Steel Industry Achieves Record High Performance Last Year Amid COVID-19 Pandemic

Strong Results Continue in Q1 This Year Due to Steel Product Price Increases

Demand Declines from China COVID Lockdowns → Steel Price Drop

Concerns Over Economic Slowdown Lead to Large-Scale Stimulus in China… Korea Zinc Recommended as Top Pick

[Asia Economy Reporter Ji Yeon-jin] Steel companies achieved record-high profits last year amid the COVID-19 pandemic, with their stock prices soaring significantly. This was thanks to the surge in raw material prices triggered by the global supply shortage caused by COVID-19, which allowed for product price increases and strong earnings. However, despite comprehensive product price hikes in the first quarter of this year, stock prices have been under adjustment for over a month. This is due to falling steel prices caused by reduced steel demand from the US monetary tightening and subsequent recession risks, as well as China's COVID lockdowns. Attention is now focused on whether steel stock values will rise again as China recently began economic stimulus measures.

According to a report published on the 4th by NH Investment & Securities, domestic steel companies continued to deliver better-than-expected strong earnings in the first quarter of this year. Prices for automotive steel sheets and shipbuilding heavy plates were raised, along with price increases for cold-rolled coated steel and hot-rolled steel sheets. This is expected to enable profitability defense through the first half of this year.

The problem lies in the second half. Steel prices in China shifted to a downward trend from the early April peak. The impact of COVID lockdowns within China was significant. Automobile production declined, and with the real estate slump continuing, infrastructure investments were delayed. Baoshan Iron & Steel, China’s largest state-owned steel company, lowered its domestic shipment prices this month.

Iron ore prices also fell. With the seasonal low demand period approaching in summer, it is expected to take time for prices to rebound. Overseas steel prices are showing weakness with regional time lags, so domestic steel prices are also expected to be affected.

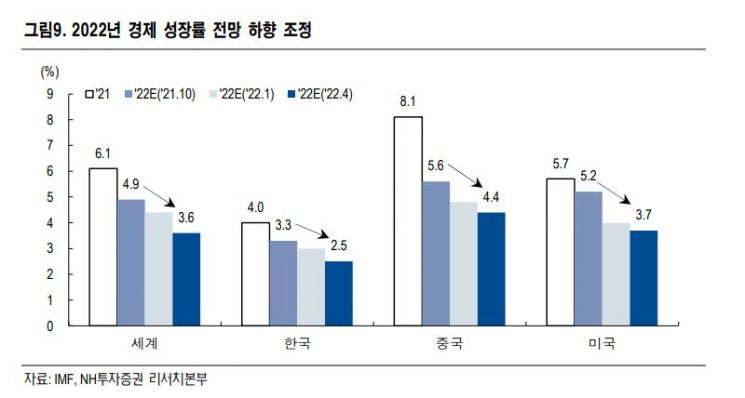

However, aggressive monetary tightening by the US Federal Reserve (Fed), renewed COVID lockdowns in China, and global economic slowdown concerns due to the Russia-Ukraine war could actually act as positive factors for the domestic steel industry. Byun Jong-man, a researcher at NH Investment & Securities, explained, "China’s government-set 2022 economic growth target of 5.5% has become difficult to achieve," adding, "This is why expectations for expanded infrastructure investment in China are growing."

The People’s Bank of China recently lowered the 5-year Loan Prime Rate (LPR), signaling a willingness to stimulate the real estate market. The steel consumption share of China’s construction sector exceeds 50%, with real estate accounting for two-thirds of steel consumption within construction, and the remainder for infrastructure investment. Due to COVID lockdown effects, China’s cumulative new construction area from January to April this year decreased by 26.3% year-on-year, with the decline from January to March at 17.5%, indicating a widening decrease.

Researcher Byun said, "China must consider yuan depreciation and capital outflows caused by interest rate differentials with the US, so fiscal policy and infrastructure investment are important, but the government’s stance on COVID prevention lockdowns and the financial condition of local governments will be key issues."

Non-ferrous metal prices are also under adjustment. The 'LME Index,' composed of aluminum, copper, zinc, and nickel, has fallen 17.9% from its all-time high on March 7. Considering it rose 146.7% from the low point before March 23, 2020, at the start of the COVID-19 pandemic, this is not considered a sharp correction.

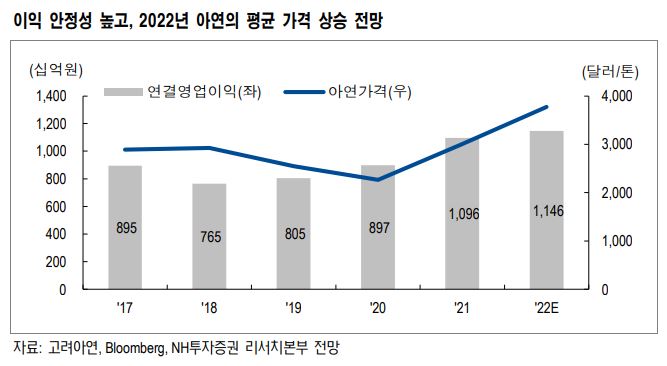

Meanwhile, copper prices have turned weak due to global interest rate hikes, but low inventory levels and increased demand driven by energy paradigm shifts could limit price declines, and prices may rebound if China’s infrastructure investment increases. In the case of zinc, supply shortage issues could support the price floor.

Researcher Byun stated, "Expectations for demand from China’s economic stimulus in the second half have grown amid inflation caused by supply-side factors," adding, "We have a positive view on the steel and metal industry and recommend Korea Zinc as the top pick within the sector." Although volatility in non-ferrous metal prices is expected to increase, high profit stability, shareholder returns through dividends, and entry into the secondary battery materials business are key investment points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)