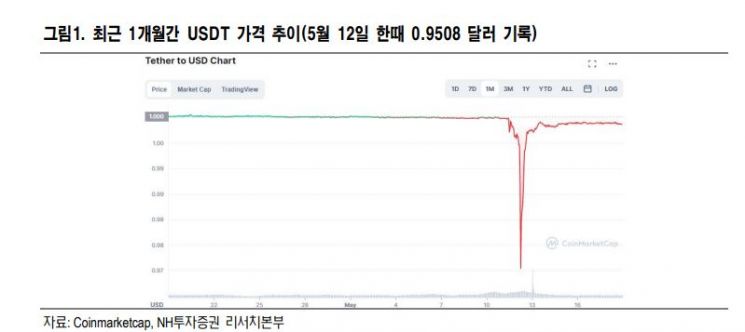

[Asia Economy Reporter Ji Yeon-jin] Following the depegging of the domestic stablecoin Terra (UST), which caused its value to fall below 1 dollar and plummet, leading to its delisting from global cryptocurrency exchanges one after another, the price of the dollar stablecoin Tether (USDT) has also recently experienced depegging, increasing uncertainty in the crypto market.

According to the cryptocurrency platform CoinMarketCap on the 21st, USDT fell to as low as 0.9508 dollars on the 12th (local time), then rebounded and traded at 0.9988 dollars the day before.

USDT ranks third in total digital asset market capitalization (74 billion dollars) and is the number one stablecoin. Tether issues and circulates USDT, which is pegged to the price of 1 dollar. Tether's parent company, iFinex Inc., operates the digital asset exchange Bitfinex.

Bitfinex was indicted in 2018 for covering up losses of 850 million dollars from the Panama-based Crypto Capital Fund using customer deposits held in Tether. At that time, the New York Attorney General imposed a fine of 18.5 million dollars and banned operations within the state.

Although concerns about Tether's insolvency have been consistently raised, USDT ranks third in total crypto asset market capitalization, with a daily trading volume of 56 billion dollars, ranking first. Recently, daily trading volume even increased to 159 billion dollars.

However, USDT's market capitalization decreased by 9.1 billion dollars from 83.2 billion dollars on the 10th to 74.1 billion dollars on the 19th, within just nine days. Tether announced that it paid this amount out in fiat USD.

According to data disclosed by Tether, as of the end of last year, Tether's total assets amounted to 78.7 billion dollars, consisting of 24.2 billion dollars in commercial paper and negotiable certificates of deposit, 7.2 billion dollars in cash and money market funds (MMF), 34.5 billion dollars in short-term U.S. Treasury bonds, and other assets.

Kim Yeol-mae, a researcher at NH Investment & Securities, said, "As the pace of U.S. monetary tightening accelerates, prices across the digital asset market continue to decline," adding, "USDT is used instead of dollars on exchanges where fiat currency deposits and withdrawals are restricted, but uncertainty remains in the digital asset market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.