[Asia Economy Reporter Song Hwajeong] This year, the 'Finding Hidden Financial Assets' campaign across all financial sectors helped recover approximately 1.5 trillion KRW in hidden financial assets and returned them to consumers.

According to the Financial Services Commission (FSC) on the 4th, the FSC and the Financial Supervisory Service (FSS), together with all financial sectors, conducted a six-week joint campaign from April 11 to May 20 to enable financial consumers to easily check and reclaim hidden financial assets.

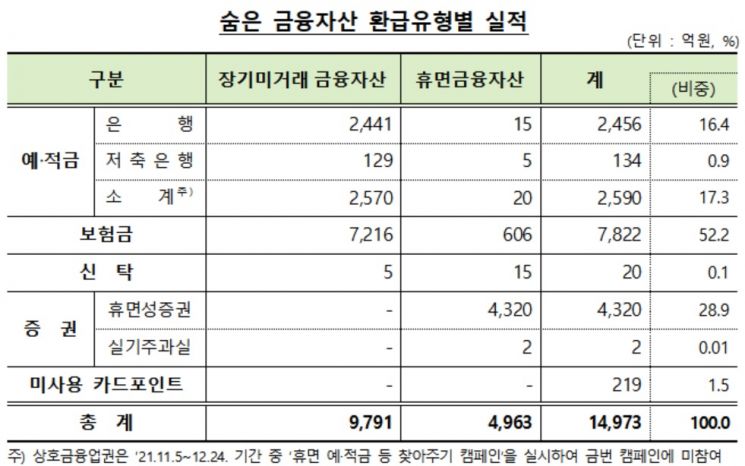

During the campaign period, hidden financial assets reclaimed by consumers amounted to about 1.5 trillion KRW from 2.55 million accounts. This represents about 40% of the total refunds (3.7 trillion KRW) since June 2015 through campaigns and the ongoing refund system, and exceeds the 1.4 trillion KRW reclaimed during the 2019 campaign. The hidden financial assets reclaimed during the campaign included long-term inactive financial assets worth 979.1 billion KRW, dormant financial assets worth 496.3 billion KRW, and unused card points worth 21.9 billion KRW.

By type of hidden financial asset, insurance payouts were the largest at 782.2 billion KRW (52.2%), followed by dormant securities at 432 billion KRW, deposits and savings at 259 billion KRW, unused card points at 21.9 billion KRW, and trusts at 2 billion KRW. Most insurance payouts (721.6 billion KRW) were long-term inactive insurance funds such as mid-term insurance payouts (policyholder dividends, survival pensions, etc.) and maturity insurance payouts.

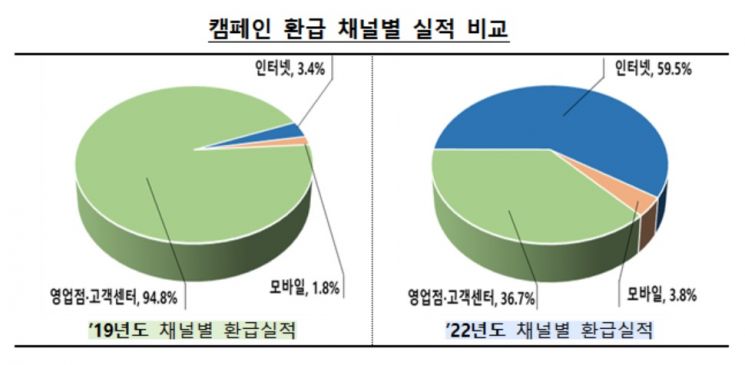

By refund channel, 948 billion KRW (63.3%) was refunded via internet and mobile, and 549.3 billion KRW (36.7%) through branches and customer centers. This shift from branches and customer centers to internet and mobile as the main refund channels is attributed to the widespread adoption of non-face-to-face financial transactions following COVID-19. In the 2019 campaign, refunds through branches and customer centers accounted for 94.8% of the total.

By age group, those aged 60 and above accounted for the largest share at 45.0%, followed by those in their 50s at 27.6%, 40s at 16.1%, 30s at 8.2%, and 20s and below at 3.1%.

The financial authorities plan to strengthen the functions of the ongoing hidden financial asset inquiry system, as a significant amount of hidden financial assets still remain despite continuous campaigns. To this end, they plan to expand the inquiry targets from existing personal accounts to corporate accounts and enhance the refund effect of hidden financial assets by raising the balance transfer limit of the 'Integrated Account Information Management Service,' a system that allows simultaneous inquiry of all financial sector accounts. Additionally, they will consider adding more asset types to the campaign and review the status of customer guidance for financial assets prone to becoming hidden, aiming to strengthen the guidance system.

An FSC official stated, "We will establish a virtuous cycle system where financial institutions proactively prevent the occurrence of hidden financial assets and encourage consumers to reclaim them," adding, "We will include the refund performance of dormant financial assets as a quantitative indicator in the financial consumer protection performance evaluation to induce voluntary refunds by financial institutions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.