Rising Raw Material Costs Widen Deficits

Excessive Hiring and Wage Increases Also Contribute

Financial Improvement Lacking Beyond Rate Hikes

1,603 Regular Employees Added in 5 Years

Moon Administration's Overdrive on Renewable Energy

Controversy Over Hanjeon University’s Hasty Opening

There is no denying that the record-high operating losses Korea Electric Power Corporation (KEPCO) posted in the first quarter of this year, following last year, were largely due to rising fuel costs caused by a surge in raw material prices. When fuel costs increase, the electricity wholesale price (SMP) at which KEPCO purchases power from power producers soars, creating a structure where the more they sell, the more losses they incur.

However, the government pointed out that despite KEPCO’s massive debt burden, its focus on excessive welfare such as increasing staff and raising employees’ wages rather than improving its financial structure also contributed to the growing deficit. President Yoon Suk-yeol emphasized at the Cabinet meeting on the 21st that public enterprises should "lead by example by returning the treatment received by highly paid executives and reducing excessive welfare systems." This was for the same reason. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho’s call for KEPCO’s ‘self-reflection’ is also interpreted as a signal that the management cannot be free from lax management amid record losses.

Soaring electricity purchase prices surpassed sales prices in October last year

According to KEPCO, in October last year, when the Russia-Ukraine war was intensifying, the SMP per 1 kWh was 107.76 won, exceeding the sales price of 98.0 won. From that point, the structure of incurring losses the more they sell became fully established. When the SMP hit an all-time high of 202.11 won in April this year, the electricity sales price was 103.7 won, resulting in a loss of about 98.4 won per kWh. Compared to June 2017, five years ago, when the SMP was 82.71 won and the price at which electricity was sold to consumers was 115.4 won, generating a profit of about 32.69 won per kWh, the financial structure is analyzed to be in a seriously difficult state. During the same period, fuel costs soared by more than 3 trillion won, from 4.2968 trillion won in 2017 to 7.6484 trillion won this year.

Increased electricity consumption also worsened KEPCO’s deficit structure. According to KEPCO, per capita electricity consumption in Korea increased by 4.6%, from 9,869 kWh to 10,330 kWh during the same period. The problem is that despite the worsening deficit structure, KEPCO made minimal efforts to improve its financial structure beyond requesting appropriate rate hikes. An industry insider said, "As a public institution, KEPCO has endured deficits for the sake of stabilizing citizens’ lives," but also pointed out, "In the past, when KEPCO posted an operating loss of 2.8 trillion won in 2008, the government injected taxpayers’ money as subsidies to compensate, leaving a precedent that the government will help in times of difficulty."

Excessive expansion of workforce and labor costs alienates public sentiment

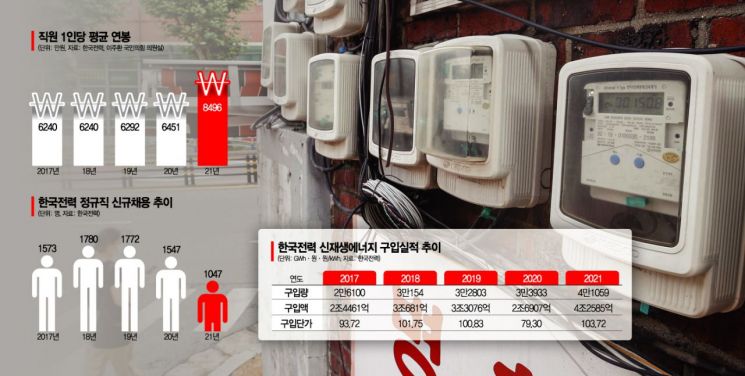

The aggressive increase in workforce over the past five years also negatively impacted KEPCO’s financial structure. During President Moon Jae-in’s five-year term, KEPCO hired an average of 1,544 regular employees annually. During this period, KEPCO posted operating profits in only two years, 2017 and 2020. Last year, KEPCO recorded a record annual loss of 5.86 trillion won. Despite such management difficulties, KEPCO increased its regular workforce by about 1,500 employees each year, driven by the Moon administration’s policy to expand public institution hiring as part of employment policy.

The Moon administration’s ‘Zero Non-Regular Workers’ policy is also closely related to this increase in regular employees. KEPCO’s regular workforce grew from 22,114 in 2017 to 23,717 in the first quarter of this year, an increase of 1,603 employees in just about five years. In contrast, during the same period, KEPCO’s non-regular workforce shrank from 566 to 112, nearly one-fifth.

The ‘Public Institution Autonomous Quota Adjustment System’ temporarily implemented by the previous government from 2018 for three years is also evaluated to have encouraged KEPCO’s workforce expansion. This system allowed public institutions to increase their regular employee quotas without approval from the Ministry of Economy and Finance if necessary. The government introduced this system to expand public institution hiring but abolished it early in March 2020 after discovering side effects such as accelerated deterioration of financial structures due to public enterprises expanding their organizational sizes one after another.

Mandatory expansion of renewable energy share also a burden

The rapid expansion of renewable energy supply is another major factor increasing KEPCO’s deficit. During the Moon administration, the share of expensive renewable energy was significantly increased, while the relatively cheaper share of nuclear power was reduced, inevitably raising the power generation cost. In fact, the amount of renewable energy purchased by KEPCO last year was 41,059 GWh, nearly 1.6 times the 26,100 GWh in 2017. During the same period, the share of renewable energy in the power purchased by KEPCO increased by 2.5 percentage points, from 4.9% to 7.4%. The cost KEPCO paid for renewable energy last year was 103.72 won per kWh, nearly twice that of nuclear power at 56.28 won.

Additionally, the Korea Energy Engineering University (KEPCO University), a national project under the Moon administration, also had an impact. Opened in March, KEPCO University is expected to require about 1.6 trillion won in expenses over the next ten years. A significant portion of the establishment costs will be borne by KEPCO and its power group companies. KEPCO has already contributed about 80 billion won to KEPCO University from 2020 through last year. The university opened in March with only one main building, sparking controversy over a ‘hasty opening.’ This is because there are many facilities yet to be built, such as dormitories, and the faculty is not adequately staffed. This means KEPCO will have to spend considerable additional costs on KEPCO University.

Of course, there are also voices within KEPCO expressing a sense of unfairness. They argue that the main cause of KEPCO’s deficit is electricity rates, but the government is trying to shift responsibility onto KEPCO’s lax management. Some view that KEPCO, as a public enterprise, simply followed government policies, which led to the increased deficit.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.