[Asia Economy Reporter Kim Hyunjung] As the U.S. Trade Representative has begun a legal review of the high tariffs imposed on Chinese imports, President Biden has hinted at a reduction in tariffs on Chinese goods, drawing significant attention. The focus is more on partial tariff reductions on consumer goods rather than a comprehensive tariff cut.

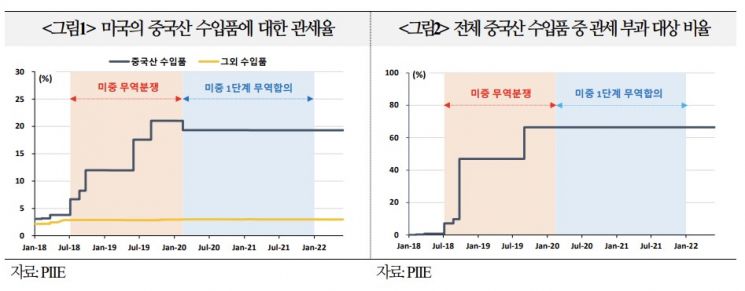

On the 23rd, during a press conference at the U.S.-Japan summit, U.S. President Joe Biden stated that the tariffs on Chinese imports were imposed by the previous administration and that some reductions are being considered. Currently, the U.S. imposes an average tariff of 19.3% on Chinese imports following trade disputes, which is significantly higher than the pre-trade dispute rate of 3.1%. Additionally, the proportion of Chinese imports subject to tariffs has expanded dramatically from less than 1.0% to 66.4%.

Nomura Securities expects that the Biden administration is more likely to implement partial tariff reductions on consumer goods rather than a full-scale tariff cut on Chinese imports, while simultaneously applying non-tariff measures on non-consumer goods.

Currently, President Biden faces the challenge of curbing inflation, which has reached its highest level in over 40 years, ahead of the November midterm elections. The U.S. consumer price inflation rate slightly decreased from 8.5% in March to 8.2% in April, a 0.3 percentage point drop, but it still significantly exceeds the Federal Reserve’s target of 2.0%.

Nomura also forecasts that even if tariffs on Chinese imports are fully reduced and companies pass on 100% of the savings to consumer prices, the impact on U.S. inflation would be limited to a 0.4 percentage point decrease.

Over the past four years, many U.S. companies have diversified their China operations to other countries, suggesting that the effect of tariff reductions on Chinese imports may be smaller than expected. Furthermore, it is important to note that the benefits of tariff reductions could be offset by worsening global supply bottlenecks.

On the other hand, if the U.S. strengthens non-tariff measures against China, China may retaliate with increased tariffs on U.S. imports or non-tariff measures such as restricting raw material exports. China has experience imposing retaliatory tariffs during past trade disputes and, given its relatively low inflation, has sufficient capacity to pressure the U.S. through increased tariffs on American goods.

China could also restrict exports of rare earth elements essential for semiconductor production or add U.S. companies to the list of unreliable entities, thereby banning their investments and operations in China. The fact that the U.S. Trade Representative excluded Chinese rare earths from the tariff list four years ago indicates China’s dominant position over the U.S. in raw material exports such as rare earths.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)