Establishment of Lotte Biologics at the End of This Month

Utilizing Growth Strategies Including Global Collaboration and Large-Scale Investment

[Asia Economy Reporter Lee Gwan-joo] As Lotte Group begins to actively enter the bioindustry, identified as its next growth engine, it appears set to utilize the growth strategies previously employed by Samsung Biologics. Since it is first venturing into the Contract Development and Manufacturing Organization (CDMO) business for pharmaceuticals, analysts expect it to adopt strategies similar to those of early Samsung Biologics, such as global partnerships and large-scale investments.

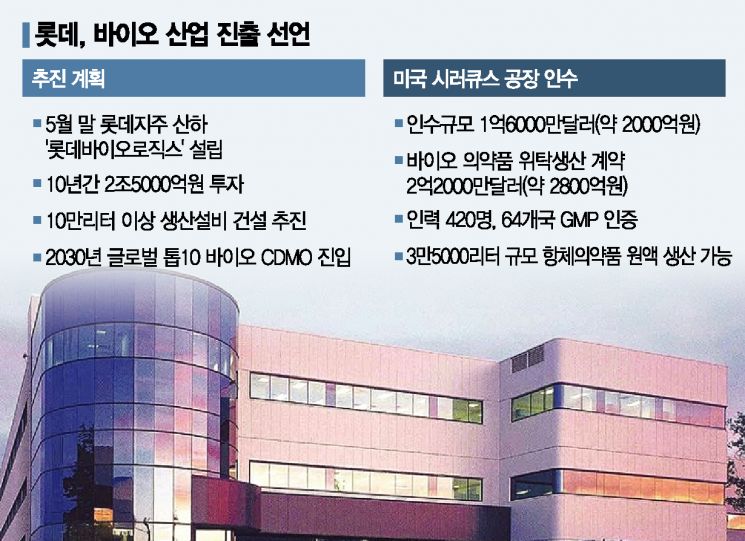

According to the bioindustry on the 16th, Lotte Group will officially enter the bio market by establishing a subsidiary, ‘Lotte Biologics,’ under Lotte Holdings by the end of this month. Lotte plans to initially focus on the CDMO business for antibody drugs and has decided to acquire a biopharmaceutical manufacturing plant owned by the global bio company Bristol Myers Squibb (BMS) located in Syracuse, New York, for $160 million (approximately 200 billion KRW). It has also signed a contract for contract manufacturing of biopharmaceuticals worth at least $220 million (approximately 280 billion KRW).

The Syracuse plant has a total capacity of 35,000 liters for producing antibody drug substance (DS). Lotte plans to convert the facility into one capable of producing finished pharmaceuticals (DP) and cell and gene therapies through additional investments. It is also considering establishing a separate U.S. corporation and constructing a production plant with a capacity exceeding 100,000 liters. A Lotte official stated, "The Syracuse plant has extensive experience in clinical and commercial production and is ready for immediate operation, making it an optimal asset for Lotte to quickly achieve results." He added, "By focusing on antibody drug CDMO in the early stages, we plan to demonstrate our capabilities as a bio business operator and expand the scale and scope of our business."

Until now, it has been difficult to directly compare domestic conglomerates that have entered the bioindustry because their main focus areas differ. Samsung Biologics has specialized in CDMO, Celltrion in biosimilars, SK Bioscience in vaccines, and LG Chem’s Life Sciences division in new drug development. However, with Lotte entering the CDMO business, comparisons with Samsung Biologics have become inevitable. Coincidentally, BMS was one of the first global bio companies to partner with Samsung Biologics at its inception.

Samsung Biologics began construction of its Plant 1 immediately after its establishment in 2011, completed it in 2012, and signed its first production partnership with BMS in 2013. Lee Won-jik, Executive Director (Head of New Growth Team 2), who is currently leading Lotte’s bio business, is also a former Samsung Biologics employee. An industry insider said, "The bioindustry has high entry barriers and requires significant initial investment, so a detailed business strategy is necessary. As a latecomer, benchmarking companies that entered the industry earlier and adapting their strategies to the current situation is the easiest approach."

The biggest difference between Lotte and Samsung Biologics lies in the initial investment amount. Lotte has announced plans to invest 2.5 trillion KRW over the next 10 years, whereas Samsung Biologics invested 2.1 trillion KRW solely in securing its own facilities during its early stages and has invested 1.74 trillion KRW in the construction of its currently largest Plant 4. The difference in ‘ammunition’ inevitably leads to differences in strategy.

Lotte is expected to prioritize a growth strategy through mergers and acquisitions (M&A) of existing mid- to small-scale infrastructures rather than building its own facilities, which require large investment costs and time for GMP certification. This is also a means to quickly secure technology and expert personnel as a latecomer. An industry insider commented, "Considering Lotte’s goal of entering the global top 10, the investment amount is not considered large. It is expected to actively pursue M&A and open innovation in the early stages of the business, and the future direction will depend on which companies it partners with."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.