[Y-nomics, This Must Be Done] ④ Fiscal Soundness Normalization

[Asia Economy Sejong=Reporters Kim Hyewon and Son Seonhee] The Yoon Seok-yeol administration’s decision to formulate a “debt-free supplementary budget” just three days after its inauguration reflects a minimal show of “sincerity” toward normalizing national fiscal soundness, a key government task. While pushing for the largest supplementary budget ever, nearing 60 trillion won, the first-term economic team of the Yoon administration particularly emphasized that “no deficit bonds will be issued, and instead, 9 trillion won of government bonds will be repaid.” Thanks to this, fiscal indicators such as national debt and fiscal balance showed slight improvements compared to the last supplementary budget under the Moon Jae-in administration, but the national debt burden per citizen still amounts to about 21 million won. Starting with a national debt era of 1,000 trillion won, the Yoon administration plans to accelerate the legislative process for fiscal rules, an institutional framework to secure sustainable fiscal soundness.

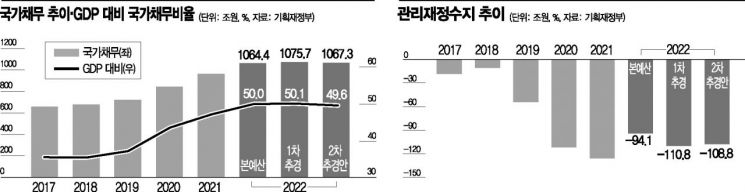

According to data from the Ministry of Economy and Finance and the International Monetary Fund (IMF) on the 13th, South Korea’s national debt, combining central and local governments, increased by 407.1 trillion won from 660.2 trillion won in 2017 to 1,067.3 trillion won based on this year’s second supplementary budget. During the same period, the managed fiscal balance deficit, which shows the government’s net fiscal position excluding the four major social security funds, ballooned from 18.5 trillion won to 108.8 trillion won.

If the second supplementary budget is implemented as planned, the ratio of national debt to gross domestic product (GDP) will be 49.6%, and the managed fiscal balance will be -5.1%. Compared to the first supplementary budget, the national debt-to-GDP ratio decreased by 0.5 percentage points from 50.1% to 49.6%, and the managed fiscal balance deficit improved by 0.1 percentage points from 5.2% to 5.1%. Despite the record-high supplementary budget of 59.4 trillion won, the fiscal situation did not worsen because excess tax revenue and expenditure restructuring were used as resources instead of issuing deficit bonds, and some government bonds were repaid. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said at a government joint briefing, “Considering existing global surpluses, it seems possible to repay about 12 trillion won more in government bonds.” As a member of the People Power Party, Deputy Prime Minister Choo repeatedly emphasized that “when excess tax revenue occurs, it is normal to reduce the deficit bonds originally planned to be issued and reduce debt first.”

The Yoon administration’s stance is to support private-led growth through fiscal normalization. To this end, it has made the introduction of fiscal rules a national task. The first-term economic team plans to swiftly push forward the institutionalization of fiscal rules, which failed to pass the National Assembly during the Moon administration. Currently, several bills related to fiscal rules, including the partial amendment to the National Finance Act, which Deputy Prime Minister Choo sponsored as a lawmaker, are pending in the National Assembly. In the 20th and 21st National Assembly sessions, Deputy Prime Minister Choo led the proposal of relatively stringent fiscal rules bills aiming to maintain the national debt-to-GDP ratio below 40-45% and the managed fiscal balance deficit below 2-3%. However, since these figures were considered unlikely to be met and could cause rigidity in fiscal management, there was a consensus inside and outside the government and the National Assembly that the stance would change. How Deputy Prime Minister Choo will resolve this issue is also a point of interest.

Experts point out that fiscal rules should be designed tightly to flexibly respond to changes in the environment, such as economic and social crises, and that mechanisms ensuring maximum independence from political influence should be established. Ok Dong-seok, president of the Korean Fiscal Policy Association, recently stated in a report by the Korea Fiscal Information Service’s “National Finance” that “strict and enhanced approval requirements, like a two-thirds vote in the National Assembly, are necessary for adopting fiscal rules and allowing exceptions, similar to constitutional procedures,” and argued that “the conditions and scale of exceptions to balanced-budget fiscal rules should not be arbitrarily changed by politicians.”

The establishment of fiscal rules in South Korea is also closely watched overseas. Among OECD member countries, only South Korea and Turkey lack fiscal rules, while more than 90 countries worldwide have introduced and operate them. A former senior official of the Ministry of Economy and Finance pointed out, “International credit rating agencies such as Moody’s are closely monitoring South Korea’s fiscal management methods,” and warned, “If the new government fails to restore fiscal soundness, the possibility of a downgrade in the country’s credit rating cannot be ruled out.”

In line with the new government’s policy direction, the Ministry of Economy and Finance has also reorganized the budget formulation guidelines for next year and notified each ministry on the same day. The guidelines reflect President Yoon Seok-yeol’s key pledges, including raising the basic pension, establishing a Youth Leap Account, increasing soldiers’ pay, and providing parental benefits. The Ministry stated, “All discretionary spending projects will be reexamined from zero base, and at least 10% will be compulsorily restructured.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)