[Asia Economy Reporter Jeon Jinyoung] The shopping carts of Olive Young Global Mall users are changing. The previously undisputed number one popular item, sheet masks, has been surpassed by sunscreen, cushions, essences, and other basic and color cosmetics.

Olive Young announced the results of an analysis of customer purchase data from the Global Mall on the 16th, reflecting this trend.

Olive Young held a large-scale regular discount event called Olive Young Sale for a week from the 2nd to the 8th at the Global Mall, which operates for overseas consumers. The Global Mall is a ‘reverse direct purchase’ platform where Korean cosmetics can be purchased from over 150 countries worldwide.

During this sale, the purchasing trend expanded from focusing on sheet masks to encompassing basic and color cosmetics overall. It is analyzed that customers who experienced Korean cosmetics through the low-entry-barrier sheet masks became interested in K-Beauty, leading to expanded purchases.

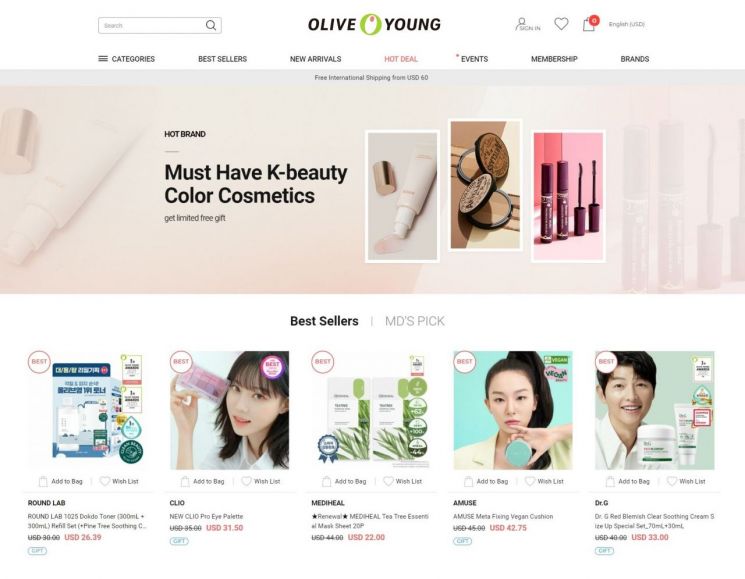

Accordingly, the ranking of popular products showed a distinctly different pattern compared to last year. Based on sales during the sale period, the best-selling product was the ‘Round Lab Birch Sunscreen.’ The second and third places were taken by ‘Laneige Neo Cushion’ and ‘Isoi Blemish Serum,’ respectively.

Although basic cosmetics account for a high proportion of sales, interest in color cosmetics is gradually increasing. Looking at sales by category during the sale period, base makeup (+184%), eye makeup (+153%), and lip makeup (+141%) all saw sharp increases in sales compared to the June sale last year. This is interpreted as an effect of the global shift toward color-focused cosmetics consumption amid expectations of the COVID-19 endemic transition.

Consequently, Global Mall sales are also showing strong growth. During the sale period, Global Mall order amounts increased by about 125% compared to the June sale last year. In particular, purchases by local foreign customers increased, greatly surpassing the purchase amounts of Korean residents abroad. Additionally, among the top 10 brands in sales, nine were domestic small and medium-sized enterprise brands such as Round Lab, Clio, Mediheal, Dr.G, COSRX, and Rom&nd, demonstrating their role as a ‘K-Beauty hub.’

An Olive Young official stated, “The recovery of domestic cosmetic exports centered on color cosmetics, along with the diversification of K-Beauty lineups and popular brands previously represented by sheet masks, is a positive sign,” adding, “We will continue to actively discover and support growth opportunities for K-Beauty and take the lead in globalizing Korean cosmetics.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.