[Asia Economy Reporter Minji Lee] Expectations are rising that Tencent Holdings will achieve a stock price turnaround in the second half of the year.

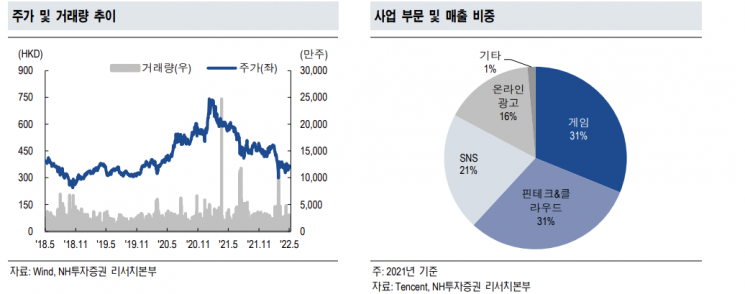

Looking at Tencent Holdings' stock price on the 22nd, it closed at 352.20 Hong Kong dollars as of the 20th. Tencent Holdings' stock price has fallen 22.39% since the beginning of the year. This decline is analyzed to reflect concerns over performance due to regulatory uncertainties from the Chinese government and COVID-19 lockdown measures.

In the first quarter, Tencent Holdings posted revenue of 135.5 billion yuan, a 0.1% increase compared to the same period last year. Net profit was 25.5 billion yuan, down 23% from the same period last year. Both revenue and net profit fell short of market expectations by 4% and 3%, respectively.

By segment, gaming revenue was 43.6 billion yuan, maintaining the same level as last year. Domestically, due to restrictions on game usage time by minors and a decrease in paying users, along with revenue declines from "Tianya Mingyue Dao" and "Call of Duty," revenue was 33 billion yuan, down 1% year-on-year. Overseas revenue grew 4% to 10.6 billion yuan, driven by growth in "Valorant" and "Clash Royale," despite a decline in "PUBG Mobile" revenue after COVID-19. The SNS segment increased by 1.4% to 29.1 billion yuan.

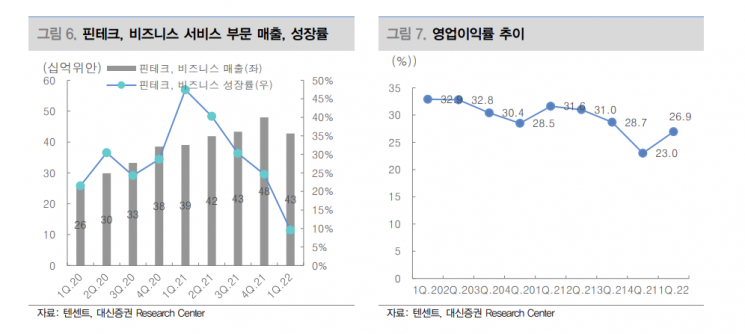

Fintech and cloud computing revenue reached 42.8 billion yuan, growing 9.7% compared to the same period last year. Fintech revenue growth slowed due to the impact of COVID-19. The slowdown in cloud segment growth is analyzed to reflect the company's shift from an unconditional growth strategy to qualitative growth. Dong-yeon Lee, a researcher at Korea Investment & Securities, said, "Considering that cloud revenue grew 52% last year, the growth rate has sharply declined," adding, "The strategic change is expected to contribute to profitability improvement."

Online advertising recorded 18 billion yuan, down 17.5%. Revenue declined due to the impact of COVID-19, weak advertising demand in industries such as private education, internet services, and gaming, and the influence of online advertising regulation laws.

The resolution of regulatory uncertainties is expected to boost the stock price going forward. Amid a sharp deterioration in the Chinese economy, the Chinese government emphasized "economic stability" at the Communist Party Central Political Bureau meeting held on the 29th of last month and stressed the regularization of platform industry-related laws. Net profit growth rates are forecasted to be -2% in the third quarter and 31.3% in the fourth quarter compared to the same period last year.

The lifting of China's lockdown measures is also expected to impact performance improvement. Among Tencent's core businesses, the ones most affected by the economy are online advertising and fintech. These two businesses accounted for about 40% of first-quarter revenue and were significantly impacted by China's lockdown measures. Researcher Dong-yeon Lee explained, "Tencent's performance will improve from the second half of the year when lockdown measures are lifted and gaming segment results improve," adding, "In the short term, attention should be paid to whether the mobile game Apex Legend, launched in April, continues to succeed in the global market."

Researcher Jaeyoung Jang of NH Investment & Securities said, "The recovery of net profit growth rate, along with expectations for the resolution of regulatory uncertainties related to the platform industry, will act as a factor increasing the stock price's downside rigidity," and explained, "If concerns about sharp interest rate hikes by the U.S. Federal Reserve (Fed) ease in the second half, the stock price will trend upward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.