Galbitang, Chicken, Hoe, Jjajangmyeon Prices Rise Over 10%

40% of Businesses Increase Delivery Fees... Major Delivery Apps See Sharp User Decline This Year

#Housewife Kim Young-hyun (alias) decided against ordering food delivery for lunch with her children. The prices of frequently ordered dishes like Jajangmyeon had increased, and the delivery fees seemed expensive. In the current situation of soaring prices where nothing remains unaffected, Kim chose to prepare food at home that could be stored and eaten later rather than ordering delivery for a single meal.

#Office worker Park Kyung-gi (alias) recently stopped ordering food delivery for lunch. During the intense spread of COVID-19, he preferred ordering the food he wanted and enjoying lunch alone in the meeting room rather than visiting restaurants. The reason for quitting delivery was the price increase of more than 10%. Park is now looking for a company cafeteria where he can have lunch at half the cost of delivery orders.

The continuously rising prices are also impacting the delivery platform market. As the spread of COVID-19 slows down, user numbers are decreasing, and soaring prices have further hit the delivery market. With high inflation putting wallets under strain, more people are feeling burdened by the costs involved in delivery services.

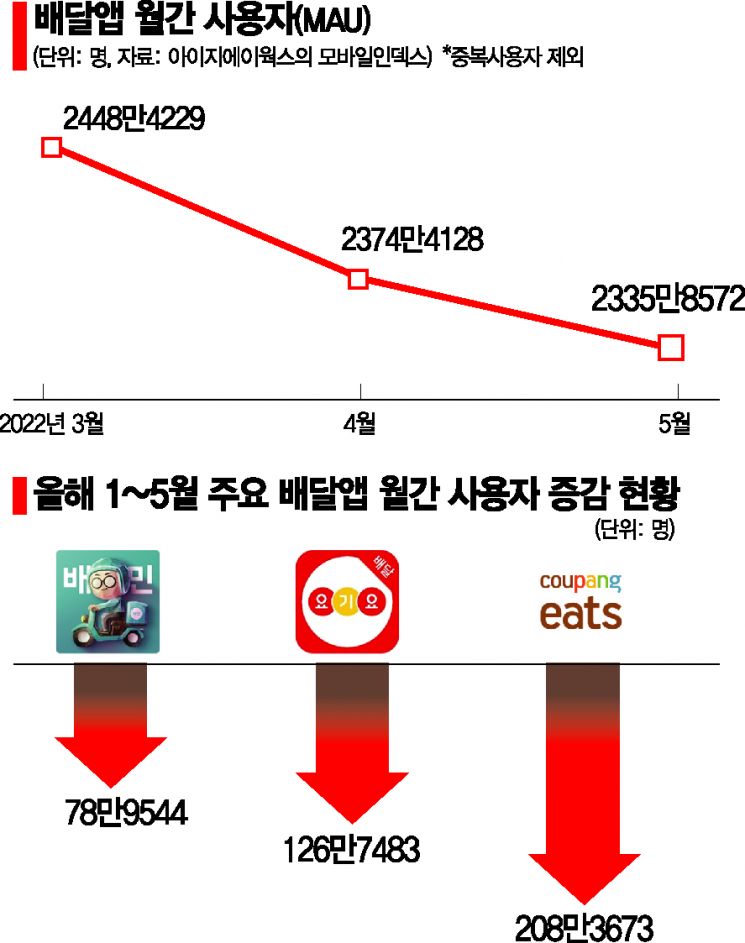

According to Mobile Index by data company IGAWorks on the 8th, the number of users in the delivery application (app) category on Android and iPhone (iOS) smartphones last month was 23.36 million. This is about 1.13 million fewer users compared to March. This means that over one million users have exited the delivery app market in just two months.

Especially since delivery app users tend to use apps selectively in a ‘multi-homing’ manner, the loss of one million users is directly reflected in each company. Last month, the monthly active users (MAU) of Baedal Minjok (Baemin), Yogiyo, and Coupang Eats were 19.94 million, 7.65 million, and 4.5 million respectively. Compared to March, Baemin lost 860,000 users, while Yogiyo and Coupang Eats saw decreases of 1.18 million each. Compared to last year, the downward trend in delivery platform users is even clearer. Baemin, the market leader, fell below 20 million monthly users again for the first time in a year since May last year. Compared to December last year, Yogiyo lost 1.39 million users, and Coupang Eats lost 2.52 million.

Industry insiders cite the biggest reason for the decrease in delivery platform users as the reduction in delivery orders following the lifting of social distancing measures. On top of that, the recent sharp rise in food prices has made users hesitate to ‘click’ and bear the additional service costs associated with delivery. According to Statistics Korea, the price of noodles rose 33.2% last month, flour by 26.0%, and cooking oil by 22.7%. This is reflected in food prices as well, with dishes like galbitang (beef rib soup), chicken, raw fish, and jajangmyeon increasing by more than 10%. Considering that restaurants usually price delivery menu items the same or higher than in-store prices, the burden of delivery food has grown accordingly.

The issue of increased delivery fees has also contributed to user attrition. The rise in delivery fees is mainly driven by the ‘single-order delivery’ service, where one delivery rider handles one order at a time. According to a survey by the Korea Consumer Agency’s Price Monitoring Center on Seoul delivery fees last month, 11.6% of restaurants raised delivery fees in May compared to March, but for single-order delivery, over 40% of providers increased fees. The increase was as much as 2,000 KRW in some cases.

While the increase in delivery fees is inevitable due to issues like rider shortages, the industry is concerned and cannot just watch user numbers decline. There are even worries that a continued decrease in users could destabilize the delivery ecosystem. Each company is busy preparing countermeasures. Baemin’s recent swift expansion of its single-order delivery service, Baemin1, is a representative example. Starting this month, Baemin is conducting pilot services in Sejong City, Cheonan, and Asan in Chungnam Province, and plans to provide single-order delivery services in these areas from the 19th of next month. An industry official said, "Each delivery platform company is seriously aware of the recent decline in users," adding, "We are focusing on devising strategies that satisfy all ecosystem participants including restaurants, users, and riders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.