Progress Rate at 32.3% Compared to Revenue Budget... Highest Since the 2000s

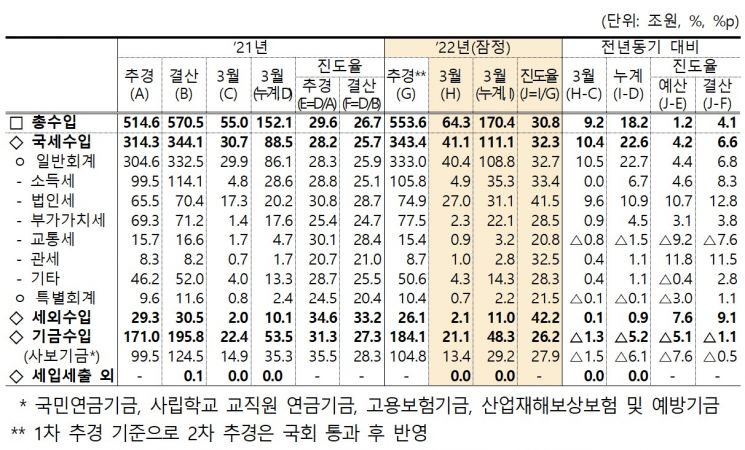

[Asia Economy Sejong=Reporter Kim Hyewon] National tax revenue in the first quarter of this year amounted to 111.1 trillion won, an increase of 22.6 trillion won compared to the same period last year. Corporate tax revenue increased by about 11 trillion won due to improved corporate performance, and income tax and value-added tax also increased by about 10 trillion won. The progress rate compared to the revenue budget was 32.3%, the highest since the 2000s.

National Tax Revenue from January to March 111.1 Trillion Won... Corporate Tax Up 10.9 Trillion Won, Income Tax Up 6.7 Trillion Won

According to the Fiscal Trend report published by the Ministry of Economy and Finance on the 19th, national tax revenue in the first quarter (January to March) of this year was 111.1 trillion won, an increase of 22.6 trillion won compared to one year ago. The progress rate against the revenue budget (343.4 trillion won) as of March was recorded at 32.3%.

By tax category, corporate tax increased by 10.9 trillion won compared to the same period last year. This was due to improved corporate performance amid economic recovery.

Income tax increased by 6.7 trillion won compared to one year ago, mainly due to wage income tax, reflecting employment recovery. Value-added tax increased by 4.5 trillion won due to increased consumption and imports.

On the other hand, transportation tax decreased by 1.5 trillion won due to the reduction in fuel tax.

Non-tax revenue in the first quarter was 11 trillion won, increasing by 900 billion won compared to the same period last year due to an increase in government payments from Bank of Korea surplus funds (400 billion won) and increased penalty income (200 billion won). The progress rate was 42.2%.

During the same period, fund revenue was 48.3 trillion won, decreasing by 5.2 trillion won due to a decline in asset management income despite an increase in insurance premium income. The progress rate was 26.2%.

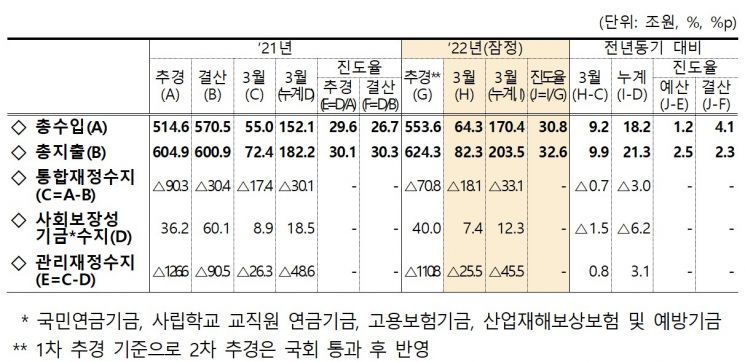

The total revenue for the first quarter, combining national tax revenue, non-tax revenue, and fund revenue, was 170.4 trillion won, an increase of 18.2 trillion won compared to one year ago. Total expenditure was 203.5 trillion won, an increase of 21.3 trillion won compared to the same period last year, due to responses to infectious disease crises and support for vulnerable groups such as small business owners. The progress rates were 30.8% and 32.6%, respectively.

Accordingly, the integrated fiscal balance, which is total revenue minus total expenditure, recorded a deficit of 33.1 trillion won. The deficit widened by 3 trillion won compared to the previous year (30.1 trillion won), influenced by a decrease in the surplus of social security funds. The social security fund balance in the first quarter showed a surplus of 12.3 trillion won, a decrease of 6.2 trillion won compared to the previous year.

The management fiscal balance, which shows the government's actual fiscal condition by deducting the four major social security funds from the integrated fiscal balance, recorded a deficit of 45.5 trillion won, an improvement of 3.1 trillion won compared to one year ago.

The central government's national debt balance in the first quarter was 981.9 trillion won, an increase of 42.8 trillion won compared to last year's settlement. The issuance scale of treasury bonds in April was 18.9 trillion won. Foreigners' net investment in treasury bonds in April was 2.2 trillion won, continuing net inflows for 37 consecutive months, and foreign holdings of treasury bonds reached a record high of 174.8 trillion won as of the end of April.

An official from the Ministry of Economy and Finance stated, "We plan to manage the balance and debt at the level projected in the second supplementary budget until the end of the year." The government's forecast for this year's fiscal condition is a management fiscal balance deficit of 108.8 trillion won and national debt of 1,067.3 trillion won.

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is delivering opening remarks at the 'Small and Medium Business Owners Meeting' held at the Korea Federation of SMEs in Yeouido, Seoul, on the 18th. Photo by Kang Jin-hyung aymsdream@

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is delivering opening remarks at the 'Small and Medium Business Owners Meeting' held at the Korea Federation of SMEs in Yeouido, Seoul, on the 18th. Photo by Kang Jin-hyung aymsdream@

Yoon Administration Considering Corporate Tax Law Revision... Choo Kyung-ho Says "There Is a Need to Improve Tax Rates"

The Yoon Seok-yeol administration, which advocates private-led growth, is considering revising tax laws including lowering the highest corporate tax rate. It is reported that the administration plans to revert the corporate tax highest rate to the original level after the Moon Jae-in administration, in its first year, created a new tax bracket for taxable income over 300 billion won and raised the highest corporate tax rate to 25% for the first time in 28 years. If the highest corporate tax rate is lowered, it is likely to be restored to the previous highest rate of 22%.

Choo Kyung-ho, Deputy Prime Minister and Minister of Economy and Finance, said at a visit to the Korea Federation of SMEs yesterday, "I feel the need to improve and reform Korea's corporate tax rates and system compared to advanced countries." He added, "I will discuss specific reform methods and timing after further review."

During his confirmation hearing at the National Assembly, Minister Choo also stated, "To actively support private-led growth and strengthen corporate international competitiveness, it is necessary to reconsider the current corporate tax system, which has a high top rate and complex taxable income brackets."

He also mentioned, "I have always said that corporate tax should be lowered because Korea's tax rates are high compared to the OECD and major competitors, and tax competitiveness is not good. That has not changed."

As a member of the National Assembly in July 2020, Deputy Prime Minister Choo proposed a bill to lower the highest corporate tax rate to 20% and reduce the taxable income brackets from four to two (under 200 million won and over 200 million won).

The issue is that corporate tax accounts for a large portion of national tax revenue, which could pose a burden on fiscal soundness management. The government recently submitted a supplementary budget of 59.4 trillion won, estimating excess tax revenue of 53.3 trillion won, of which corporate tax accounts for more than half at 29.1 trillion won. The forecast for corporate tax revenue this year alone is 104.1 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)