[Industry and Wealth Landscape Changed by COVID-19]

Last Year’s Top 500 Listed Companies by Sales Include Many COVID-19 Beneficiaries

'PCR Kit' Maker Seegene’s Sales Increase Tenfold… SK Bioscience Also Benefits from Vaccine CMO

Post-With-Corona, Performance Limits Emerge… Time to Focus on Individual Company Results

[Asia Economy Reporter Myunghwan Lee] COVID-19 presented new opportunities for the pharmaceutical and bio industries. The unprecedented pandemic led to a global surge in demand for diagnostic kits, vaccines, and therapeutics. At the early stage of the pandemic, as countries accelerated efforts to secure diagnostic kits and develop vaccines and treatments, Korean bio and pharmaceutical listed companies benefited significantly. However, as the situation transitions into the endemic phase, experts advise focusing on the performance of individual companies.

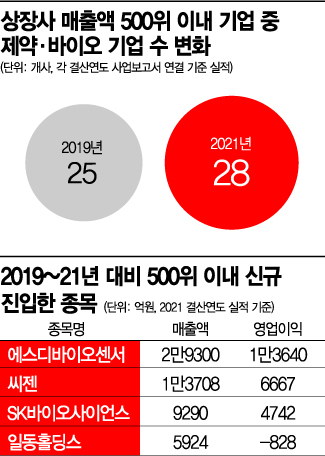

On the 23rd, Asia Economy analyzed the financial results of corporations for 2019 and 2021. Among the top 500 companies by sales last year, 28 pharmaceutical and bio-related companies listed on the KOSPI and KOSDAQ markets (including holding companies) were identified. This represents an increase of three companies compared to 25 in 2019. Compared to 2019, four companies were newly listed, while one company was excluded.

The companies newly included in the 2021 top 500 sales list are ▲SD Biosensor ▲Seegene ▲SK Bioscience ▲Ildong Holdings. These companies are classified as beneficiaries of the COVID-19 pandemic, producing diagnostic kits, vaccines, and therapeutics.

SD Biosensor, which newly listed on the KOSPI market last year, recorded the highest sales among pharmaceutical and bio companies in its debut year. The company posted sales of 2.93 trillion KRW last year, ranking 125th among all listed companies. Its operating profit was also the highest among pharmaceutical and bio listed companies at 1.364 trillion KRW.

Compared to 2019, the company with the most significant growth was Seegene, a producer of molecular diagnostic kits. Seegene experienced explosive growth early in the pandemic by leading with its COVID-19 gene amplification (PCR) diagnostic kits. Seegene’s sales soared from 122 billion KRW in 2019 to 1.3708 trillion KRW last year, growing more than tenfold. Operating profit increased even more dramatically, rising from 22.4 billion KRW in 2019 to 666.7 billion KRW last year, nearly a 29-fold increase.

Listed companies involved in COVID-19 vaccine production also saw substantial performance growth. SK Bioscience, which listed last year, significantly boosted its results by undertaking contract manufacturing (CMO) of AstraZeneca’s vaccine during the early vaccine introduction phase. The company posted sales of 929 billion KRW and operating profit of 474.2 billion KRW last year. Compared to 2019, sales increased fourfold, and operating profit nearly 20-fold. Samsung Biologics, which undertook CMO for Moderna’s vaccine, also showed growth with sales rising 1.2 times and operating profit increasing 4.8 times over two years.

Among pharmaceutical and bio holding companies, JW Holdings’ operating profit stood out, increasing nearly tenfold. JW Holdings’ operating profit rose from 6 billion KRW in 2019 to 68.7 billion KRW last year, more than a tenfold increase.

Besides these, most pharmaceutical and bio companies achieved performance growth. Of the 28 companies listed among the top 500, all but two increased sales. Their average sales growth rate reached 77.47%. Operating profit trends varied by company. Three companies saw a decrease in operating profit, and three others either turned to losses or expanded their losses.

However, securities analysts note that the growth momentum of pharmaceutical and bio companies has faced limits in the first half of this year. This is attributed to the decline in stock prices of beneficiary companies due to reduced COVID-19 concerns and the transition to phased daily recovery (With COVID-19) policies. Other negative factors include interest rate hikes amid aggressive tightening policies in major countries. Jaekyung Park, a researcher at Hana Financial Investment, pointed out, "Investor sentiment has weakened due to increased discount rates on new drug candidates caused by interest rate hikes, disappointing R&D results of individual companies, and difficulties in biotech fundraising due to a cooling IPO market."

Accordingly, experts advise focusing on the performance of individual companies. Donggeon Lee, a researcher at Shinhan Financial Investment, said, "It is necessary to pay attention to individual company momentum," adding, "Selective responses are needed for companies expected to show results in performance and individual pipelines from the second quarter through the second half of the year." Researcher Jaekyung Park also explained, "Focus should be on the capabilities and direction of the company, not the theme."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)