[Asia Economy Reporter Minji Lee] There is a forecast that the stock prices of telecommunications companies will show a gradual upward trend in the second half of the year. This is based on the expectation of definite profit growth due to the increase in 5G subscribers.

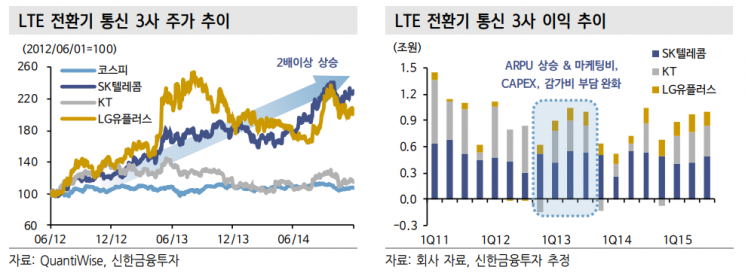

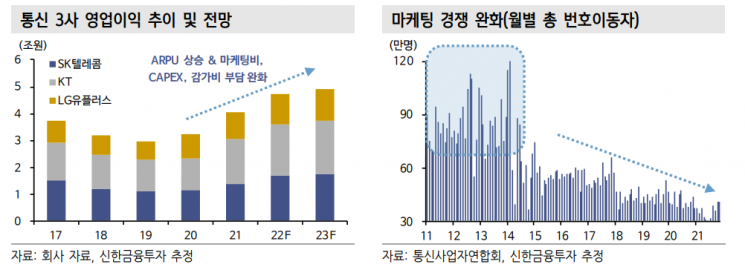

According to Shinhan Financial Investment on the 12th, the operating profit of the three companies (SK Telecom, KT, LG Uplus) is expected to grow by 17% compared to the same period last year, reaching 4.72 trillion KRW this year. From the second half of 2012, when the LTE transition began, to the second half of 2014, the market capitalization of the three telecom companies increased by 79.7%, and this year, a similar situation is expected to occur as 5G subscribers increase.

Above all, an increase in ARPU is anticipated due to the rise in 5G subscribers. The number of 5G subscribers is expected to reach 27.52 million by the end of the year. As the contract periods of LTE device purchasers from the early days of 5G commercialization come to an end, a level-up is expected with the release of flagship models in the second half of the year.

The cost burden is also limited. All three telecom companies have continued communication to avoid wasteful marketing competition, and the amortization of marketing expenses from the early 5G introduction period, when subscriber acquisition competition was intense, has been completed. Facility investments are being efficiently executed through joint network construction among the three companies. This year, the three companies’ facility investments and depreciation expenses are estimated to increase by 4% and 17% year-on-year to 8.01 trillion KRW and 9.69 trillion KRW, respectively.

The impact of the introduction of mid-tier plans is also limited. In April, the transition committee selected the 5G mid-tier plan as an excellent public proposal. Although the possibility of price reductions due to regulation attracted attention, there seems to be no need to excessively expand concerns.

Unlike the selective discount system, which required all subscribers’ communication fees to be reduced by regulation, the mid-tier plan allows telecom companies to decide the detailed contents of the plans. Telecom companies are known to go through stages such as demand surveys, rate design, customer migration simulation, profitability checks, and terms and conditions reporting before launching a plan. Researcher Aram Kim of Shinhan Financial Investment explained, “It is unlikely that a plan that would cause significant fluctuations in overall ARPU will be launched.” She added, “Rather, the transition of LTE subscribers, who faced higher price hurdles, to 5G is expected.”

Researcher Kim also stated, “With the discussion on the launch of mid-tier plans, the risk of price reduction regulation has been somewhat resolved, creating a favorable environment with definite profit growth, dividend expansion, and limited regulatory risks.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.