Bank of Korea Governor Lee Chang-yong's First Monetary Policy Meeting

Base Rate Raised by 0.25 Percentage Points

First Consecutive Increase in Two Months in 15 Years

Inflation Forecast Also at 4.5%

Lee Chang-yong, Governor of the Bank of Korea, is explaining the base interest rate hike at a press conference held at the Bank of Korea in Jung-gu, Seoul on the 26th. / Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is explaining the base interest rate hike at a press conference held at the Bank of Korea in Jung-gu, Seoul on the 26th. / Photo by Joint Press Corps

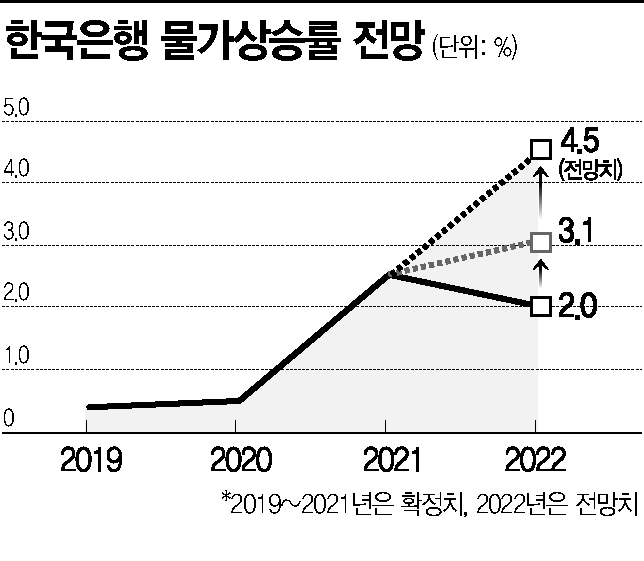

[Asia Economy Reporters Seo So-jeong and Moon Je-won] The Bank of Korea tightened monetary policy reins sharply on the 26th by raising the base interest rate and significantly upgrading this year's consumer price inflation forecast to 4.5%, the highest in 13 years and 10 months. This was an unusual move, marking the third rate hike this year and the second consecutive monthly increase following April. It clearly signaled that this stance will continue going forward. If the Bank of Korea raises rates further at the remaining monetary policy meetings this year (July, August, October, November), the year-end base rate could rise to as high as 2.75%. Even with one or two speed adjustments, it is certain to rise to the mid-2% range.

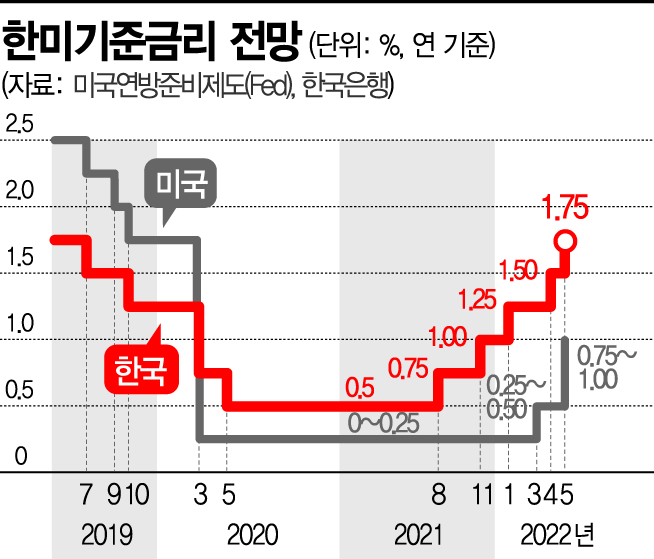

The Monetary Policy Board of the Bank of Korea held a monetary policy meeting on the day and raised the base interest rate by 0.25 percentage points from 1.50% to 1.75% per annum. Previously, the Monetary Policy Board signaled normalization of monetary policy by raising rates by 0.25 percentage points in August last year, and continued the hike streak in November of the same year, January this year, and again in April and May.

As inflationary pressures intensified, the Monetary Policy Board decided on an additional hike last month despite the unprecedented absence of a governor. At the first meeting chaired by Governor Lee Chang-yong, the Board again raised rates, tightening monetary policy reins. This is the first time in 14 years and 9 months that the Bank of Korea has raised the base rate for two consecutive months since July and August 2007. Considering that the call rate was the policy rate at that time, this is effectively the first time the base rate has been raised two months in a row since it became the policy rate. The Bank of Korea's unusual consecutive rate hikes in April and May, following two hikes in November and January last year, reflect the rapid and widespread inflationary pressures recently.

4.5% Realization Would Mark Highest Inflation Rate in 14 Years

In the revised economic outlook released that day, the Bank of Korea raised the consumer price inflation forecast from the current 3.1% by 1.4 percentage points to 4.5%. This is the highest forecast since July 2008, when the consumer price inflation was projected at 4.8%, marking the highest in 13 years and 10 months. If the 4.5% annual forecast materializes, it will be the highest annual inflation rate in 14 years since 2008 (4.7%). Next year's inflation forecast was also raised from 2.0% to 2.9%, an increase of 0.9 percentage points.

At the press conference following the Monetary Policy Board meeting, Governor Lee openly showed a hawkish (monetary tightening preference) stance. He said, "The Statistics Korea will announce May's inflation rate in early June, and according to the Bank of Korea's estimate, it seems it will exceed 5%," emphasizing, "We will focus on inflation in operating monetary policy over the coming months." He added, "Even if oil prices fall, international grain prices tend to remain high for a considerable period once they rise, so we expect consumer price inflation to remain at 3-4% until early next year."

The Bank of Korea's significant upward revision of this year's inflation forecast is due to the uncontrollable rapid spread of inflation recently. The consumer price index in April rose 4.8% compared to the same month last year, influenced by soaring international energy prices and supply chain disruptions. This is the highest level in 13 years and 6 months since October 2008 (4.8%).

Kim Woong, Director of the Bank of Korea's Research Department, cited four inflation factors at the economic outlook briefing: energy prices, food prices, broad inflation spread, and increased demand following the lifting of social distancing measures. He said, "We expect the consumer price inflation rate to exceed 5% in May and June." He added, "All four factors were reflected in this forecast. The combination of global food and energy prices, the Ukraine crisis, and China's lockdown measures creates significant uncertainty." Regarding the large supplementary budget of 59 trillion won, he said, "We calculated the forecast assuming the supplementary budget raises growth by 0.2-0.3 percentage points and inflation by about 0.1 percentage points."

A bigger problem is that economic agents expect prices to rise further. According to the Bank of Korea's consumer sentiment survey, the expected inflation rate in May was 3.3%, the highest in 9 years and 7 months since October 2012 (3.3%). Kim Jung-sik, Emeritus Professor of Economics at Yonsei University, said, "The Ukraine war has sharply increased crude oil, raw materials, and grain prices, and the US interest rate hikes have pushed up exchange rates, causing import prices to soar." He emphasized, "The Bank of Korea must raise rates to lower inflation expectations. Lowering inflation expectations is crucial to stabilizing prices."

Interest Rate Inversion Between Korea and the US Realized in Second Half

With the US Federal Reserve (Fed) signaling additional big steps (0.5% hikes at once), the possibility of interest rate inversion between Korea and the US in the second half, which could trigger massive capital outflows, is also cited as a reason for rate hikes. With the 0.25 percentage point hike at the Monetary Policy Board meeting, the base rate gap between Korea (1.75%) and the US (0.75-1.00%) widened to 0.75-1.00 percentage points. If the Fed raises rates by 0.5 percentage points at the Federal Open Market Committee (FOMC) meeting on June 14-15 and continues big steps thereafter, interest rate inversion in the second half could become a reality.

For the Korean won, which is not a key currency like the dollar, interest rate inversion or narrowing can lead to foreign investor capital outflows, and the resulting sharp rise in the won-dollar exchange rate can fuel inflation. Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "Considering the speed of US rate hikes, domestic high inflation, and the Korea-US interest rate inversion situation, this month's rate hike was an inevitable choice," adding, "Gradual and continuous rate hikes should continue going forward."

However, experts see a low possibility of the Monetary Policy Board implementing big steps in the second half. Moon Hong-chul, a researcher at DB Financial Investment, said, "The Bank of Korea may raise the base rate again in July, marking three consecutive hikes, then take one or two pauses between August and November," predicting, "Still, the domestic base rate will be at least 2.25% by the end of this year." Professor Kim Tae-gi of Dankook University's Department of Economics said, "The base rate is likely to rise to 2.5% by the second half. The Ukraine crisis does not seem to be resolved soon, and China's 'zero-COVID' policy is expected to continue for some time, so the rapid inflation trend may ease only by the end of the year."

Governor Lee also explained that the damage from the Korea-US interest rate inversion would be less than expected. He said, "There is no rule that the Korea-US interest rate gap must never invert in the short term," and explained, "Even if rates invert, large-scale capital outflows or exchange rate issues are unlikely to be significant given the current situation in Korea."

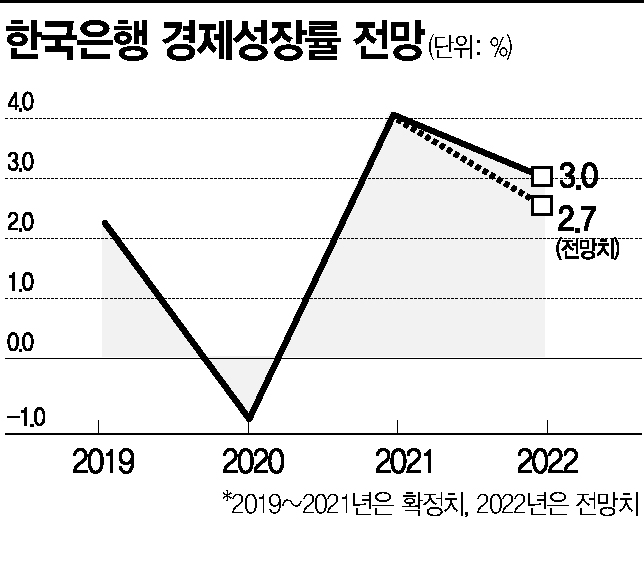

On the day, the Bank of Korea lowered this year's real gross domestic product (GDP) growth forecast from 3.0% to the 2.7% range. The forecast for private consumption growth was raised from 3.5% to 3.7%, but growth forecasts for facility investment and construction investment dropped from 2.2% and 2.4% to -1.5% and -0.5%, respectively. The growth rates for goods exports and imports were also lowered by 0.1 and 0.4 percentage points from 3.4% and 3.8% to 3.3% and 3.4%, respectively.

The Bank of Korea also lowered next year's growth forecast from 2.5% to 2.4%, reflecting the impact of rising raw material prices, supply chain disruptions, and China's lockdowns on the global economic slowdown expected to continue into next year. However, Governor Lee said regarding the possibility of stagflation (economic stagnation with inflation), "The 2.7% growth forecast for this year is still above the potential growth rate," adding, "While the economy is slowing, it is too early to worry about stagflation."

Professor Kim Jin-il of Korea University's Department of Economics said, "The Korean economy is not yet in a dangerous situation, but since inflation has risen more than initially expected, the situation is more unstable than before," adding, "It is necessary for the government and central bank to share and cooperate on economic assessments to control the situation and prevent further deterioration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)