Soaring Jeonse Prices Due to Lease 3 Laws

Interest Bomb on Additional Jeonse Loans Over 100 Million Won

If Base Rate Rises 3 Times by Year-End

Loan Interest Burden Doubles

[Asia Economy Reporter Sim Nayoung] Tenants who need to renew their jeonse contracts this year are facing not only a sharp increase in deposit burdens but also an interest rate bomb. The dominant expectation in the financial industry is that the Bank of Korea will raise the base interest rate up to three more times this year, including at the Monetary Policy Committee meeting on the 26th of this month. Applying this scenario shows that loan interest rates applied to tenants without housing when renewing their jeonse contracts could nearly double.

Jeonse Loan Interest Rates Double in Two Years

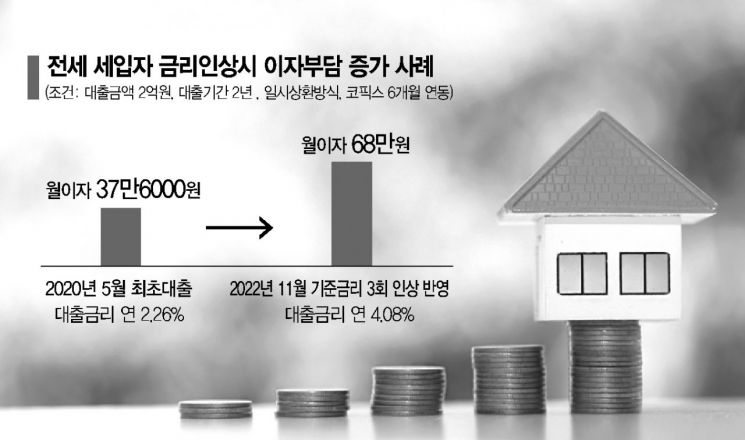

According to an analysis by a commercial bank on the 16th, a jeonse tenant who took out a 200 million KRW jeonse loan at an annual interest rate of 2.26% in May 2020 paid 376,000 KRW in monthly interest. When this tenant renewed the loan in May this year, two years later, the applied interest rate was 3.33%, increasing the monthly interest to 555,000 KRW.

The tenant's interest burden is expected to rise much more steeply going forward. Most jeonse loan interest rates are variable rates (linked to COFIX) that change every six months. If the Bank of Korea raises the base interest rate three times by November, the interest rate applied to this tenant at the end of the year will rise to 4.08%. The monthly interest cost alone will reach 680,000 KRW.

A bank official said, "This case involves a loan from the Korea Housing Finance Corporation, which has a lower interest rate than other products and a loan limit of up to 222 million KRW," adding, "Since jeonse deposits have surged by hundreds of millions of KRW in many places, this tenant will have to take out more expensive unsecured loans or switch to loans guaranteed by Seoul Guarantee Insurance." Besides the doubling of interest costs, when combined with additional jeonse loan interest, the burden on jeonse tenants will snowball.

Variable Interest Rate Risk Increasing Despite Higher Proportion

The risk of variable interest rates is growing. The Korea Federation of Banks will announce the COFIX (Cost of Funds Index) for April at 4 p.m. on the 16th. COFIX is the standard for calculating variable interest rate loans and follows the base interest rate trend. COFIX surpassed 1% in September last year and rose to 1.72% in April this year, the highest since July 2019. The banking sector is confident that COFIX will rise again in May. If this trend continues, it is expected to reach 2.0% in the first half of this year.

The problem is that, although it is common for borrowers to avoid risk by choosing fixed interest rates during periods of clear interest rate increases, recently the proportion of variable interest rate loans has been growing instead. According to the Bank of Korea, among new household loans from deposit banks in March, 80.5% were variable interest rate loans, and 19.5% were fixed interest rate loans. Fixed interest rate loans decreased by 2.6 percentage points compared to 22.1% in February. A Bank of Korea official pointed out, "The increase in the proportion of variable interest rate loans during a period of rising interest rates is a risk factor for both borrowers and financial institutions."

The reason for this unusual phenomenon is that fixed interest rates are currently higher than variable interest rates. The mixed (fixed) interest rates for mortgage loans at the four major banks (KB Kookmin, Shinhan, Hana, Woori) as of the 13th range from 4.280% to 6.590% annually. Mortgage loan variable interest rates range from 3.420% to 5.092%, with the upper limit 0.860 percentage points lower than fixed rates.

COFIX, the benchmark for variable interest rates, changes monthly reflecting deposit rates and other funding costs, but fixed interest rates are influenced daily by market rates such as financial bonds, causing them to rise faster than variable rates. A commercial bank official advised, "During periods of rising interest rates, banks set fixed interest rates higher in advance as a form of insurance against further increases," adding, "Still, over time, variable interest rates cause interest burdens to increase significantly, so it is advisable to take out loans with fixed interest rates now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.