48 weeks and 32 weeks. The downward trend in apartment prices in Sejong City and Daegu City, which were directly hit by a supply surge, continues without showing any signs of bottoming out. As the government plans to review lifting restrictions on some regulated areas within this month, attention is focused on which regions will be deregulated.

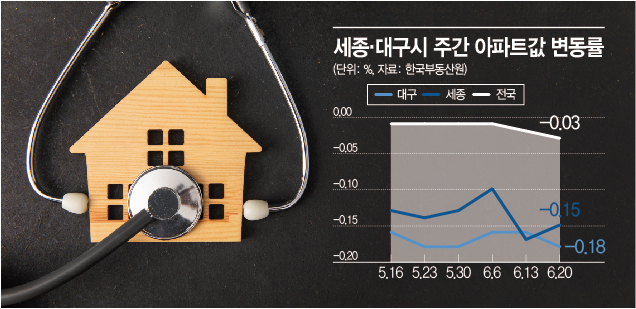

According to a survey by the Korea Real Estate Board on the 24th, nationwide apartment prices in the third week of June fell by 0.03% compared to the previous week. This marks the seventh consecutive week of decline since the first week of May, with the rate of decrease growing larger. Among the 176 cities, counties, and districts where apartment prices are publicly announced, the number of areas with price increases dropped from 65 to 53 compared to the previous week, while the number of areas with price decreases rose from 97 to 109.

Meanwhile, the government is reportedly planning to hold the Housing Policy Deliberation Committee (Jujeongsim) within this month to review the deregulation of some areas, drawing increased attention from local governments nationwide. Currently, there are 49 Speculative Overheated Districts and 112 Adjusted Target Areas designated nationwide. Being classified as a regulated area subjects residents to extensive restrictions on loans, taxation, and subscription rights. In Adjusted Target Areas, the Loan-to-Value ratio (LTV) is limited to 50% for properties valued up to 900 million KRW and 30% for the portion exceeding 900 million KRW. Debt-to-Income ratio (DTI) restrictions of 50% also apply, along with increased burdens from capital gains tax and comprehensive real estate tax.

Sejong City and Daegu City, which have not escaped the quagmire of prolonged stagnation, are particularly hopeful for the Jujeongsim meeting. Apartment prices in Sejong City fell by 0.15% in the third week of June, continuing a decline for 48 consecutive weeks since July 26 of last year. The rate of price decline is the highest among the 17 metropolitan cities and provinces nationwide, reaching 7%. Daegu City has been in a downward trend for 32 consecutive weeks since November 15 of last year. As of the end of April, Daegu had 6,827 unsold houses, an increase of about 250 units from the previous month’s 6,572 units. Compared to 897 unsold houses in Daegu a year ago, this is more than seven times higher.

When designating Adjusted Target Areas, the Ministry of Land, Infrastructure and Transport first identifies regions where the housing price increase rate over the past three months exceeds 1.3 times the local inflation rate, then examines subscription competition rates and pre-sale transaction volumes. So far, Daegu City, along with Yangju, Paju, and Gimpo in Gyeonggi Province, Cheongju in Chungbuk Province, Nam-gu in Ulsan, and Jeonju in Jeonbuk Province, have officially requested the Ministry to lift their Adjusted Target Area status. All these regions claim they meet the conditions for deregulation.

However, while the government is considering deregulation, it has clearly stated that the lifting of restrictions will be done in a ‘gradual’ manner. If many areas are deregulated in a short period, it could instead trigger market instability. If a phased deregulation occurs, Sejong City and Daegu City are expected to be the first. Lim Byung-cheol, Senior Researcher at Real Estate R114, said, "It is necessary to prioritize deregulation for areas like Daegu where housing price declines have been prolonged, apartment supply is steady, and unsold inventory continues to increase." The Ministry of Land, Infrastructure and Transport said, "We are reviewing whether to lift restrictions on some areas considering the housing market situation and the overall market impact," adding, "We plan to comprehensively review recent housing price trends, unsold housing inventory, and subscription competition rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.