Seoul Housing Prices Rise 0.9% in First Half of Year

Lowest Increase Rate in 3 Years

Top 50 Complexes Nationwide Also Stall

Up 0.06%, Lowest in 2 Years

[Asia Economy Reporters Kim Hyemin and Ryu Taemin] The housing sale prices in Seoul recorded a growth rate in the 0% range in the first half of this year. This is the lowest level in three years since the first half of 2019, and the value of flagship apartments also dropped significantly.

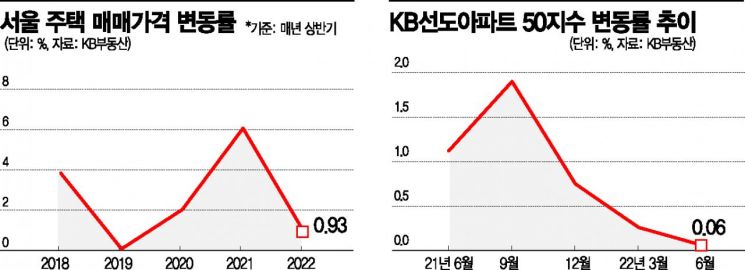

According to the monthly housing price trend time series data compiled by KB Kookmin Bank on the 27th, the housing sale prices in Seoul in the first half of this year rose by only 0.93% (cumulative) compared to December last year. Compared to the cumulative increase of 6.07% in the first half of last year, the upward trend sharply contracted within a year. This is the lowest level in three years since the first half of 2019 (0.08%).

By autonomous district, the housing price increase in Nowon-gu, which recorded the highest growth rate of 12.35% in the first half of last year, sharply slowed down. The housing sale price increase rate in Nowon-gu in the first half of this year was 0.24%, turning negative for the first time in May (-0.03%) and further declining this month (-0.09%). On the other hand, Yongsan-gu rose 2.6% and Seocho-gu 1.61%, both exceeding the Seoul average. This appears to be influenced by a prolonged transaction freeze caused by a decrease in purchases by people in their 20s and 30s, who had been active over the past two years, combined with perceptions of peak housing prices and interest rate hikes.

In particular, the apartment sale price increase rate dropped sharply from 8.43% in the first half of last year to 0.83% this year. The so-called 'flagship apartments' leading apartment prices have also entered a correction phase. This month, the 'KB Leading Apartment 50 Index' rose by only 0.06% compared to the previous month, marking the lowest level in two years since May 2020 (-0.64%). This index selects the top 50 complexes nationwide by market capitalization and indexes the market capitalization fluctuation rate, mainly used as a leading indicator of the housing market. The sharp decline in the rise of this index, which includes high-priced apartments concentrated in the Gangnam area, is interpreted as indicating that demand for 'smart single homes' is also slowing down.

Although the new government has introduced policies easing regulations from loans to taxes, the outlook is that the housing price rise will remain sluggish in the second half of the year. According to KB, the housing sale price forecast index predicted by Seoul real estate agents was 78 this month, sharply down from 92.2 last month. This index forecasts housing price increases or decreases on a scale from 0 to 200, with lower numbers indicating a higher proportion of expected declines. This means that the number of real estate agents predicting a price drop is increasing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.