Real Estate R114, This Week's Seoul Apartment Price Trends

[Asia Economy Reporter Kim Hyemin] With the one-year postponement of the capital gains tax surcharge, the number of apartment listings in Seoul has increased, leading to a relatively smaller rise in sale prices. This is due to the increase in housing sales ahead of the property tax assessment date on the 1st of next month.

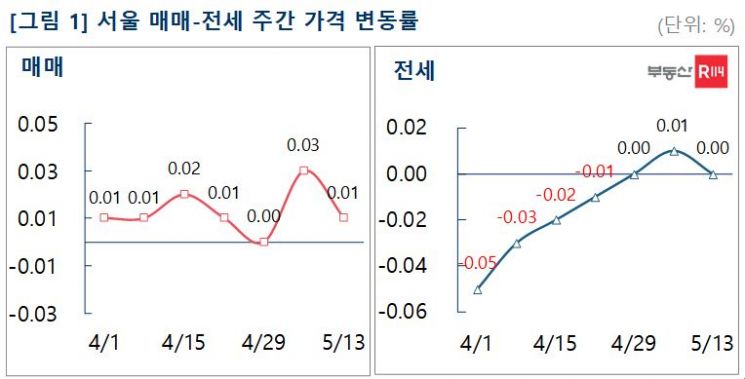

According to Real Estate R114, this week, the Seoul apartment sale prices rose by 0.01%, a slight decrease from the previous week's 0.03%. General apartments increased by 0.01% compared to the previous week, while redevelopment apartments remained flat.

By district, prices rose in the following order: ▲Gwangjin (0.06%) ▲Yongsan (0.05%) ▲Gangnam (0.04%) ▲Dongdaemun (0.04%) ▲Gwanak (0.03%). Conversely, despite the increase in listings, demand was insufficient, causing declines in ▲Dobong (-0.04%) ▲Nowon (-0.02%) ▲Yangcheon (-0.01%) ▲Seongdong (-0.01%).

Real Estate R114 analyzed that the reduced price increase is because some multi-homeowners, who had refrained from selling due to the burden of the capital gains tax surcharge, are now realizing profits. In fact, if a two-homeowner sells a property held for more than 10 years, or a three-homeowner sells a property held for more than 15 years, the Long-Term Holding Special Deduction (Jangteuk Gongje) applies, reducing the tax burden by more than 50% compared to the existing surcharge.

Meanwhile, prices of apartments in new towns remained flat, and prices in Gyeonggi and Incheon fell by 0.02% compared to the previous week.

In new towns, the upward trend in first-phase new towns was still prominent, but some areas declined as the enactment of the special law is expected to take time. By region, ▲Ilsan (0.08%) ▲Sanbon (0.01%) rose, while ▲Dongtan (-0.05%) ▲Pyeongchon (-0.02%) ▲Bundang (-0.01%) fell.

In Gyeonggi and Incheon, prices rose in ▲Paju (0.06%) ▲Icheon (0.04%) ▲Namyangju (0.03%), while ▲Hwaseong (-0.08%) ▲Yongin (-0.05%) ▲Suwon (-0.05%) ▲Seongnam (-0.04%) declined.

The jeonse (lease) market remained flat in both Seoul and new towns, while Gyeonggi and Incheon saw a 0.01% decrease compared to the previous week.

Yoon Jihae, chief researcher at Real Estate R114, said, "Although the capital gains tax surcharge has been eased with the new government this week, policy uncertainty remains. As the second year of the Lease 3 Act begins, the volume of contracts converting to new leases inevitably causes housing instability for tenants."

She added, "Various regional development pledges are emerging ahead of local elections, and as the tax assessment date passes, some listings may be withheld. For the time being, while jeonse prices are expected to continue rising, sale prices will show mixed trends depending on the region."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)