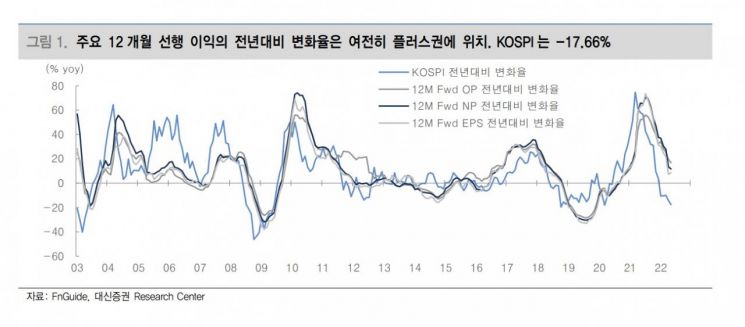

[Asia Economy Reporter Lee Seon-ae] Daishin Securities judged on the 30th that the KOSPI index is currently in a technical rebound and is positioned in an extremely undervalued area compared to earnings and fundamentals, which are the basic premises of a relief rally.

As of the closing price on the 27th (2638.05), the KOSPI has recorded a year-on-year change rate of -17.66%. In contrast, the KOSPI earnings and major economic indicators

are still in positive territory. Regardless of whether there is a turnaround in the economy, it is judged that the current KOSPI is significantly undervalued.

Lee Kyung-min, a researcher at Daishin Securities, said, "We expect a technical rebound and relief rally in the KOSPI," adding, "The global financial market has largely priced in bad news, and investor sentiment is extremely depressed, so we believe that a psychological relief alone can lead to a KOSPI rebound." He forecasted the first technical rebound target of the KOSPI at the 2700 level and the relief rally target at the high 2800 level.

The gap in year-on-year change rates between the KOSPI and major earnings and economic indicators is below -1 standard deviation of the average since 2010. In particular, the gap with the export change rate is -36.86%, which is about 10 percentage points below the -2 standard deviation level (-27.2%) of the average since 2010. This is why it is judged that there is about a 10% upside potential (high 2800 level) for the KOSPI even if earnings and economic momentum recovery are limited.

The global financial markets, including the KOSPI, have partially priced in a 'giant step' in monetary policy reaching a base interest rate of over 3% within the year, and concerns about an economic recession in terms of economic outlook. The researcher said, "This is seen as not just simple anxiety but also the inflow of fear psychology," adding, "Conversely, if the variables that triggered fear psychology do not materialize in the short term, a mood reversal is possible."

This week, the improvement in China's PMI, continued improvement in Korean exports, and reduction in trade deficit are expected to support the KOSPI rebound. These changes increase pressure for the strengthening of the yuan and won, which is likely to have a positive impact on foreign demand for the KOSPI. The trade deficit, which had stimulated won depreciation pressure, is also likely to shrink. He emphasized, "Rather than being swayed by short-term changes in investment sentiment and fluctuations in supply and demand, it is time for a trading strategy prepared for a technical rebound and relief rally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)