[Asia Economy Reporter Lee Seon-ae] In the wake of the stock market crash, there is a strong consensus in the securities industry that investors should avoid “selling without practical benefit.” However, so-called “debt investing” retail investors who borrowed money to invest are now facing a situation where they cannot hold on, gripped by the fear of forced liquidation of stocks due to their inability to repay the borrowed funds.

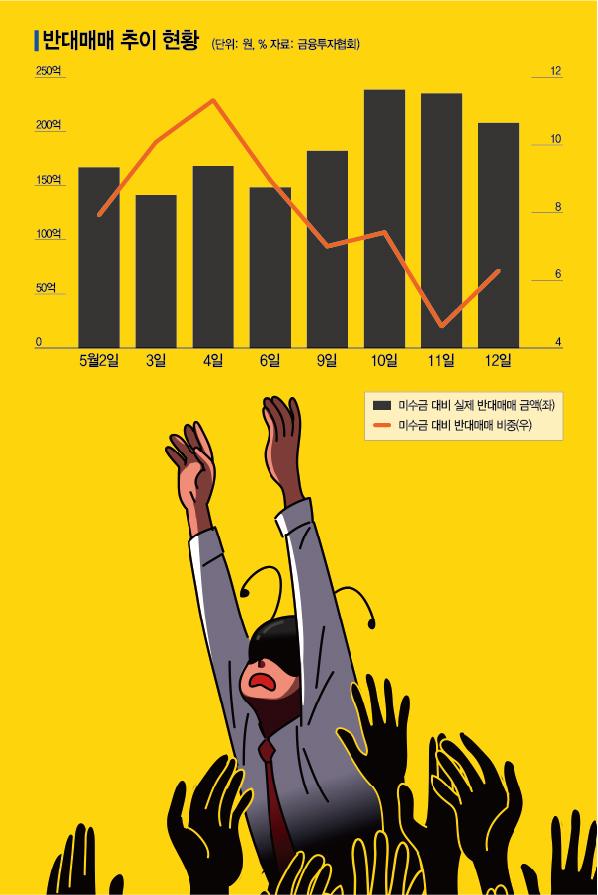

According to the Korea Financial Investment Association on the 16th, the amount of forced liquidation, which had been maintained at around 10 billion KRW, recently surged again to around 20 billion KRW. On the 10th, the actual forced liquidation amount compared to outstanding margin debt sharply increased to 23.8 billion KRW. This far exceeds the monthly average of 15.6 billion KRW. On the 11th and 12th, the amounts remained above 20 billion KRW at 23.5 billion KRW and 20.8 billion KRW, respectively. The forced liquidation ratio against margin debt on the 10th was recorded at 11.2%, the highest since January 26th’s 11.7%. As the index plunged day after day, the forced liquidation ratio has continued to rise over the past few days. It was 7.0% on the 6th, 8.9% on the 9th, and jumped to double digits on the 10th when the KOSPI fell below 2600, then recorded 10.0% and 7.9% on the 11th and 12th, respectively. Yoon Ji-ho, head of the Ebest Investment & Securities Research Center, warned, “There is no need to join panic selling out of fear, but if the credit ratio is high, forced liquidation can occur.”

Forced liquidation refers to the process where securities firms forcibly sell stocks to recover debts when the value of stocks purchased on borrowed money falls below a certain level or when payment for stocks bought on credit is not made. When forced liquidation occurs, not only do individual investors suffer losses, but the flood of sell orders also puts additional downward pressure on the stock market. Moreover, investors fearing forced liquidation may engage in so-called “panic selling” during sharp price drops.

The surge in forced liquidation is attributed to individual investors prematurely judging the market bottom and aggressively buying. In fact, the balance of margin loans, which corresponds to “debt investing” in the domestic stock market, has also shown a continuous upward trend. As of the 9th, the balance of margin loans was 22.3366 trillion KRW, an increase of 37.5 billion KRW from the previous trading day’s 22.2991 trillion KRW. On the 10th, it remained at 22.2673 trillion KRW, and on the 11th and 12th, it was recorded at 22.028 trillion KRW and 21.8247 trillion KRW, respectively.

Furthermore, securities firms are raising interest rates on margin loans one after another, which is expected to significantly increase the burden on debt-investing retail investors. The interest rates on credit loans secured by stocks are higher than those of banks, and failure to repay on time can lead to forced liquidation.

Yuanta Securities plans to raise the interest rates on margin loans by 0.25 percentage points from the 23rd of this month, differentiated by customer and period. For the MyLoan Silver grade (the second lowest of four grades), the 7-day rate will increase from 8.25% to 8.50%, the 15-day rate from 8.55% to 8.80%, and the 30-day rate from 8.85% to 9.10%. DB Financial Investment will also raise margin loan interest rates by 0.2 percentage points starting June 1. If margin loans are used for more than 90 days, a maximum annual rate of 9.71% will apply. Shinhan Investment Corp. will raise the margin loan interest rate by 0.25 percentage points from 4.5% to 4.75% (7-day basis) starting June 2. The increase applies to loans with a term of 60 days or less. For 15 days, the rate will rise to 7.25%, for 30 days to 7.65%, and for 60 days to 8.70%. Previously, Daishin Securities, Meritz Securities, and Daol Investment & Securities also recently raised their margin loan interest rates.

The Korea Capital Market Institute advised, “Margin loans can be sufficiently utilized to maximize investors’ expected returns, but conversely, they can amplify investors’ losses, so a cautious approach is necessary.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.