months. Customers can deposit surplus funds without any amount limit and freely make deposit and withdrawal transactions at any time.

Typically, if funds are withdrawn before the maturity of a fixed deposit, an early termination interest rate is applied, resulting in a lower interest rate on the entire amount. However, 'My Run Account No. 5' is structured so that the longer the deposit period for each deposit transaction, the higher the interest rate, making it a ‘parking account’ that allows efficient management of surplus funds.

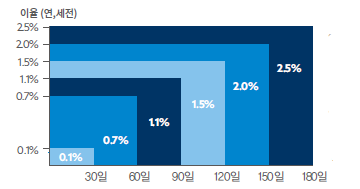

Specifically, if the deposit period per transaction is 30 days or less, the interest rate is 0.10%; 31 to 60 days, 0.70%; 61 to 90 days, 1.10%; 91 to 120 days, 1.50%; 121 to 150 days, 2.00%; and 151 to 180 days, 2.50%. The number of days is calculated for each deposit transaction up to the withdrawal date or product conversion date, and the corresponding interest rate for that number of days is uniformly applied to the entire deposit period. When withdrawing deposits, a first-in, first-out method is applied, meaning the earliest deposited amount is withdrawn first, so the fewer withdrawal transactions there are, the higher the interest rate one is likely to receive.

Meanwhile, on the 181st day from the new account opening date, interest is calculated on the entire balance up to the previous day, and the account is automatically converted to My Simple Account after deposit. The My Simple Account is a demand deposit that offers an interest rate of 0.4% on amounts exceeding 3 million KRW in the daily balance.

The sales period for My Run Account No. 5 is until the 22nd of this month, with a sales limit of 200 billion KRW. Sales may end early if the sales limit is reached. Eligible applicants are individuals and sole proprietors, and only one account per person can be opened. More detailed information can be found on the SC First Bank website or through the customer contact center.

Jonggwan Park, Head of Collateral Loan/Deposit Products Division at SC First Bank, said, "My Run Account, which combines the advantages of demand deposit accounts and fixed deposits, is suitable for customers who want to manage surplus funds stably," adding, "In a situation where domestic and international economic volatility is increasing, customers will be able to enjoy both the convenience of demand deposit accounts and the benefits of high interest rates simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.