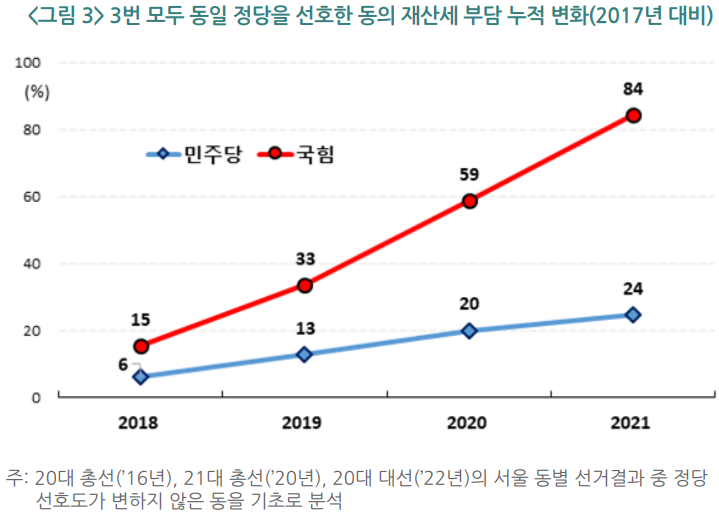

Democratic Party Preferred Areas Property Tax Increase Rate 24%... People Power Party 84%

Correlation Between Property Tax Burden Increase Rate and Party Support Observed

The sharp rise in real estate prices and the resulting 'tax bomb' have been found to closely influence the outcomes of the recent presidential and local elections, according to a new study. Comparing property tax burdens by neighborhood with election results revealed a strong tendency for areas with increasing property tax burdens to shift their support toward the People Power Party.

The report titled "Changes in Property Tax Burden and Party Support by Neighborhood in Seoul," recently published by the Korea Local Tax Research Institute, examines the correlation between the rate of increase in property tax burdens and party support.

The report matched the results of three elections?the 20th National Assembly election (April 13, 2016), the 21st National Assembly election (April 15, 2020), and the 20th presidential election (March 9, 2022)?with the average changes in property tax burdens by neighborhood, revealing a clear correlation between the two variables.

Neighborhoods that consistently favored the Democratic Party saw an average property tax burden increase of 24% from 2017 to 2021, whereas those that consistently supported the People Power Party experienced an 84% increase, showing a 3.4-fold difference.

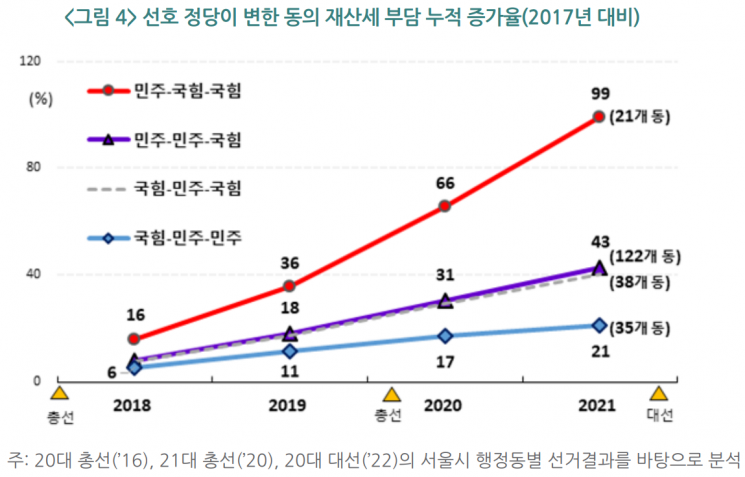

Neighborhoods where party preference shifted from the Democratic Party to the People Power Party had property tax burden increases averaging over 40%.

In the 2016 general election, neighborhoods with high Democratic Party support had an average property tax burden increase of 36% from 2017 to 2019, just before the 2020 general election when preferences began to shift. Similarly, neighborhoods that maintained Democratic support until the 2020 general election but shifted in the 2022 presidential election had property tax burden increases averaging between 40% and 43% from 2017 to 2021.

On the other hand, the 35 neighborhoods where party preference shifted to the Democratic Party from 2020 onward had an average property tax burden increase of only 11% just before the election.

Park Ji-hyun, the research fellow who authored the report, stated, "Because property tax is levied regardless of cash flow, it fundamentally causes taxpayer resentment. The recent increase in property tax through the realization of official property prices likely heightened taxpayers' anxiety. Increasing property tax requires public consensus first, and it is necessary to raise the tax burden gradually over the medium to long term."

Meanwhile, the government announced on the 16th in its "New Government Economic Policy Direction" that it will reduce the fair market value ratio used to calculate the 2022 property tax for single-homeowners from the current 60% to 45%, effectively restoring the property tax burden for single-homeowners to the level of two years ago.

In fact, Seoul's residential property tax increased by 8.0% to 10.3% annually from 2017 to 2021, significantly outpacing household income growth rates of 1.6% to 4.1%. Within Seoul, there were large regional disparities: among 426 administrative neighborhoods, the property tax burden increased by a minimum of 15% and a maximum of 153% from 2017 to 2021, showing more than a tenfold difference.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.