[Asia Economy Reporter Ryu Taemin] The apartment auction market in Seoul, considered a leading indicator of the real estate market, has struggled to recover from its slump. The frozen apartment sales market, coupled with increased financing burdens due to interest rate hikes and the Debt Service Ratio (DSR) regulations, appears to have reduced investment demand within the metropolitan area.

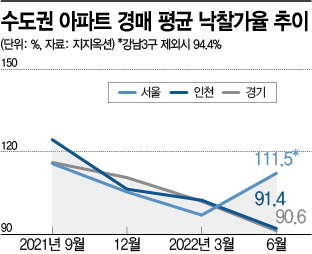

According to court auction specialist company Gigi Auction on the 28th, the average winning bid rate for apartment auctions in Seoul this month was 111.5%. This is a 15.1 percentage point increase from last month’s 96.4%, marking the highest rate so far this year. However, a closer look at the winning bids reveals that ‘Gangnam special’ properties such as Banpo Xi and Jamwon Shinbanpo unusually exceeded a winning bid rate of 140%, which pulled up the average winning bid rate. Excluding these, the average winning bid rate for other Seoul apartments this month was 94.4%, effectively a 2 percentage point decline from last month.

The winning bid rate for Seoul apartments had surpassed 110% for seven consecutive months from the first half of last year, breaking the all-time high five times, but has been declining since November last year. In February, the winning bid rate fell into the 90% range for the first time in a year. The winning bid rate refers to the ratio of the winning bid price to the appraised value; exceeding 100% means an apartment appraised at 100 million KRW was sold at a price higher than 100 million KRW. The decline in apartment prices and weakened buyer sentiment seem to have been reflected in the auction market as well.

The winning bid rates in metropolitan areas outside Seoul are also on a downward trend. This month, the winning bid rate for apartments in Incheon dropped by 5.8 percentage points from the previous month to 91.4%, marking the lowest in 18 months. This is a 32.5 percentage point decrease compared to the all-time high of 123.9% recorded in August last year.

In Gyeonggi Province, the rate fell by 3.1 percentage points from the previous month to 90.6%, the lowest within the metropolitan area. This is the lowest in 30 months since January 2020 (90.36%), raising concerns that it might drop into the 80% range.

The contraction of the metropolitan apartment court auction market is attributed to consecutive base interest rate hikes and the government’s comprehensive tightening of loan regulations. Additionally, as the outlook for the housing sales market darkens, investment demand that had been flocking to the auction market is also withdrawing. Lee Joo-hyun, senior researcher at Gigi Auction, explained, "As buyers’ financing capacity shrinks, it has become difficult for them to actively participate in bidding," adding, "With the apartment sales market showing signs of stagnation this year, the auction market is also experiencing a slowdown."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.