Netflix, Industry Leader, Lays Off Around 150 Employees Amid Poor Performance

Paid Subscribers Decline for the First Time Since 2011 in Q1

Outdoor Theaters Thrive Post-Distancing, Domestic OTTs Also Impacted

[Asia Economy Reporter Lim Hye-seon] Online video services (OTT) have simultaneously entered a period of stagnation. Since the easing of COVID-19 social distancing measures, the number of subscribers has sharply declined. There are few hit titles gaining popularity in the global market, while service prices are rising and competition is intensifying.

According to major foreign media including The Wall Street Journal on the 18th, Netflix laid off about 150 employees, which accounts for approximately 2% of its total workforce at its U.S. headquarters. Netflix announced in its first-quarter earnings report that its global paid subscribers decreased by 200,000 compared to the fourth quarter of last year (October to December). This is the first time Netflix’s subscriber count has declined since 2011. Netflix also warned that an additional 2 million subscribers could be lost in the second quarter (April to June), suggesting that its workforce reduction policy is expected to continue.

In the Korean market, which had been on a growth trajectory, OTT influence is also weakening. This is due to the recovery of daily life and the lifting of social distancing, which has increased visits to theaters and outdoor venues. Marvel’s new release, “Doctor Strange in the Multiverse of Madness,” attracted 4 million viewers within a week of its release.

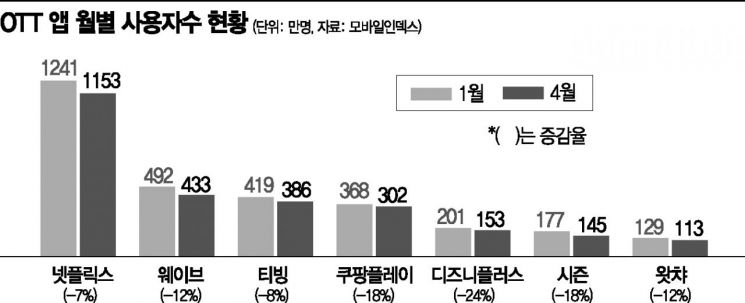

According to Mobile Index, a big data analytics solution by IGAWorks, the monthly mobile user count for OTTs last month dropped by up to 24% compared to January this year. Netflix’s monthly user count decreased by 7%, from 12.41 million to 11.53 million. The popularity of new releases has been low since “Squid Game.” Additionally, Netflix raised its prices by nearly 20% this year, drawing consumer complaints. Wavve’s users decreased by 12%, from 4.92 million to 4.33 million, and TVING’s users dropped by 8%, from 4.19 million to 3.86 million. The most heavily shunned platform was Disney Plus, whose user count plunged 24% in just three months, from 2.01 million to 1.53 million.

Disney Plus appears to be losing competitiveness increasingly. Although its daily active users (DAU) rose to 273,697 on Children’s Day, May 5th, this number fell to 179,382 on the 10th. Industry insiders attribute Disney Plus’s poor performance to a significantly low number of new content updates and the absence of Korean original content. Disney Plus announced plans to sequentially release more than 20 Korean titles, including at least 12 originals this year, but content updates remain slow.

OTT platforms plan to increase investments to strengthen content competitiveness. Netflix will invest 800 billion KRW in the Korean market, up from 550 billion KRW last year. Wavve plans to invest 1 trillion KRW by 2025, and TVING will invest 400 billion KRW by next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.