Operating Revenues of 7 Major Securities Firms Down 28% Year-on-Year

[Asia Economy Reporter Minji Lee] Securities stocks are expected to report poor earnings again in the second quarter. This is because profits are predicted to significantly decrease due to bond management losses caused by the shock of rapid interest rate hikes and a sharp decline in the stock market.

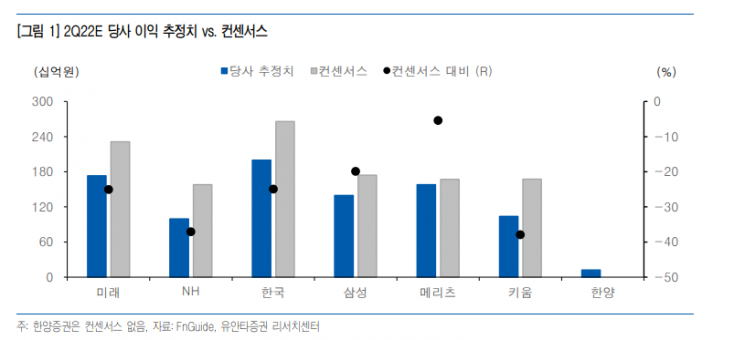

According to Yuanta Securities on the 4th, the estimated net operating income for the second quarter of seven securities firms including Mirae Asset Securities, NH Investment & Securities, Korea Investment & Securities (Korea Financial Group), Samsung Securities, Meritz Securities, Kiwoom Securities, and Hanyang Securities is 2.667 trillion KRW. This figure represents a 28% decrease compared to the same period last year and a 13.6% decline compared to the previous quarter.

This is expected due to the expansion of bond management losses as market interest rates have surged. Coupled with the sharp drop in the stock market, a decrease in profits related to stocks and equity-linked securities (ELS) and a reduction in interest income due to shrinking credit balances are also anticipated.

IB-related revenues are also expected to decline. Cases of defaults in real estate project financing (PF) are emerging, leading to strengthened risk management trends. This is analyzed to have a limited effect on performance defense because it results in a decrease in new deals and a drop in earnings.

However, the extent of the stock price decline appears to be greater than expected. This reflects concerns that the interest rate environment may further deteriorate. It is expected that profits will recover as tightening ends and market interest rates fall during the second half of the year.

Jung Tae-joon, a researcher at Yuanta Securities, said, “Considering the increasing burden on the domestic economy and household debt, the Bank of Korea will not blindly follow the U.S. in raising the base interest rate,” adding, “Market interest rates will face greater downward pressure as concerns over an economic recession intensify.”

Among the covered securities firms, the stock prices of Meritz Securities, Mirae Asset Securities, and Hanyang Securities have recently fallen sharply. This is analyzed as a decline in stock prices mainly in companies with high real estate exposure due to growing instability in the real estate market.

Researcher Jung Tae-joon explained, “Since large-scale losses were reflected in a short period, and real estate prices have not plunged sharply, the actual impact on earnings will be limited.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)