[Asia Economy Reporter Song Hwajeong] The proportion of loans to middle- and low-credit borrowers by the three internet banks?KakaoBank, K Bank, and Toss Bank?increased in the first quarter of this year.

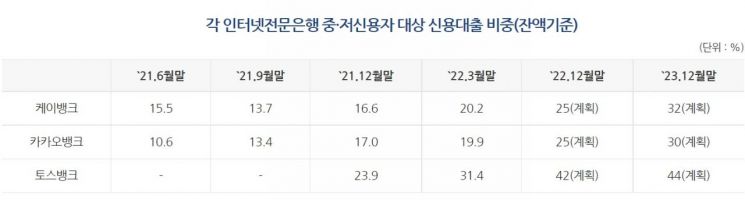

According to the Bankers Association disclosure on the 5th, the "proportion of credit loans to middle- and low-credit borrowers (based on outstanding balance)" for each internet-only bank was 19.9% for KakaoBank, 20.2% for K Bank, and 31.4% for Toss Bank. Compared to the end of last year, KakaoBank's proportion increased by 2.9 percentage points, K Bank's by 3.6 percentage points, and Toss Bank's by 7.5 percentage points.

The proportion of credit loans to middle- and low-credit borrowers refers to the share of loans to borrowers in the lower 50% credit score bracket (KCB score of 850 or below) based on the Korea Credit Bureau (KCB) credit rating among the total household credit loans of each internet bank.

Financial authorities pointed out in May last year that internet-only banks were conducting conservative lending focused on high-credit borrowers, contrary to their original establishment purpose of expanding loan supply to middle- and low-credit groups, and urged them to increase the proportion of loans to middle- and low-credit borrowers. By the end of last year, none of the three banks had reached their initially targeted levels. The year-end target proportions set for this year are 25% for KakaoBank and K Bank, and 42% for Toss Bank.

Toss Bank showed the largest increase in the proportion of middle- and low-credit borrowers, surpassing 30%. As of the end of May, it reached 35.2%. Despite an increase in total loan balances, it rose by 3.6 percentage points over two months from 31.4% in the first quarter, showing a significant gap compared to other internet banks. The total amount of loans supplied to middle- and low-credit borrowers over eight months reached 1.4185 trillion KRW (based on executed amount).

K Bank's proportion of middle- and low-credit (based on KCB score of 820 or below) customers among newly supplied credit loans in the first quarter of this year was 34%. This represents an increase of about 25.6 percentage points compared to the same period last year. The total loan amount also nearly quadrupled to 423.4 billion KRW during the same period. The credit loan volume for K Bank's middle- and low-credit customers increased from 325.1 billion KRW in 2020 to 751 billion KRW last year, and in the first quarter of this year, it supplied 423.4 billion KRW, which is more than half of the total supply for 2021.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)