Base Rate Hikes to Continue Throughout This Year

High Possibility of 2% Point Increase in One and a Half Years

Inflation Rate to Peak at 4.5% This Year

Household Finances to Become More Strained

[Asia Economy Reporter Shim Nayoung] "My salary is the same, but prices are soaring and interest rates are rising... We have no choice but to buy less and eat less. We need to cut back on weekend dining out first."

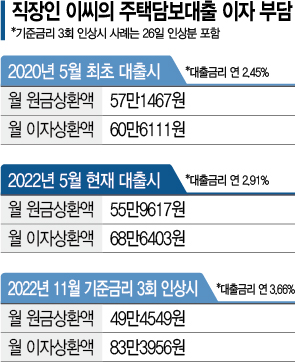

Working mom Lee Jihyun (41) sighed as she looked at her bank account. When she bought an apartment in Gangbuk-gu, Seoul, in May 2020, two years ago, she took out a mortgage loan of 300 million KRW (30-year installment repayment, variable interest rate). At first, she paid 600,000 KRW in interest monthly (annual 2.45%). The variable interest rate, which changes every six months, had been declining until the first half of last year but started to rise from the second half due to the Bank of Korea's base rate hikes. This month, Lee paid 680,000 KRW in interest (annual interest rate 2.91%).

Lee visited the bank where she borrowed the money and asked how much more interest she would have to pay if the rates continued to rise like this. She said, "They told me that if the base rate rises three more times by November this year, including yesterday's hike, the annual interest rate will reach 3.66%. The monthly interest will jump to 830,000 KRW." Annually, this means that compared to two years ago when she first borrowed the money, her interest expenses will increase by 3 million KRW. "Nothing hasn't gone up?from gas prices to my child's academy fees?so what am I supposed to do..." Lee's face was full of worry.

As the Bank of Korea raised the base rate again to 1.75% on the 26th, the burden of loan interest is snowballing. The base rate has been raised five times over nine months since August 2021. People like Lee, who have borrowed to the maximum ('Yeongkkeul-jok'), are terrified every six months when the bank notifies them of the new interest rate. The problem is that rate hikes are expected to continue. The financial sector is confident that the base rate will be raised two to three more times this year.

Lee Changyong, Governor of the Bank of Korea, also said at a press conference held immediately after the Monetary Policy Committee meeting, "We judge that the inflation risk is high under the current situation," and regarding the market's forecast that the base rate will reach 2.25?2.50% by the end of the year, he called it a "reasonable expectation." A representative from a commercial bank said, "Since last August, the base rate has risen by 1.25 percentage points, and if it goes up two or three more times, it will increase by about 2 percentage points in a year and a half," adding, "People who took out mortgage loans of 300 to 400 million KRW will see their annual interest burden increase by hundreds of thousands of KRW."

Research results also show that if the pace of rate hikes accelerates, not only 'Yeongkkeul-jok' but also self-employed people, whose financial soundness has been weakened by COVID-19, will be the most vulnerable. The Hyundai Research Institute stated in its report released on the 22nd, "The Impact of Rising Loan Interest Rates on Household Financial Soundness," that "If loan interest rates rise by 2 percentage points, the annual average interest cost for self-employed households will increase from 4.33 million KRW to 6.43 million KRW, an increase of about 2.1 million KRW," adding, "This increase was significantly higher compared to other employment statuses such as regular workers."

Self-employed people also agree that "loan interest rates are scarier than quarantine rules." Lee Seungmin (43), who runs a chicken restaurant in Seoul, said weekend sales are less than one-third of what they were during the peak of COVID-19. This is because the number of delivery orders has significantly decreased as people started going out. Lee said, "When I opened three stores, I took out loans totaling 150 million KRW from several banks. The interest, which was 300,000 KRW per month at first, has now risen to 650,000 KRW," adding, "When delivery orders were piling up, it was manageable, but now that customers have noticeably decreased, I worry about paying the interest first."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)