KRIHS 'Analysis of Determinants of Asset Inequality'

Asset Income Accumulation Much Faster Than Earned Income

Real Estate Stabilization Also Contributes to Inequality Reduction

Support Needed for Homeownership of Low-Income "Heuksujeo" Due to Initial Capital Shortage

A study has revealed that housing capital gains and intergenerational asset transfers significantly impact asset inequality. The gains obtained from rising housing prices are substantial, making it difficult to reduce disparities through income alone. Since purchasing a home requires a large initial capital, intergenerational transfers such as parental assistance during this process are also analyzed as factors that deepen inequality.

On Minjun, a senior researcher at the Korea Research Institute for Human Settlements, stated this in a working paper (No. 22-05) published by the institute on the 19th, titled "A Study on the Determinants of Asset Inequality."

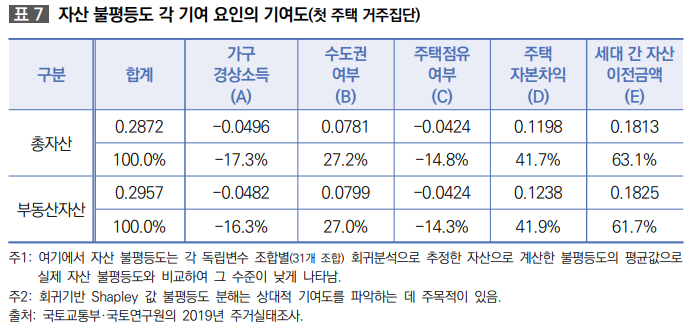

As a result of analyzing the contribution to asset inequality in the study, it was confirmed that intergenerational asset transfers such as gifts and inheritance, and housing capital gains contribute significantly to asset inequality. The amount of intergenerational asset transfers contributed the most, followed by housing capital gains.

Contrary to common perception, homeownership showed a relatively low contribution to asset inequality. This appears to be because homeownership itself contributes less to producing asset inequality, whereas the capital gains arising from rising housing prices after homeownership contribute more to asset inequality.

Since homeownership requires a large initial capital, intergenerational asset transfers influenced the speed of asset accumulation through the medium of housing. Once a home is purchased with parental assistance, the impact of increased asset income due to rising house prices is significant, and these differences in the speed of asset accumulation deepen asset inequality.

Households without initial equity find it difficult to own a home, so the speed of asset accumulation can vary depending on whether they can secure initial equity. Especially in the current environment of high housing prices, it is difficult to prepare initial capital solely through earned income, and intergenerational asset transfers play a significant role in securing initial capital.

Researcher Oh said, "Since housing capital gains have been confirmed to affect asset inequality, inducing asset price stabilization through housing market stabilization can alleviate social polarization in the long term." Stabilizing the housing market also plays a role in mitigating asset inequality that may arise from rising housing prices.

He also suggested, "Efforts to reduce asset inequality are needed by providing equal opportunities for asset accumulation through support for housing acquisition, which requires a large initial fund." Measures to lower entry barriers to homeownership, focusing on actual demanders including newlyweds and first-time homebuyers, are possible.

Along with affordable housing supply, easing entry barriers through financial support focused on actual demanders is also necessary. Researcher Oh emphasized, "Ultimately, efforts to reduce asset inequality are needed by providing equal opportunities for asset accumulation through support for housing acquisition, which requires a large initial fund."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.