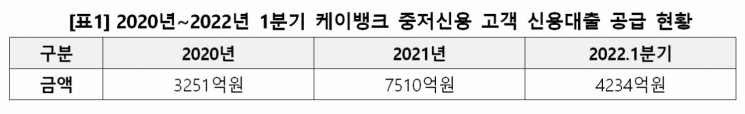

Total Loan Amount Also Increased Fourfold Compared to the Same Period Last Year

[Asia Economy Reporter Minwoo Lee] Among those who newly took out unsecured loans from K-Bank in the first quarter of this year, 34% were middle-to-low credit customers. It is interpreted that the introduction of an in-house credit scoring system (CSS) to precisely assess the target and offer relatively low interest rates was effective.

According to the industry on the 29th, the proportion of middle-to-low credit (based on KCB score of 820 or below) customers among all new unsecured loans supplied by K-Bank in the first quarter of this year was 34%. This is an increase of about 25.6 percentage points (p) compared to the same period last year. The total loan amount also increased nearly fourfold to 423.4 billion KRW during the same period.

The proportion of loans to middle-to-low credit borrowers among all unsecured loans was 20.2%, up 3.6 percentage points compared to the end of last year. As of the end of this month, it was recorded at 22.7%.

Since the financial authorities pointed out in May last year that internet-only banks were conducting conservative lending focused on high-credit customers, contrary to their original establishment purpose of expanding loan supply to middle-to-low credit groups, there has been a steady trend of increasing middle-to-low credit loan customers.

K-Bank stated that the introduction of specialized CSS reflecting the characteristics of middle-to-low credit and thin-file customers (those with insufficient financial information) in February was effective. After applying the specialized CSS, the loan approval rate and loan limits for middle-to-low credit customers increased, and the effective interest rates decreased, leading to an increase in loans to middle-to-low credit customers.

They also considered the relatively low interest rates to be effective. The average interest rate on loans newly executed for middle-to-low credit customers at K-Bank in the first quarter was 7.09% per annum. This is 7.72 percentage points lower than the average interest rate on household credit loans at savings banks (based on March data from the Savings Banks Association Consumer Portal), which is 14.81% per annum. Additionally, the lowest interest rate executed for middle-to-low credit customers was 3.41% per annum, and they reported that a customer with a credit score of 270 also received a loan.

A K-Bank official said, "In line with the establishment purpose of internet banks to include financially marginalized groups, we are continuously expanding loan supply to middle-to-low credit customers," adding, "We will continue to be a warm bank that provides various benefits to financially marginalized groups."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.