Korean Air Q1 Revenue 660 Billion KRW... Up 103.1% YoY

Asiana Airlines Increased by 83.42%

International Oil Prices Soaring, Q2 Costs Expected to Rise Further

[Asia Economy Reporter Yoo Hyun-seok] Domestic airlines have spent more than 1 trillion won on fuel costs in the first quarter alone. This is due to the rise in global oil prices caused by Russia's invasion of Ukraine and other factors. Recently, fuel surcharges have also reached record highs due to the increased oil prices, which is putting growing pressure not only on consumers but also on airlines.

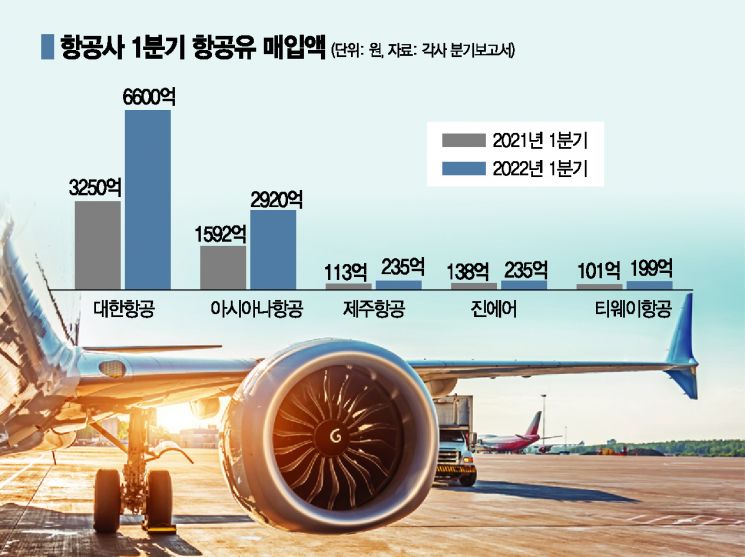

According to the aviation industry on the 18th, Korean Air spent 660 billion won on fuel costs in the first quarter. This is a 103.1% increase compared to 352 billion won in the first quarter of last year. Asiana Airlines spent 292 billion won, up 83.42% from 159.2 billion won during the same period. Fuel costs nearly doubled.

The situation is similar for low-cost carriers (LCCs). Jeju Air's fuel costs increased from 11.3 billion won in the first quarter of last year to 23.5 billion won this year, nearly doubling, and Jin Air's costs rose from 13.8 billion won to 23.5 billion won. During the same period, T'way Air's fuel costs also increased from 10.1 billion won to 19.9 billion won. The total fuel costs for these five airlines reached 1.0189 trillion won.

This increase in fuel costs is attributed to the rise in international oil prices. In the first quarter, West Texas Intermediate (WTI) crude oil in the U.S. briefly reached $123.70 per barrel, with the average price approaching $100 per barrel. As a result, the prices airlines pay for fuel have also increased. Korean Air spent 177.99 cents per gallon domestically and 196.57 cents overseas last year, but in the first quarter of this year, these costs rose to 237.89 cents and 275.87 cents respectively. This means an additional 59.9 cents and 79.3 cents were spent per gallon.

The problem lies in the second quarter. As international oil prices continue to rise, it is expected that airlines' expenditures will increase further. On the 17th (local time), the June WTI price on the New York Mercantile Exchange closed at $112.40 per barrel, down $1.80 (1.6%) from the previous trading day. Although oil prices fell that day, since April, WTI prices have mostly remained above $100 except for early April.

The rising fuel surcharges are also a cause for concern. In June, Korean Air and Asiana Airlines' international fuel surcharges are applied at level 19. Korean Air charges fuel surcharges ranging from 37,700 won to 293,800 won based on one-way distance, while Asiana Airlines charges between 40,400 won and 229,600 won. Level 19 is the highest since the distance-based fuel surcharge system was introduced in July 2016. After level 10 was applied in March, the surcharge levels have steadily increased to 14 in April, 17 in May, and 19 in June.

Since aviation fuel typically accounts for 30% of an airline's operating costs, the rise in fuel costs inevitably burdens airlines. Especially from the 23rd, overseas arrivals will be allowed to use professional rapid antigen tests (RAT) in addition to PCR tests before entry, which is expected to increase the number of consumers traveling abroad. However, the high fuel surcharges could hamper this. For airlines, although international scheduled flights are expected to increase, if demand does not keep up due to fuel surcharges and other costs, it could lead to a loss-making structure.

An industry official explained, "The sharp rise in oil prices increases fuel surcharges, raising the price of airline tickets borne by consumers, which reduces demand for air travel. The increase in fuel costs, which account for 20-30% of expenses, negatively affects airlines' profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.