Economic Growth Rate Forecast Likely to Be Revised Down from 3.1% to the High 2% Range

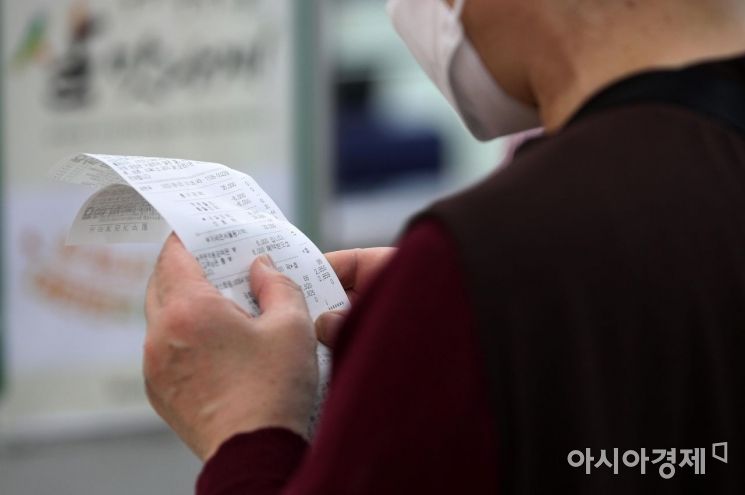

On the 5th, a citizen is examining a receipt at a large supermarket in Seoul. Amid the recent severe inflation situation, with last month's consumer price inflation rate exceeding 5%, the international grain price surge caused by the Ukraine crisis and export restrictions from major grain-producing countries is being transmitted domestically. Additionally, with recent drought damage added, the cost of living is showing unstable patterns, especially centered on some agricultural and livestock products. Photo by Kim Hyun-min kimhyun81@

On the 5th, a citizen is examining a receipt at a large supermarket in Seoul. Amid the recent severe inflation situation, with last month's consumer price inflation rate exceeding 5%, the international grain price surge caused by the Ukraine crisis and export restrictions from major grain-producing countries is being transmitted domestically. Additionally, with recent drought damage added, the cost of living is showing unstable patterns, especially centered on some agricultural and livestock products. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Kim Jung-wan] The government is strongly considering revising this year's consumer price inflation forecast to the 4% range for the first time in 11 years. This is because the inflation rate exceeded 5% last month, causing the previous forecast of 2.2% to become unrealistic. The real Gross Domestic Product (GDP) growth rate forecast is also being reviewed for a downward adjustment from the previous 3.1% to the high 2% range.

According to the Ministry of Economy and Finance on the 5th, the government plans to announce this economic outlook along with the new administration's economic policy direction within this month.

Unexpected variables such as Russia's invasion of Ukraine in the first half of this year and the sharp rise in international oil and grain prices have caused inflation to rise more steeply than expected. As a result, the government's inflation forecast of 2.2% for this year, presented in the economic outlook in December last year, has become inevitable to be significantly revised.

The year-on-year inflation rate rose from 3.6% in January and 3.7% in February to 4.1% in March, surpassing the 4% mark. In April, it increased further to 4.8%, and in May, it soared to 5.4%, exceeding 5%. The cumulative year-on-year inflation rate up to May is already 4.3%. Unless inflation significantly slows down in the remaining period, the prevailing view is that the annual inflation rate this year will exceed 4%. Moreover, many market forecasts predict that inflation in the 5% range will continue for some time. There are also projections that inflation could rise to the 6% range in June or July.

Domestic and international institutions are successively revising upward their inflation forecasts for Korea this year. Last month, the Bank of Korea raised its forecast from 3.1% to 4.5%, and the Korea Development Institute (KDI) also increased its previous forecast of 1.7% to 4.2%. The International Monetary Fund (IMF) raised its forecast from 3.1% to 4.0% in April. Although the Organisation for Economic Co-operation and Development (OECD) is maintaining its December forecast of 2.1%, it is expected to revise this in the economic outlook to be announced this week.

The government also plans to raise its inflation forecast in the new economic outlook. It is considering presenting a figure in the low to mid 4% range, about 2 percentage points higher than the previous forecast (2.2%).

This will be the first time in over 10 years that the government has presented an inflation forecast in the 4% range, the last being the economic outlook announced at the end of 2011, which projected a 4.0% inflation rate for that year.

Additionally, the government is reviewing lowering this year's GDP growth forecast from 3.1% to the high 2% range. The government expects that growth may decline more than previously anticipated due to worsening trade balance caused by rising raw material prices and supply chain disruptions, as well as decreases in facility and construction investments.

Previously, the Bank of Korea lowered its growth forecast from 3.0% to 2.7%, and KDI from 3.0% to 2.8%. The IMF reduced its forecast from 3.0% to 2.5%, and the OECD is also likely to revise its 3.0% forecast this week.

Meanwhile, the high inflation shock is spreading comprehensively across the Korean economy due to global supply chain disruptions. According to Statistics Korea on the 3rd, petroleum products such as diesel and gasoline (34.8%) and manufactured goods including processed foods (7.6%) led the inflation surge, rising 8.3% year-on-year. With the increase in energy prices and the rise in electricity rates in April, electricity, gas, and water charges also increased by 9.6%, and prices of agricultural, livestock, and fishery products rose by 4.2%.

Analyzing the contribution to inflation, manufactured goods accounted for 2.86 percentage points and personal services including dining out accounted for 1.57 percentage points, showing that 82% of last month's inflation causes were related to crude oil, grains, and dining out prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)