Financial Supervisory Service 2023 Financial Statement Review Issues Advance Notice

[Asia Economy Reporter Ji Yeon-jin] Kim, a team leader at company C, a KOSDAQ-listed company, embezzled company funds continuously by unauthorized withdrawals and arbitrary sales of accounts receivable without the review or approval of superiors while handling funds for a long period. To conceal this, he directly entered and manipulated accounting records, inflated foreign currency deposits in overseas banks with insufficient bank balance verification, and even swapped manipulated bank inquiry documents with originals during the external auditor's on-site audit period. Company C failed to establish proper internal control measures, thus failing to detect such embezzlement, and overstated cash and cash equivalents in the audit report.

As embezzlement incidents among executives and employees of listed companies have frequently occurred this year, the Financial Supervisory Service (FSS) decided to focus on companies' cash flows when reviewing financial statements next year.

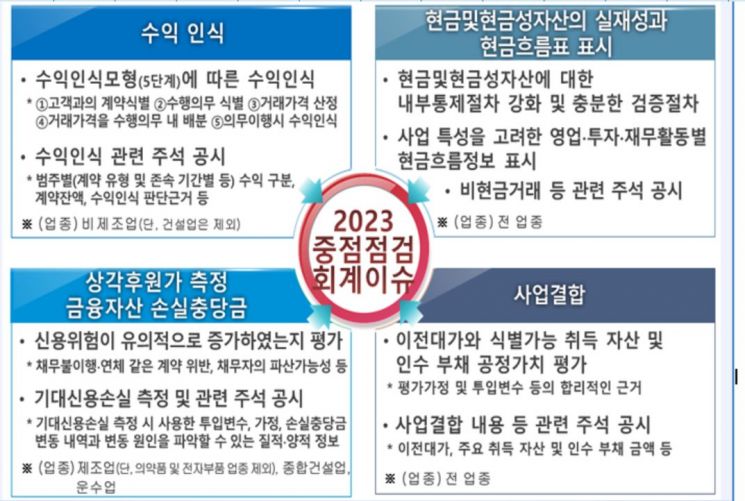

The FSS announced in advance on the 26th the four key accounting issues and industries to be focused on in the 2023 financial statement review.

Every year, the FSS conducts reviews mainly based on disclosure materials, concluding minor accounting standard violations with guidance and recommendations for amended disclosures, and conducting audits only for significant violations. To ensure companies and auditors pay sufficient attention to areas vulnerable to accounting errors in next year’s financial statement review, the FSS announces the key inspection areas for the next fiscal year every June.

Next year, the FSS plans to inspect all industries to verify the existence of cash and cash equivalents and whether cash flows are appropriately presented by activity. Target companies will be selected by sampling based on asset size and listed status, and the effectiveness of internal controls over cash and cash equivalents will be examined along with balance verification procedures to confirm existence.

Additionally, amid concerns over corporate performance due to recent global interest rate hikes and raw material price increases, the FSS will inspect whether impairment losses on accounts receivable and other amortized cost financial assets directly related to business activities have been properly recognized. This is because companies may arbitrarily judge impairment without reasonable grounds and understate loss provisions. The inspection will target manufacturing, general construction, and transportation industries.

Furthermore, since frequent cases of non-compliance with the new revenue recognition standard (K-IFRS) introduced in 2018 have been detected, the FSS plans to review non-manufacturing industries excluding construction to ensure revenue is recognized considering all contract terms and related facts and circumstances with customers, and that disclosure requirements are faithfully reported. Regarding the recent active corporate mergers and acquisitions (M&A), the FSS will also check whether the fair value of identifiable acquired assets and assumed liabilities has been measured based on reasonable grounds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)