Korea Federation of SMEs Announces Survey Results on Sharp Rise in Imported Agricultural Product Prices

Concerns Over Competitiveness Decline Compared to Other Companies... Difficulty in Raising Product Prices

[Asia Economy Reporter Kim Bo-kyung] Eight out of ten small and medium-sized food manufacturing companies reported that their business environment has deteriorated due to the recent surge in grain prices.

The Korea Federation of SMEs announced on the 7th the results of the "Survey on the Status of Small and Medium Food Manufacturing Companies Due to the Surge in Imported Agricultural Product Prices," conducted from the 12th to the 23rd of last month on 213 small and medium food manufacturing companies.

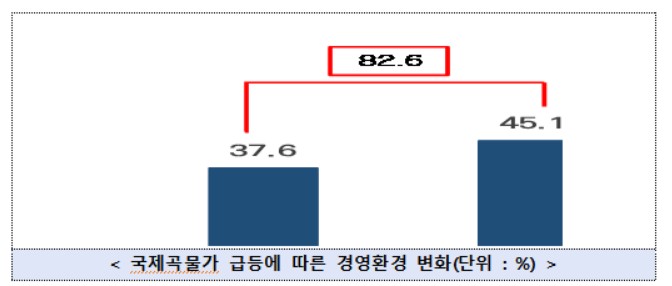

According to the survey, 82.6% of small and medium food manufacturing companies responded that their business environment has worsened due to the recent surge in international grain prices (37.6% very much worsened + 45.1% somewhat worsened).

As a result, 73.7% of the responding companies expected their operating profits to decrease compared to the previous year. In particular, one out of four companies responded that their operating profits would decrease by more than 20%.

Specifically, 26.3% of respondents expected a decrease in operating profit of more than 20%, 23.9% expected a decrease between 10% and less than 20%, and 23.5% expected a decrease of less than 10%.

Additionally, 36.2% of respondents expected raw material prices to increase by 10% to less than 20% compared to the previous year, the highest proportion, and more than one in four expected an increase of over 30%.

However, regarding product price increases, 73.2% of companies either raised prices less than the cost increase or had no plans to raise prices. Responses included 35.7% who said "No immediate plans, but will consider raising prices if unit cost continues to surge," 23.9% who planned to raise prices at a level less than the cost increase, and 13.6% who had no specific plans to raise prices.

The main reasons for not planning price increases were concerns about ▲loss of competitiveness compared to other companies (58.6%), followed by ▲fear of deteriorating relationships with suppliers (24.1%), and ▲ability to endure under current business conditions (17.2%).

Regarding this year's outlook on imported grain supply and demand, 71.4% responded that it would not be smooth, but only 13.6% of companies planned to switch to domestic grains.

The biggest reason for not planning to switch to domestic grains was "high price of domestic raw materials making replacement difficult" (58.7%). Other reasons included "supply issues such as inability to deliver in large quantities" (22.8%) and "difficulty maintaining quality when changing raw material origin or formulation" (10.9%).

As for the most needed government policies (multiple responses allowed), 49.8% of respondents chose expansion of financial support for purchasing food raw materials. This was followed by ▲market stabilization through early auction and release of stockpiles (47.9%), ▲fixed operation and expansion of TRQ (Tariff Rate Quota) and stockpiles (40.4%), and ▲raising the deduction rate for agricultural product input tax credit (16.9%).

Yang Chan-hoe, Head of the Innovation Growth Division at the Korea Federation of SMEs, said, "It is necessary to stabilize raw material supply through tailored support for small and medium food manufacturing companies, such as easing requirements for financial support for purchasing food raw materials, raising the deduction rate for agricultural product input tax credit, expanding TRQ, and releasing stockpiles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)