Second Half, Bear Market Entry "KOSPI Band Lower Bound Open Until 2100"

Do Not Presume Liquidation Timing, Confirm and Respond "Recovery Period Needed, Risk of Further Decline"

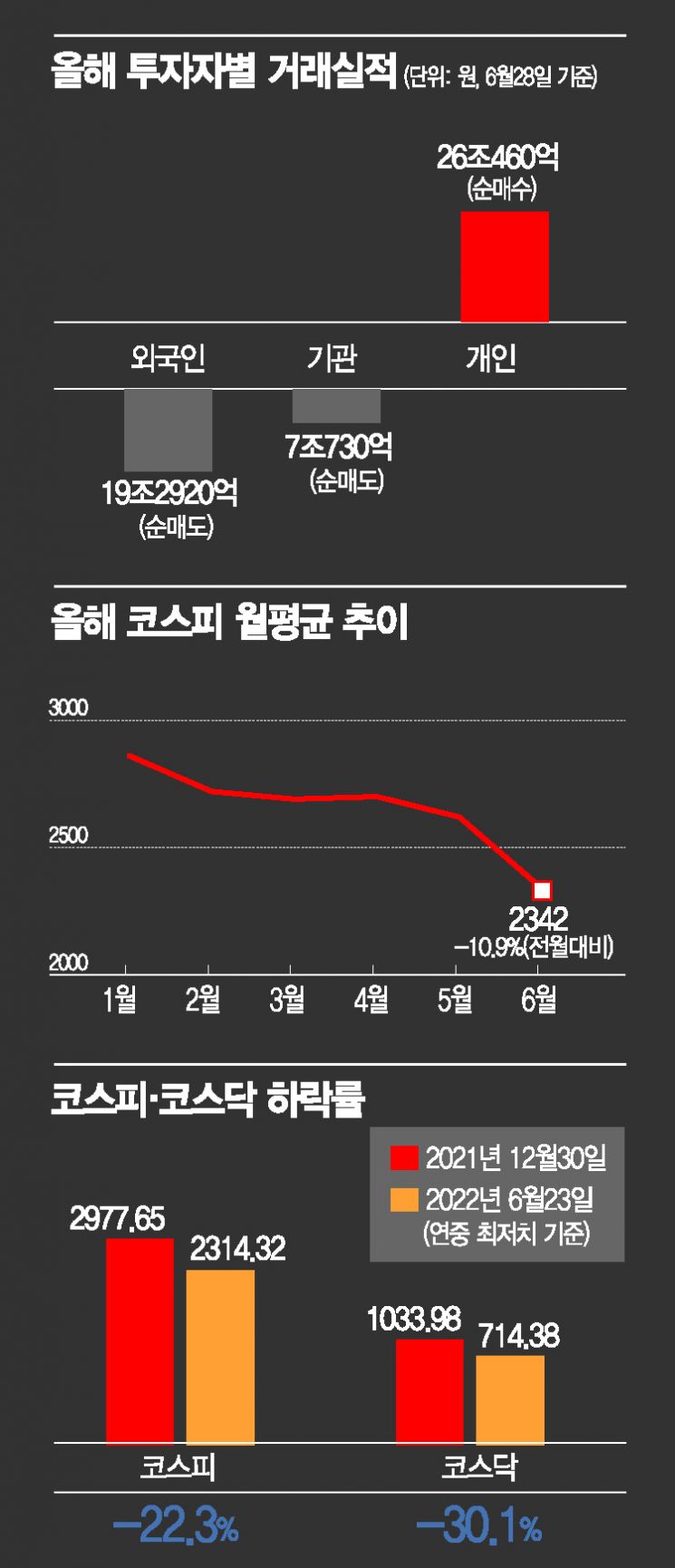

[Asia Economy Reporter Lee Seon-ae] The domestic stock market in the first half of this year can be summarized by three keywords: Sell Korea, the world's lowest decline rate, and "50,000 Electronics" (Samsung Electronics in the 50,000 KRW range). The winner in the domestic stock market was the "foreigners." They continued their relentless Sell Korea trend while adjusting their portfolios to generate profits. Although global stock markets plummeted simultaneously, the Korean stock market's decline was particularly severe, falling to the "lowest" rank. Samsung Electronics, the leading stock in the domestic market, ultimately lost its position in the "60,000 Electronics" range and was embarrassed to fall into the "50,000 Electronics" range. In the second half of the year, the domestic stock market officially enters a "bear market." Securities firms have set the lower bound of the KOSPI at 2100. Even if there is a rebound, it will only reach 2700. While the overall downtrend phase continues, it is uncertain when the bear market will end, so investment strategies must be devised accordingly.

KOSPI and KOSDAQ Rank 'Last' Among Global Stock Markets

The domestic stock market's decline in the first half of this year was particularly pronounced, recording the world's lowest level. According to the Korea Exchange on the 29th, compared to the lowest closing prices recorded on the 24th of this month and the end of last year, the KOSPI and KOSDAQ fell by 22.3% and 30.9%, respectively. Compared to major countries' stock markets, which mostly recorded single-digit decline rates, this is a disastrous level. The reasons for the particularly poor performance of the Korean stock market include export slowdown, won depreciation, foreign selling due to concerns over the interest rate inversion between Korea and the U.S., and forced liquidation sales.

The biggest cause is foreigners' Sell Korea. Foreigners have already sold more than 19 trillion KRW this year. Since the full onset of COVID-19 in 2020, foreigners have been selling Korean stocks for two years and seven months, surpassing the net purchase volume of the past 10 years. From January 2 to 28, 2020, the net selling amount was 66 trillion KRW, which means that in just two years, foreigners sold stocks they had purchased over the previous 10 years, which amounted to 52 trillion KRW. This is a selling bomb comparable to the financial crisis. Foreigners sold 74 trillion KRW worth of stocks from 2006 until the start of the financial crisis in 2008.

The proportion of foreigners in the Korean stock market has also plummeted. The share of KOSPI market capitalization held by foreigners (value of stocks held) has dropped to around 30%, a level last seen in 2009 when the global financial market was extremely depressed. SK Securities researcher Ahn Young-jin diagnosed, "In an environment of interest rate hikes, liquidity tightening, and war, where risk asset investment is avoided, it is difficult for foreigners to pay attention to the Korean market, resulting in the lowest level since 2009."

50,000 Electronics and Individual Investors' Returns Are Dire

Foreigners' Sell Korea was concentrated on Samsung Electronics. Samsung Electronics was the top net sold stock by foreigners, with sales amounting to 8.792 trillion KRW. As a result, foreigners' shareholding ratio in Samsung Electronics eventually broke below 50% and fell to the 40% range. The 50% threshold was breached for the first time in six years, and this is a low level compared to the average over the past 10 years. The highest shareholding ratio was 58.01% in July 2019, more than 9 percentage points higher than now.

Due to foreigners' selling and concerns about the business environment, Samsung Electronics' stock price plummeted, ultimately falling into the "50,000 Electronics" range. Compared to the beginning of the year, Samsung Electronics' decline rate as of the closing price on the 28th reached 24.43%.

Nevertheless, individual investors' love for Samsung Electronics remained strong. While foreigners sold 8 trillion KRW worth and institutions sold 6 trillion KRW worth, individuals scooped up 14 trillion KRW worth. Individuals also purchased 1.4621 trillion KRW worth of Samsung Electronics preferred shares. This ultimately led to a disastrous return rate. While foreigners and institutions made profits (based on the average return rate of the top 10 net purchased stocks in the first half), only individuals suffered losses. Korea Asset Investment Securities stated, "The top 10 net purchased stocks by individuals account for 90% of their total net purchases," adding, "All 10 stocks declined, and 8 of them outperformed the KOSPI decline rate, indicating that individual investors participating in the stock market in the first half suffered significant investment losses."

Do Not Prematurely Predict the End of the Bear Market in the Second Half

The domestic stock market in the second half of the year is officially defined as a bear market. Based on the criterion that a correction market is when the index falls more than 10% from its peak and a bear market is when it falls more than 20%, the KOSPI (peak on June 30, 2021, 3316 x 0.8 = 2653) is in a bear market if it falls below 2653.

The second half KOSPI outlook from major securities firms is also pessimistic. The lower bound is open to 2100. The most conservative forecast comes from KB Securities, which expects a range of 2100 to 2750. NH Investment & Securities, Samsung Securities, and Meritz Securities forecast 2200 to 2700. Daol Investment & Securities expects 2250 to 2660. Korea Investment & Securities, Shinhan Financial Investment, Daishin Securities, and Yuanta Securities plan to revise their second half outlooks downward.

Research center heads from NH Investment & Securities, Samsung Securities, and Meritz Securities expressed concerns that the decline could deepen due to foreign investors withdrawing funds amid interest rate hikes and won depreciation, worsening individual investor sentiment, and economic recession. They unanimously advised, "Even if buying at low prices with a long-term investment perspective, leverage (borrowed) investment must be strictly avoided, and risk management must be thorough, as there remain factors causing stock market instability." Additionally, Hwang Se-woon, senior researcher at the Capital Market Institute, said, "The biggest negative factors are interest rate hikes and economic recession," and predicted, "If foreign investment funds continue to exit the domestic stock market, further adjustments will occur."

In particular, there is a caution not to hastily predict the "end" of the bear market. During a long-term downtrend, even if the KOSPI experiences a short-term rebound, it is only a rebound, not a trend reversal. It is better to confirm and respond to the reversal retrospectively rather than prematurely predicting it. Korea Asset Investment Securities advised, "There is no signal that the long-term downtrend phase, which began last summer, has ended, so one should always expect and prepare for further declines," adding, "Looking at the previous three cases where the long-term downtrend ended with a major uptrend, it took more than two years and six months to recover the KOSPI before the reversal occurred."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.