'Big Spenders' New Seniors Account for One-Third of Total Transactions

Prefer Using 'App' Over Branches When Banking

Seek Stable and Sustainable Income

Provided by Hana Financial Management Research Institute

Provided by Hana Financial Management Research Institute

[Asia Economy Reporter Minwoo Lee] The 'New Senior' generation, equipped with economic power and freely using digital-based fintech (finance + technology) services such as Toss and KakaoPay, is emerging. They seek stable regular income while being familiar with digital technology, yet they emphasize that the role of offline channels remains important.

On the 19th, Hana Financial Management Research Institute released a report titled "Financial Services Desired by New Seniors," containing these findings. The term 'New Senior' refers to those born between 1957 and 1971 with financial assets exceeding 100 million KRW. An analysis of Hana Bank customers aged 50 and above by the institute showed that their transaction volume accounted for more than half of the total transaction amount. In particular, the transaction volume of the New Senior generation aged 50 to 64 accounted for more than one-third of the total. The average transaction amount per customer aged 50 and above was over 100 million KRW, 1.8 times higher than that of customers aged 40 and below.

◆ Familiar with Digital... Toss, KakaoPay OK= New Seniors were familiar with digital technology. Over 90% responded that they could use digital channels in daily life, such as online shopping, watching YouTube, and ordering via kiosks, without assistance from others. The most used means for financial transactions (based on the last 6 months) was bank applications (apps) at 83.3%, followed by internet banking at 75.8%. Branch visits accounted for only 49.3%.

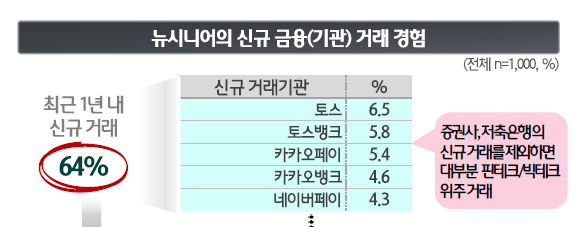

They were also relatively open to using new services. 64% answered that they had newly transacted with financial institutions within the past year, with fintech companies such as Toss, Toss Bank, and Kakao Bank ranking high. The main reason was "ease of app use" at 15.8%, followed by "excellent financial returns (14.4%)" and "new services and features (0.1%)." The main reasons for primarily transacting with banks were "salary transfers (36.8%)" and "the hassle of switching (33.1%)," ranking first and second respectively.

Nevertheless, they emphasized the need for offline channels. 78% of surveyed New Seniors responded that there are tasks that must be handled by visiting a branch in person. These tasks mainly included ▲product maturity/termination ▲cash/check deposits and withdrawals ▲loan consultation/enrollment. The most necessary function to activate digital channels was "easy connection to a consultant (77.1%)."

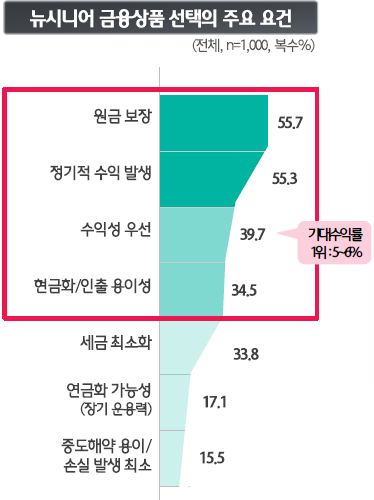

◆ Prioritizing Stable Income Over 'One-time Gains'= When choosing financial products, the factors New Seniors considered (multiple responses allowed) were "principal protection (55.7%)" and "regular income generation (55.3%)." These responses significantly outnumbered those considering "high profitability (39.7%)." They also regarded "ease of cash withdrawal (34.5%)" as important. The expected financial product yield was most commonly "5-6%."

In a similar vein, the products with high future subscription intentions included "parking accounts" that pay interest even if money is deposited for just one day, and relatively stable "indirect investment products" linked to monthly payments or stock indices. Regular payment products such as pension trusts and insurance were also preferred.

Yoon Sun-young, a researcher at Hana Financial Management Research Institute, analyzed, "New Seniors adapt to digital financial transformation without much resistance and prioritize channel convenience and new services over economic benefits, so diverse and active financial activities are expected in the future. Since there is still a strong demand for offline and personal services, financial companies should provide customized products and services that meet these needs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.