AI Insurtech Solution Company

Driving Habit-Based Insurance Premium Calculation

Pay More for Reckless Driving, Discount for Safety

Received 20.2 Billion KRW Investment Since Establishment

[Asia Economy Reporter Donghyun Choi] "The domestic automobile insurance market has not seen proper innovation due to the industry's characteristic conservatism. I hope regulatory innovation does not remain just a slogan but creates a proper environment for startups to conduct business."

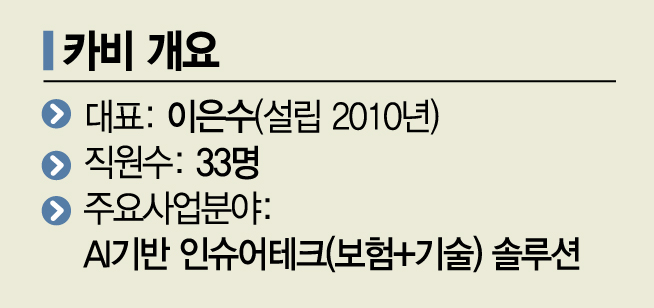

Lee Eun-su, CEO of CARVI, expressed regret, saying, "Even when innovative technologies are developed that lower insurance premiums to increase consumer benefits and promote safe driving, contributing to the public good, they often hit the solid walls of the domestic insurance industry and fail to be commercialized." Founded in 2010, CARVI is an AI-based insurtech (insurance + technology) solution company.

CARVI possesses technology that collects driver data through an AI-based video recognition engine. It gathers information by attaching separate telematics devices to vehicles or using smartphone cameras. The collected data is immediately transferred to cloud servers. There, CARVI’s independently developed deep learning-based deep data analysis system called the 'WOW Algorithm' instantly analyzes the data. It categorizes driving patterns such as the number of sudden accelerations typical of aggressive lane cutting, unnecessary lane changes, and acceleration through yellow lights. When a risky situation is predicted, the AI provides the driver with safety driving solutions through advanced driver assistance systems (ADAS) such as Forward Collision Warning System (FCWS) and Lane Departure Warning System (LDWS) to prevent accidents.

The automobile insurance product that CEO Lee currently aims to introduce domestically using CARVI’s technology is the 'Behavior-Based Insurance (BBI).' Lee emphasized, "Most domestic insurance products are calculated based on one-dimensional information such as age, gender, and accident-free periods, regardless of the driver’s actual safe driving behavior. BBI calculates premiums solely based on the driver’s driving habits, making it much more rational." Tesla launched BBI in five U.S. states, including Texas, last October, receiving great response. The introduction of BBI insurance products is rapidly gaining momentum across the United States. In Korea, it is still in its infancy, with Carrot General Insurance conducting pilot services aiming for a launch in the second half of this year.

CEO Lee stressed that BBI is above all a consumer-friendly insurance product. He explained, "If you drive safely this month, you get a discount on your premium next month; if you violate signals, speed, or drive recklessly, you pay more. It encourages safe driving and thus has high public value by reducing the probability of traffic accidents." According to U.S. insurtech company Zendrive, BBI insurance can reduce the likelihood of traffic accidents by up to 49% and reduce losses by up to $2 million per 1,000 drivers annually.

Lee also said BBI is advantageous for insurance companies. He said, "Assuming there are 100 automobile insurance subscribers, 8% cause accidents, and the current product structure requires the premiums collected from all 100 to cover the losses from those accidents. By adopting our technology, insurers can identify the 8% of drivers with a high accident probability, ultimately reducing the insurer’s loss scale." However, he added, "In Korea, because existing insurance products that do not require advanced technology and are subscribed to on an annual basis still sell well, it is true that introducing new products is conservative. Regulatory improvements are needed so that small and medium-sized companies can independently offer various insurance products, as in the UK."

Judging that more time is needed in the domestic private insurance market, CEO Lee is currently rapidly proving the effectiveness of CARVI’s solutions by establishing them in the B2G (business-to-government) market. He explained that 70% of disabled call taxis owned by local government agencies in Gyeonggi Province are either using or preparing to use CARVI’s solutions. Lee emphasized, "Our solution can manage real-time driving information of vehicles owned by corporations or institutions, and recently, inquiries for contracts have increased even in non-metropolitan areas. It is preferred because it has a function that immediately sends the accident location and accident video to managers and insurance handlers without requiring reports from drivers or witnesses when a traffic accident occurs."

Since its establishment, CARVI has received about 20.2 billion KRW in investment. It is currently preparing for Series B Plus funding. CEO Lee stated, "Once the investment is completed, we plan to officially enter the UK insurance market starting in the fourth quarter of this year. We will also gradually expand our AI technology sophistication and B2G market share in non-metropolitan areas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)