Decrease in Net Profit Due to Increased Losses on Marketable Securities from Rising Market Interest Rates

Interest Income Increased by 19.5%

[Asia Economy Reporter Song Hwajeong] Last year, the net income of foreign bank domestic branches (foreign bank branches) decreased. This was due to increased losses related to securities caused by rising market interest rates.

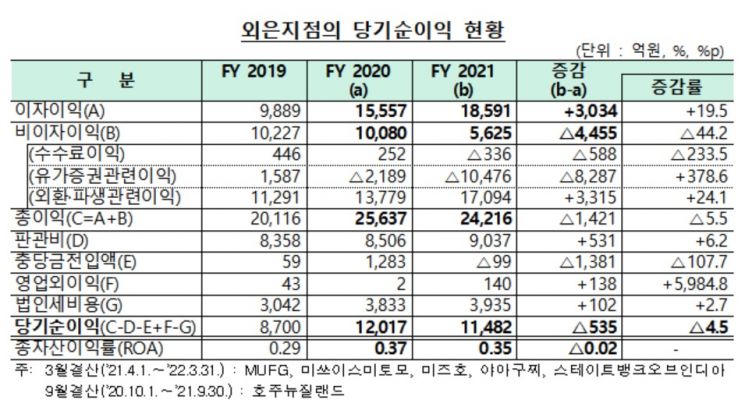

According to the "2021 Foreign Bank Domestic Branches Business Performance" announced by the Financial Supervisory Service on the 23rd, the net income of 35 foreign bank branches last year was 1.1482 trillion KRW, a 4.5% (53.5 billion KRW) decrease compared to the previous year (1.2017 trillion KRW).

Although interest income increased, non-interest income decreased due to increased losses related to securities caused by rising market interest rates. The total interest income of all foreign bank branches last year was 1.8591 trillion KRW, a 19.5% (303.4 billion KRW) increase compared to the previous year (1.5557 trillion KRW). This was due to an increase in operating assets such as loan receivables and securities, as well as a rise in net interest margin (NIM). The NIM of foreign bank branches last year was 0.94%, up 0.14 percentage points from 0.80% the previous year.

Fee losses recorded 33.6 billion KRW, a 233.5% decrease compared to the previous year. Although fee income slightly increased, fee expenses such as transfer fees paid to headquarters and other branches increased.

Foreign exchange and derivatives-related profits were 1.7094 trillion KRW, a 24.1% increase compared to the previous year. Foreign exchange-related profits decreased compared to the previous year due to foreign currency liabilities' translation losses caused by exchange rate increases, but derivative-related profits increased due to valuation and trading gains from forward foreign exchange purchase positions.

Losses related to securities were 1.0476 trillion KRW, a sharp increase of 378.6% compared to the previous year (-218.9 billion KRW). This was because securities trading and valuation losses increased as the amount of securities held increased amid rising market interest rates.

The net provision amount for all foreign bank branches last year was -9.9 billion KRW, a 10.7% decrease compared to the previous year (128.3 billion KRW). This was due to a decrease in non-performing loans and a base effect from expanded provisions in the previous year. Non-performing loans of foreign bank branches decreased from 417.2 billion KRW at the end of 2020 to 171.9 billion KRW at the end of last year.

A Financial Supervisory Service official stated, "In preparation for financial market uncertainties such as the continued interest rate hikes by the U.S. Federal Reserve (Fed) and increased exchange rate volatility, we will strengthen risk management related to foreign exchange and derivative transactions of foreign bank branches and encourage the expansion of loss absorption capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)