89 Quarterly Dividend Forecast Stocks

Attractive for Both Price Defense and Dividends

[Asia Economy Reporter Myung-hwan Lee] Despite the majority of stocks declining amid a continuous downtrend, there are still quite a few stocks offering mid-year dividends in June. Securities firms advise that dividend stocks can be an attractive option not only for dividend payouts but also for stock price defense during volatile market conditions.

According to Mirae Asset Securities on the 21st, a total of 89 stocks are expected to pay quarterly dividends in June this year. Among them, 80 are common stocks excluding 9 preferred stocks. Research firm Embrain is predicted to have the highest dividend yield at 3.71%. Embrain's dividend per share (DPS) is expected to remain at 140 KRW, the same as last year. Following Embrain, Creverse (3.65%), Leadcorp (3.46%), C&T Seongjin (3.15%), and iMarket Korea (2.75%) are also expected to record high dividend yields. HD Hyundai is expected to pay a dividend of 1,730 KRW per share, resulting in the highest dividend yield of 2.89% among stocks listed on the Korea Exchange.

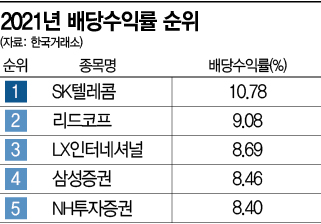

Among companies that paid dividends in 2021, financial sector stocks such as securities firms ranked high in dividend yields. An analysis by Asia Economy of Korea Exchange data showed that securities and financial stocks such as Leadcorp, which ranked second with a 9.08% dividend yield last year, Samsung Securities (8.46%), NH Investment & Securities (8.40%), DB Financial Investment (7.59%), and Industrial Bank of Korea (7.57%) were among the top performers. The stock with the highest dividend yield last year was SK Telecom at 10.78%.

Dong-chan Yeom, a researcher at Korea Investment & Securities, advised, "During periods when stock prices are falling, value stocks tend to perform better than growth stocks. Given the possibility of downward revisions in earnings estimates, it is necessary to consider dividend stocks rather than just value stocks."

There is also analysis that dividend stocks are attractive in volatile markets for both stock price defense and dividend yield. Lee Jung-bin, a researcher at Shinhan Financial Investment, said, "The KOSPI High Dividend 50 Index, one of the domestic dividend indices, outperformed the KOSPI by 10.9 percentage points compared to the beginning of this year," adding, "As concerns about inflation and interest rate hikes increase, the appeal of stable dividend stocks will be highlighted."

Among dividend stocks, attention should be paid to those with strong earnings. Min-gyu Kim, a researcher at KB Securities, said, "When filtering for stocks with high dividend yields, securities stocks, which are at the top, have announced weak first-quarter earnings, increasing the possibility of dividend cuts," and advised, "Even among high dividend stocks, focus should be on those whose net income, the source of dividends, has not decreased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.