[Asia Economy Reporter Song Hwajeong] Financial holding companies are gearing up for quarterly dividends one after another. Recently, with ongoing pressure from financial authorities and the political sphere regarding interest rates and interest-based profits, they cannot help but be cautious, fearing that it might be perceived as a dividend feast.

According to the Financial Supervisory Service's electronic disclosure system on the 27th, financial holding companies have begun closing their shareholder registers for interim dividends this month. KB Financial announced on the 10th that it decided to close the shareholder register to confirm the shareholders entitled to interim dividends. Hana Financial Group and Woori Financial Group also made disclosures on the 15th for the same reason. The record date for closing the shareholder register is the 30th of this month, and specific details such as dividend amounts will be decided later at the board meeting. Shinhan Financial Group has not yet made a related disclosure, but its articles of incorporation specify that interim dividends can be paid to shareholders listed on the final shareholder register at the end of March, June, and September, so dividends can be paid without closing the shareholder register.

Despite record-breaking earnings, financial holding companies had to be passive about dividends due to the financial authorities' recommendation to reduce the payout ratio to within 20% amid the COVID-19 crisis. Since the recommendation was lifted in July last year, they have actively pursued shareholder returns. The record earnings support the strengthening of shareholder returns. The four major financial groups recorded the highest-ever net profits in the first quarter of last year and are expected to continue strong performance, with combined net profits exceeding 4 trillion won in the second quarter.

Jeong Taejun, a researcher at Yuanta Securities, analyzed, "The overall strengthening of banks' shareholder returns is because, despite achieving record profits until last year, there were restrictions on dividends due to preparations for COVID-19, and proactive provisioning was made. After the end of policy finance, it was judged that there are no problems with asset soundness and capital adequacy."

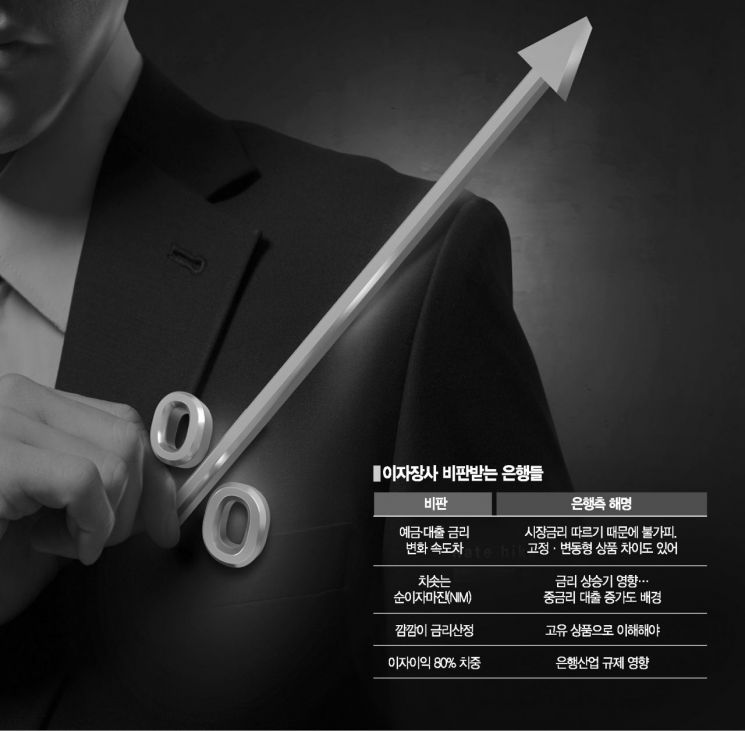

However, recent negative public opinion toward banks is a burden. Especially, following President Yoon Seok-yeol and Financial Supervisory Service Governor Lee Bok-hyun, the political sphere has also criticized banks' interest-based profits, so banks must endure criticism that they are holding a dividend feast after recording record profits through interest-based business. Earlier, Governor Lee mentioned at a meeting with domestic bank heads, "Criticism of banks' excessive profit-seeking is growing," and said, "It is necessary to calculate and operate interest rates based on more reasonable and transparent standards and procedures." Kwon Seong-dong, floor leader of the People Power Party, said, "There has been continuous criticism that commercial banks have taken excessive profits from the difference between deposit and loan interest rates. We must share the pain within the scope that does not undermine market autonomy." Sung Il-jong, chairman of the Policy Committee, said, "The livelihood economy is in a precarious situation, but banks that lend money to the people are earning huge interest profits," and added, "Should the value of the financial industry be dismissed as 'interest business'?"

Given this situation, financial holding companies cannot help but feel awkward. From the perspective of listed companies with shareholders, shareholder returns are inevitable. A financial holding company official said, "Since COVID-19, the authorities' atmosphere of refraining from dividends has continued," adding, "However, since dividends are a promise to shareholders, I believe it is a natural duty to fulfill that without fail."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.